What is a Durable Power of Attorney in Oklahoma?

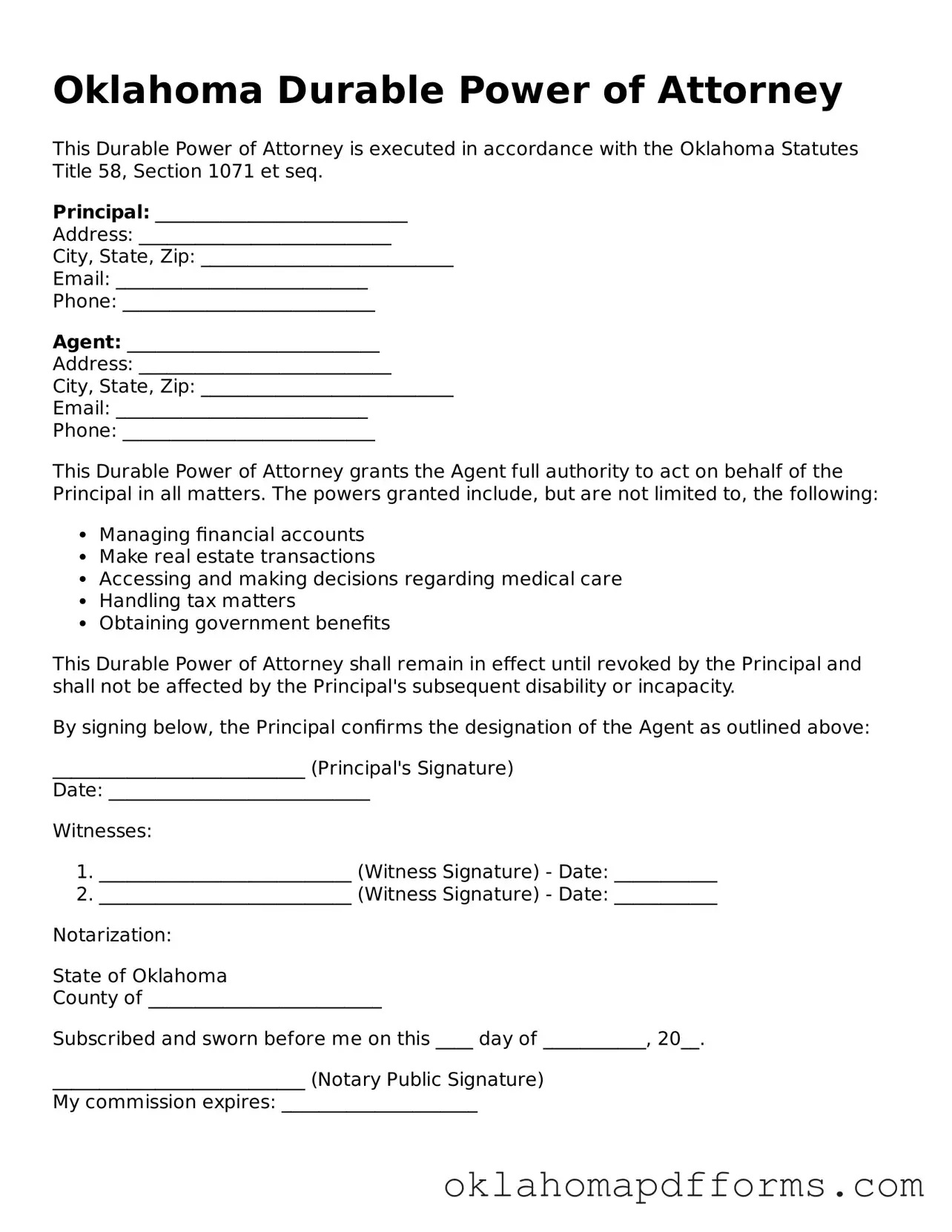

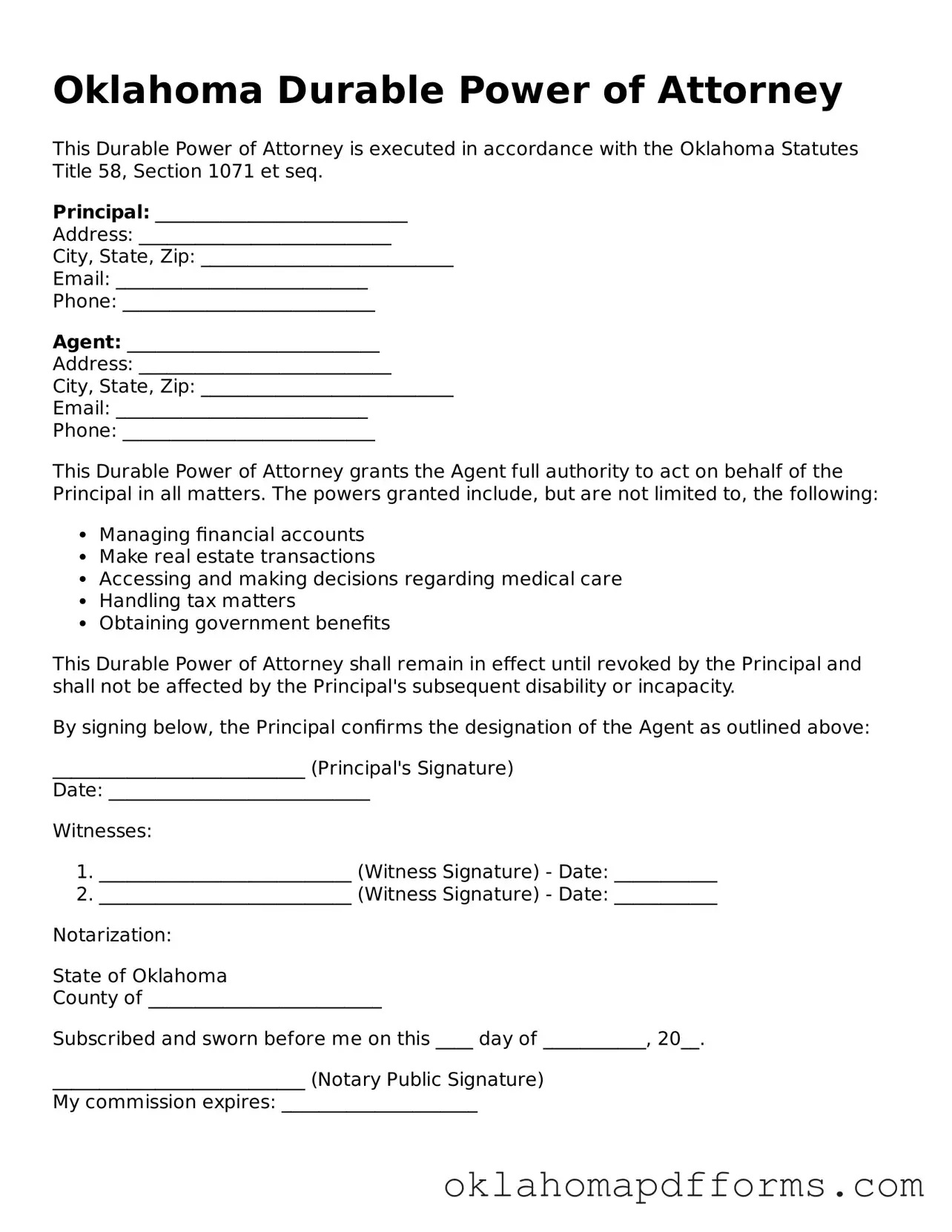

A Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to designate another person, referred to as the agent, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated, ensuring that their financial and legal matters can be managed without interruption.

Why should I consider creating a Durable Power of Attorney?

Creating a DPOA provides peace of mind. It allows you to choose someone you trust to handle your affairs if you cannot do so yourself. This can prevent potential conflicts among family members and ensure that your wishes are respected regarding financial and healthcare decisions.

Who can be appointed as an agent in a Durable Power of Attorney?

In Oklahoma, any competent adult can be appointed as an agent. This includes family members, friends, or professionals. It is essential to select someone who is trustworthy and capable of managing your affairs responsibly.

What powers can be granted to the agent in a Durable Power of Attorney?

The principal can grant a wide range of powers to the agent, including managing bank accounts, paying bills, buying or selling property, and making healthcare decisions. The specific powers should be clearly outlined in the DPOA document to avoid any confusion.

How does a Durable Power of Attorney differ from a regular Power of Attorney?

The primary difference lies in the durability of the document. A regular Power of Attorney typically becomes invalid if the principal becomes incapacitated. In contrast, a Durable Power of Attorney remains effective even in such situations, allowing the agent to continue acting on behalf of the principal.

Do I need to have the Durable Power of Attorney notarized?

Yes, in Oklahoma, a Durable Power of Attorney must be signed in the presence of a notary public. This step helps to ensure that the document is legally valid and can be enforced if necessary.

Can I revoke a Durable Power of Attorney once it is created?

Yes, a principal can revoke a Durable Power of Attorney at any time, as long as they are mentally competent. To revoke the DPOA, the principal should provide written notice to the agent and any institutions or individuals who may have relied on the document.

What happens if I do not have a Durable Power of Attorney?

If you do not have a DPOA and become incapacitated, a court may need to appoint a guardian or conservator to manage your affairs. This process can be time-consuming and may not reflect your personal wishes, making it beneficial to have a DPOA in place.

Where can I obtain a Durable Power of Attorney form in Oklahoma?

Durable Power of Attorney forms can be obtained from various sources, including legal stationery stores, online legal services, or through an attorney. It is advisable to ensure that the form complies with Oklahoma state laws to ensure its validity.