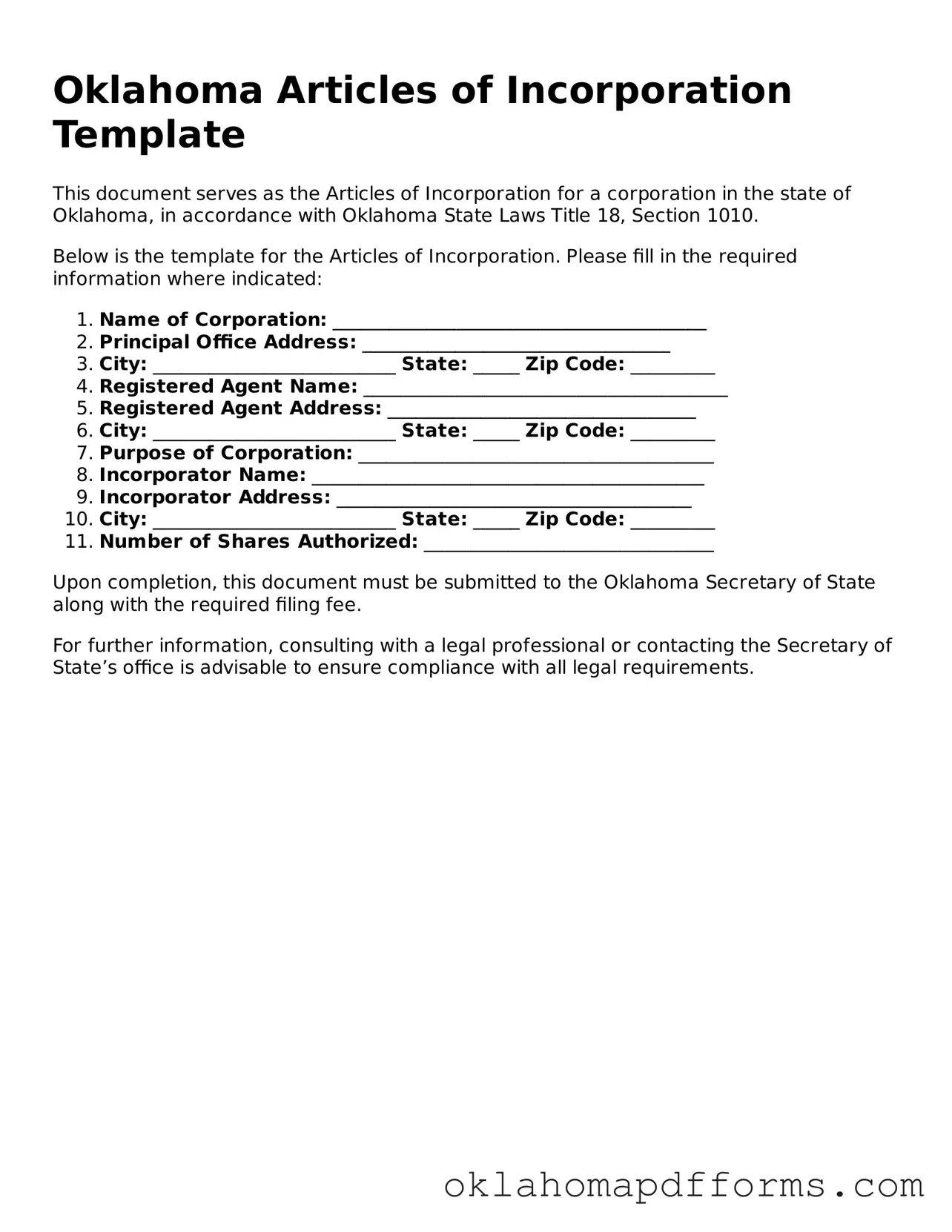

The Oklahoma Articles of Incorporation form is similar to the Certificate of Incorporation used in many states. Both documents serve the primary purpose of establishing a corporation as a legal entity. They outline essential details such as the corporation's name, purpose, and the number of shares authorized. While the specific requirements may vary by state, the fundamental goal remains the same: to provide a formal declaration of the corporation's existence to the state government.

Another document that shares similarities is the Bylaws of a corporation. While the Articles of Incorporation establish the corporation's existence, the Bylaws govern its internal operations. They detail the rules for management, including how meetings are conducted and how officers are elected. Both documents are crucial for the corporation’s functioning but serve different roles—one for external recognition and the other for internal governance.

The Limited Liability Company (LLC) Articles of Organization is another comparable document. Like the Articles of Incorporation, this form is required to legally establish an LLC. It includes information such as the LLC's name, address, and registered agent. Both documents create a distinct legal entity, though the LLC structure offers different tax benefits and operational flexibility compared to a corporation.

The Partnership Agreement also bears resemblance to the Articles of Incorporation, albeit in a different context. This document outlines the terms of a partnership, including each partner's contributions and responsibilities. While the Articles of Incorporation create a corporation, the Partnership Agreement establishes a collaborative business relationship among individuals. Both documents formalize business arrangements, providing a clear framework for operations.

The Nonprofit Articles of Incorporation serves a similar purpose for nonprofit organizations. This document establishes a nonprofit entity and outlines its mission and structure. Like the standard Articles of Incorporation, it requires information about the organization’s name, address, and purpose. Both documents are essential for legal recognition and compliance with state regulations, though the nonprofit version emphasizes charitable objectives.

The Certificate of Formation for a Professional Corporation (PC) is another related document. This form is specific to professionals, such as doctors or lawyers, who wish to incorporate their practices. It includes similar information to the standard Articles of Incorporation but may also include additional requirements specific to the profession. Both documents facilitate the creation of a legal entity, ensuring compliance with state laws governing professional services.

For those looking to purchase an all-terrain vehicle in California, it's essential to use the California ATV Bill of Sale form, which serves as an official record of the transaction. This legal document captures vital information such as the sale date, purchase price, and ATV details, providing clarity for both parties involved. To ensure that you complete this process correctly, you can refer to resources like legalpdf.org for guidance and templates.

The Statement of Information is akin to the Articles of Incorporation in that it provides essential information about a corporation after it has been formed. This document typically includes updates on the corporation's address, officers, and business activities. While the Articles of Incorporation are filed at the inception of the corporation, the Statement of Information is often required periodically to keep the state informed about the corporation's status.

Finally, the Business License application is similar in that it serves as a prerequisite for conducting business legally. While the Articles of Incorporation establish the corporation's legal status, the Business License grants permission to operate within a particular jurisdiction. Both documents are essential for compliance with state and local regulations, ensuring that the business is recognized and authorized to engage in its activities.