The Oklahoma Employment Security Commission Direct Deposit Enrollment Form shares similarities with the IRS Form W-4, which is used for withholding allowances. Both documents require personal information, such as name and Social Security number, to ensure that the correct individual is associated with the financial transactions. Each form also necessitates a signature, indicating the individual's consent for the respective organization to process payments or withholdings. The W-4 form, like the Direct Deposit form, is crucial for ensuring accurate financial management within the context of employment and taxation.

When selling or buying a vehicle in Arizona, it’s essential to have a proper documentation process in place to avoid any misunderstandings or issues later on. The Arizona Motor Vehicle Bill of Sale is one such document that plays a vital role in the transfer of ownership. By effectively utilizing resources like the arizonapdfforms.com/motor-vehicle-bill-of-sale/, both buyers and sellers can ensure a transparent and legally binding transaction, protecting their interests in the process.

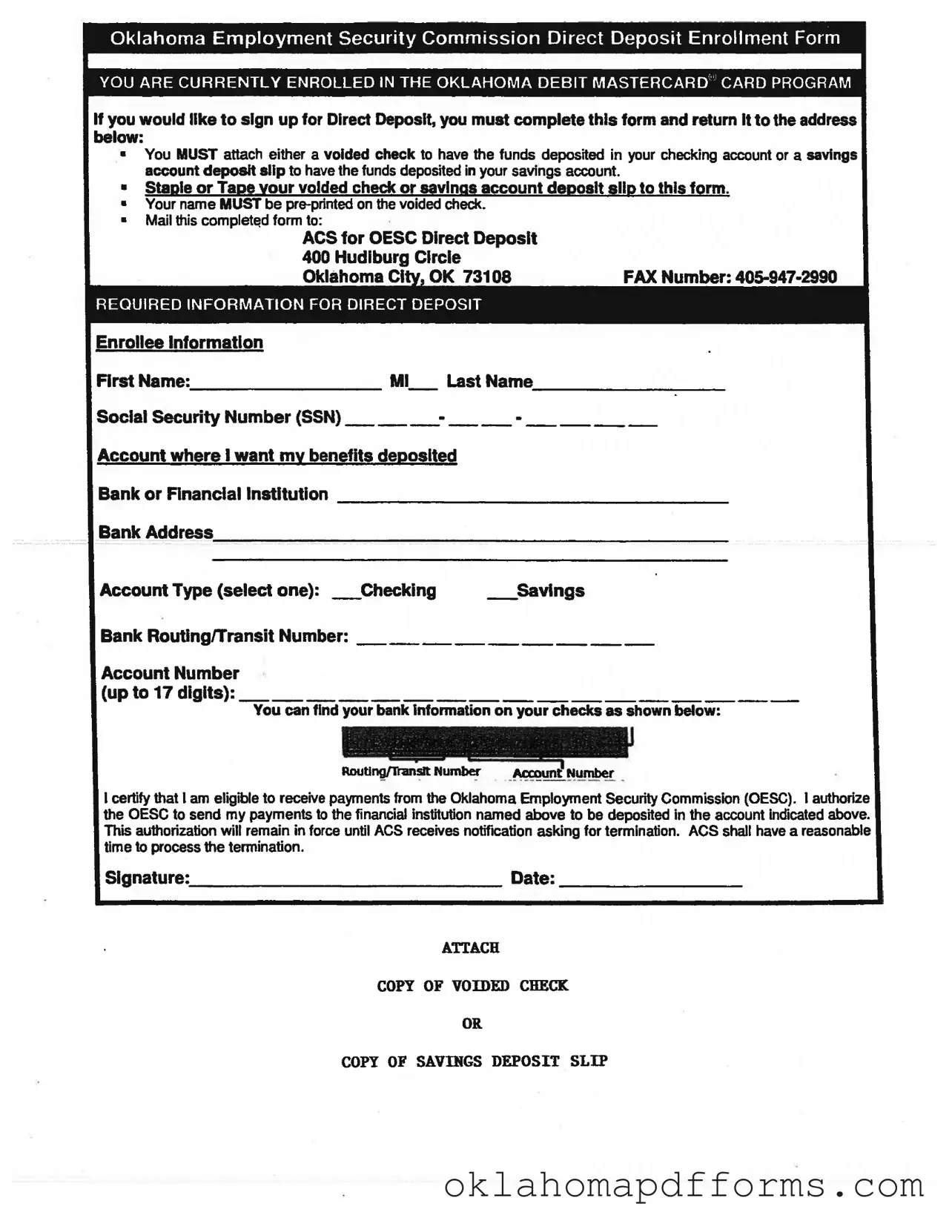

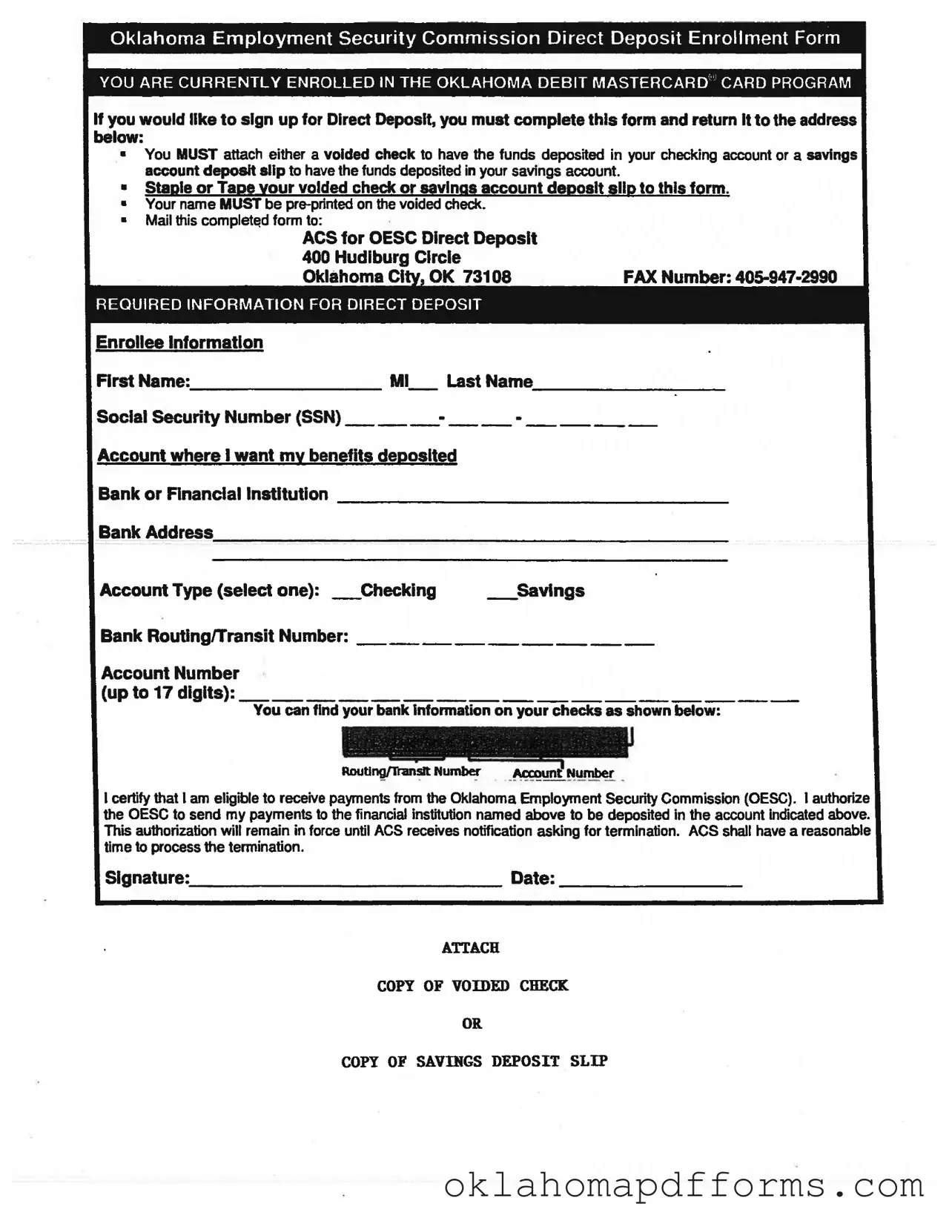

Another document comparable to the Employment Oklahoma form is the Direct Deposit Authorization Form commonly used by employers. This form also allows employees to designate a bank account for the deposit of their wages. It similarly requires the employee’s name, bank account details, and a voided check or deposit slip to confirm the account. Both forms aim to facilitate the smooth transfer of funds into the designated account while providing a clear record of authorization.

The Bank Account Verification Form is yet another document that bears resemblance to the Employment Oklahoma form. This form is often used by financial institutions to verify account details for direct deposits. Like the Direct Deposit Enrollment Form, it requires information such as the account holder's name, account number, and routing number. Both forms serve the purpose of ensuring that funds are deposited accurately into the correct accounts, thereby minimizing errors in financial transactions.

Additionally, the Unemployment Insurance Claim Form shares similarities with the Employment Oklahoma form. This form is used to apply for unemployment benefits and often requires the claimant to provide banking information for direct deposit. Both documents necessitate personal identification details and the submission of supporting documentation, such as a voided check, to facilitate the timely and correct distribution of funds to the claimant.

The Social Security Administration’s Direct Deposit Enrollment Form is another document akin to the Employment Oklahoma form. This form allows individuals to set up direct deposit for Social Security benefits. It requires similar information, including personal identification and bank account details, to ensure that benefits are deposited directly into the correct financial institution. Both forms emphasize the importance of providing accurate banking information to avoid delays in receiving funds.

The Payroll Deduction Authorization Form is also comparable to the Employment Oklahoma form. This document allows employees to authorize deductions from their paychecks for various purposes, such as retirement contributions or health insurance premiums. Like the Direct Deposit Enrollment Form, it requires personal information and may also necessitate bank account details if the deductions are to be deposited directly into a financial account. Both forms serve to streamline the management of financial transactions related to employment.

Finally, the Employee Benefits Enrollment Form is similar to the Employment Oklahoma form in that it collects personal information and requires authorization for the processing of benefits. This form is used to enroll employees in various benefits programs, which may include direct deposit options for health savings accounts or retirement plans. Both documents aim to ensure that employees receive the benefits they are entitled to while maintaining accurate records of their preferences and authorizations.