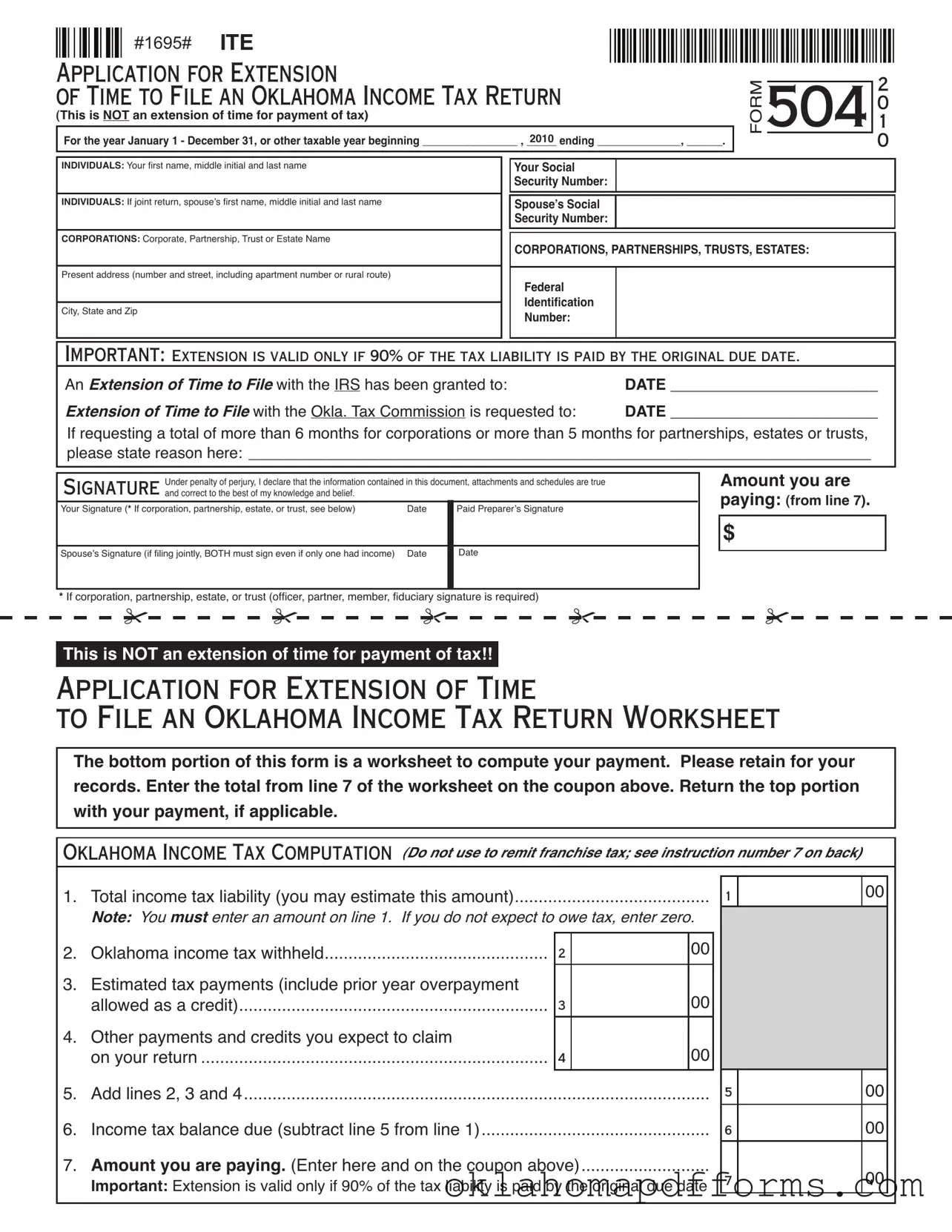

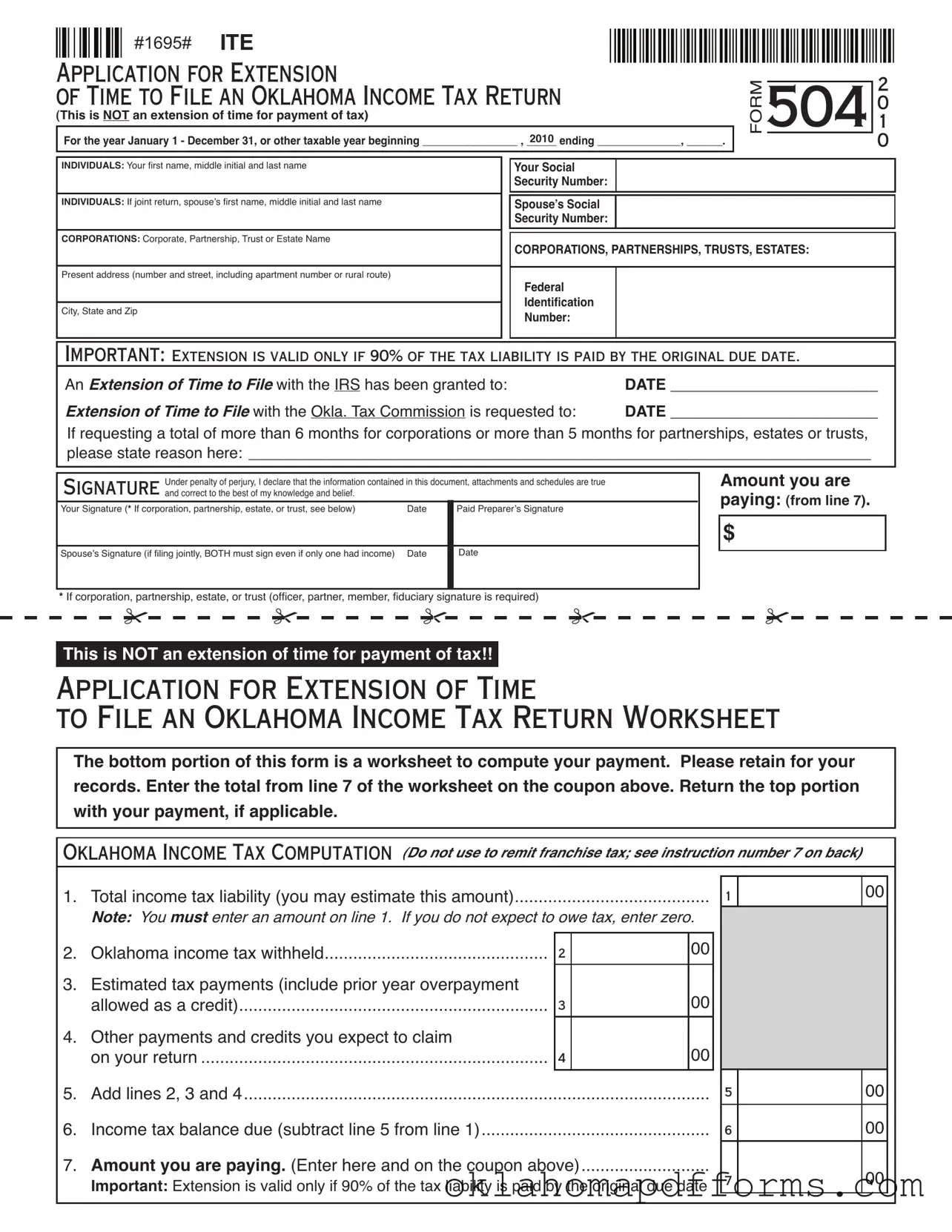

#1695# ITE

#1695# ITE

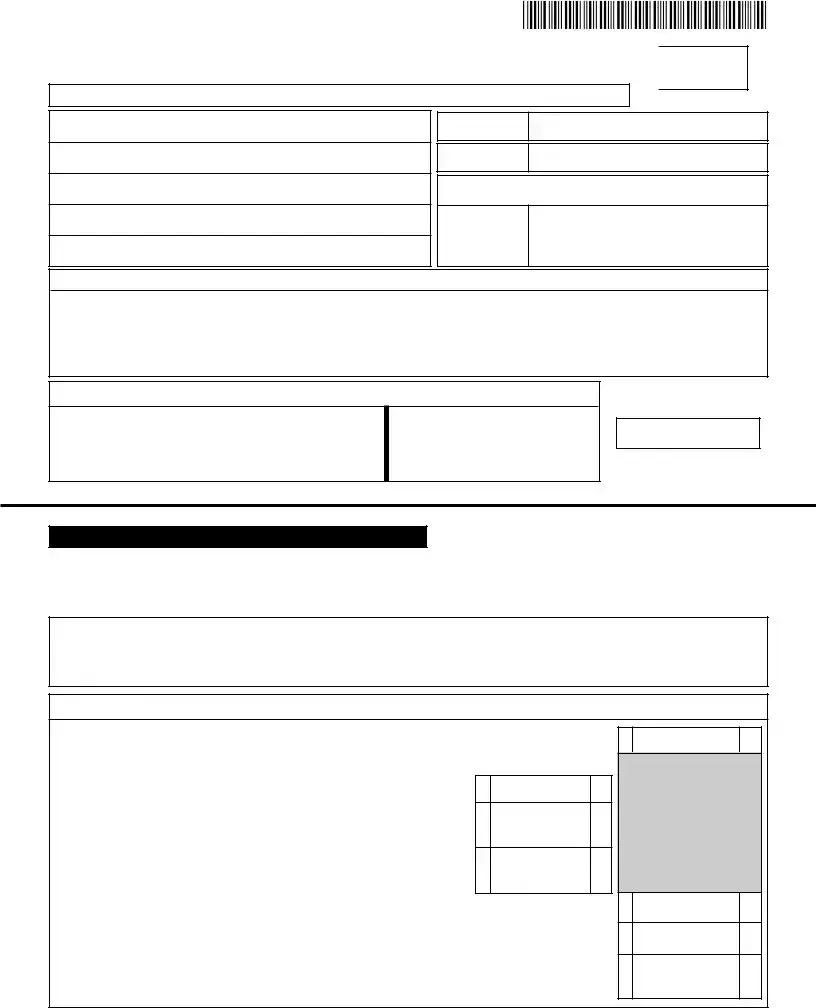

APPLICATION FOR EXTENSION

OF TIME TO FILE AN OKLAHOMA INCOME TAX RETURN

(This is NOT an extension of time for payment of tax)

For the year January 1 - December 31, or other taxable year beginning ________________ , 2010 ending ______________, ______.

INDIVIDUALS: Your irst name, middle initial and last name

INDIVIDUALS: If joint return, spouse’s irst name, middle initial and last name

CORPORATIONS: Corporate, Partnership, Trust or Estate Name

Present address (number and street, including apartment number or rural route)

City, State and Zip

Your Social

Security Number:

Spouse’s Social

Security Number:

CORPORATIONS, PARTNERSHIPS, TRUSTS, ESTATES:

Federal

Identiication

Number:

IMPORTANT: EXTENSION IS VALID ONLY IF 90% OF THE TAX LIABILITY IS PAID BY THE ORIGINAL DUE DATE.

An Extension of Time to File with the IRS has been granted to: |

DATE ________________________ |

Extension of Time to File with the Okla. Tax Commission is requested to: |

DATE ________________________ |

If requesting a total of more than 6 months for corporations or more than 5 months for partnerships, estates or trusts, please state reason here: ________________________________________________________________________

SIGNATURE Under penalty of perjury, I declare that the information contained in this document, attachments and schedules are true and correct to the best of my knowledge and belief.

Your Signature (* If corporation, partnership, estate, or trust, see below) |

Date |

Paid Preparer’s Signature |

|

|

|

Spouse’s Signature (if iling jointly, BOTH must sign even if only one had income) |

Date |

Date |

Amount you are paying: (from line 7).

$

*If corporation, partnership, estate, or trust (oficer, partner, member, iduciary signature is required)

This is NOT an extension of time for payment of tax!!

APPLICATION FOR EXTENSION OF TIME

TO FILE AN OKLAHOMA INCOME TAX RETURN WORKSHEET

The bottom portion of this form is a worksheet to compute your payment. Please retain for your records. Enter the total from line 7 of the worksheet on the coupon above. Return the top portion with your payment, if applicable.

OKLAHOMA INCOME TAX COMPUTATION (Do not use to remit franchise tax; see instruction number 7 on back)

1.Total income tax liability (you may estimate this amount).........................................

Note: You must enter an amount on line 1. If you do not expect to owe tax, enter zero.

2.Oklahoma income tax withheld...............................................

3.Estimated tax payments (include prior year overpayment allowed as a credit).................................................................

4.Other payments and credits you expect to claim

on your return .........................................................................

5.Add lines 2, 3 and 4..................................................................................................

6.Income tax balance due (subtract line 5 from line 1)................................................

7.Amount you are paying. (Enter here and on the coupon above)...........................

Important: Extension is valid only if 90% of the tax liability is paid by the original due date

FORM 504 - APPLICATION FOR EXTENSION OF TIME TO FILE AN OKLAHOMA INCOME TAX RETURN

GENERAL INFORMATION

An extension of time to ile your income tax return shall not be granted unless 90% of the tax liability is paid on or before

the original due date of the return.

Since the Oklahoma return cannot be completed until the Federal return is completed, the Oklahoma Tax Commission has

administratively adopted the policy of honoring the automatic Federal extension, when no additional state tax is due, as an extension of time to ile the Oklahoma return. When you ile your Oklahoma return, simply enclose a copy of the Federal

extension.

You only need to use this form to apply for additional time to ile your income tax return when you owe additional Okla-

homa income tax or do not have a Federal extension. Also, corporations, partnerships, estates and trusts need to use this form when iling for additional time beyond that granted by the Federal extension. When you ile your Oklahoma return,

enclose a copy of the Oklahoma Extension.

Remember, you cannot get an extension of time to pay your income tax, but only to ile your return. Delinquent pen- alty of 5% may be charged, if at least 90% of your total tax liability has not been paid by the original due date. Delinquent

interest, at the rate of 1.25% per month, may be charged if 100% of your tax liability is not paid by the original due date of the return.

INSTRUCTIONS

1.An extension cannot be granted for more than one-half the accounting period covered by the individual, partnership, estate or trust return (i.e. 6 month extension for a 12 month tax year). In the case of a corporate return, an extension may not exceed a total of 7 months.

2.Applications for extensions of time must be postmarked on or before the due date for iling the income tax return, or before the expiration of the automatic Federal extension.

3.An automatic extension, without request, is granted to members of the active military service serving outside the

United States or conined to a hospital. Such extension is granted to the 15th day of the third month following their return to the United States, or their release from a hospital.

4.This application may not be used to request an extension of time for the payment of tax. Interest will be charged at the rate of 1.25% per month from the original due date of the return until paid.

5.If husband and wife ile separate returns, each must ile application for an extension. Attorneys or agents for the tax- payer must prepare separate applications for each extension requested.

6.Any extension granted is pursuant to the provisions of Section 216 of the State Tax Uniform Procedure Act and the Oklahoma Tax Commission.

7.Do not use this form to remit franchise tax. The remittance of estimated franchise tax must be made on a ten- tative (estimated) franchise tax return (Form 200 or 215).

8.Cut Form 504 along the dotted line and submit the top portion of the Application for Extension of Time to File an Okla- homa Income Tax Return.

Mail to: Oklahoma Tax Commission

Income Tax P.O. Box 26890

Oklahoma City, Oklahoma 73126-0890

#1695#

#1695#