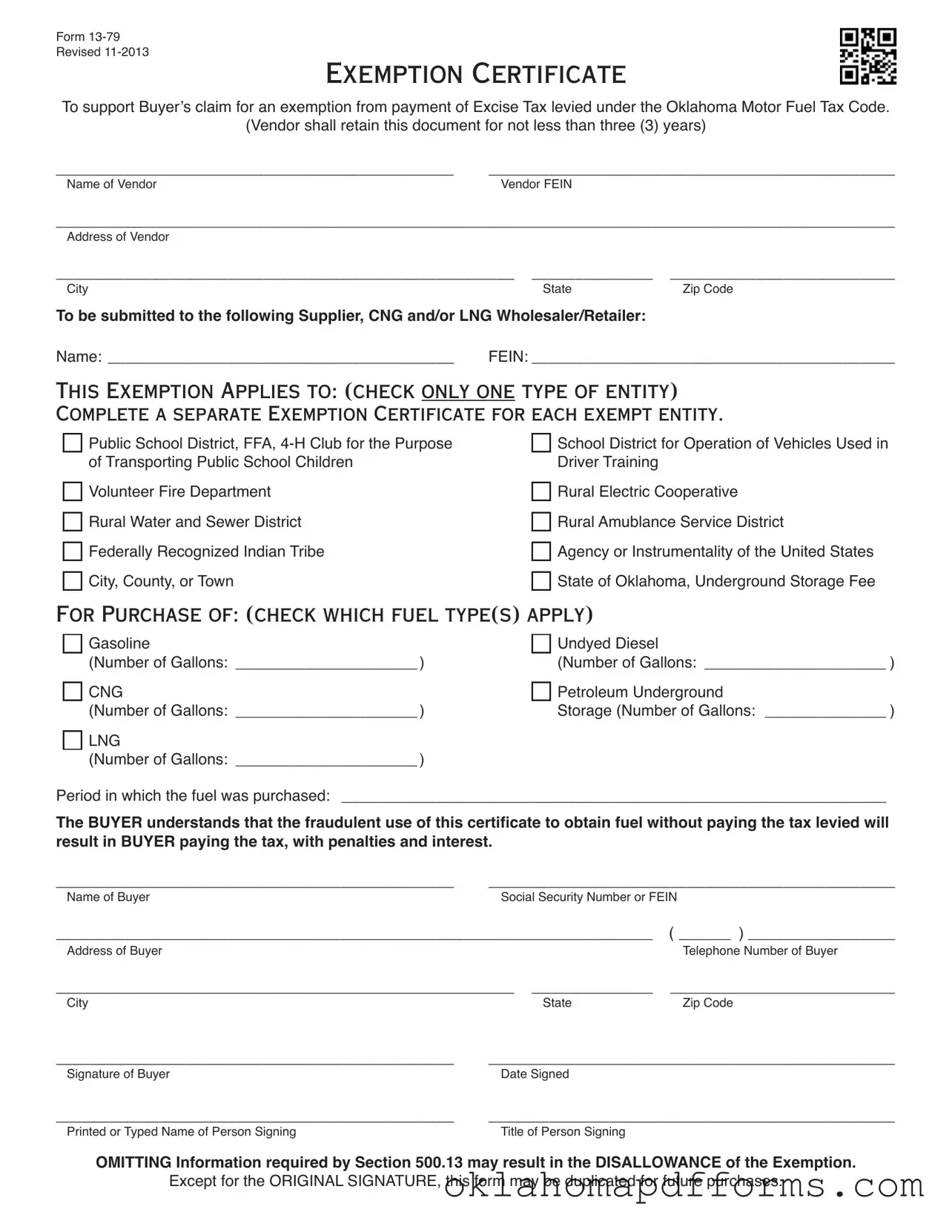

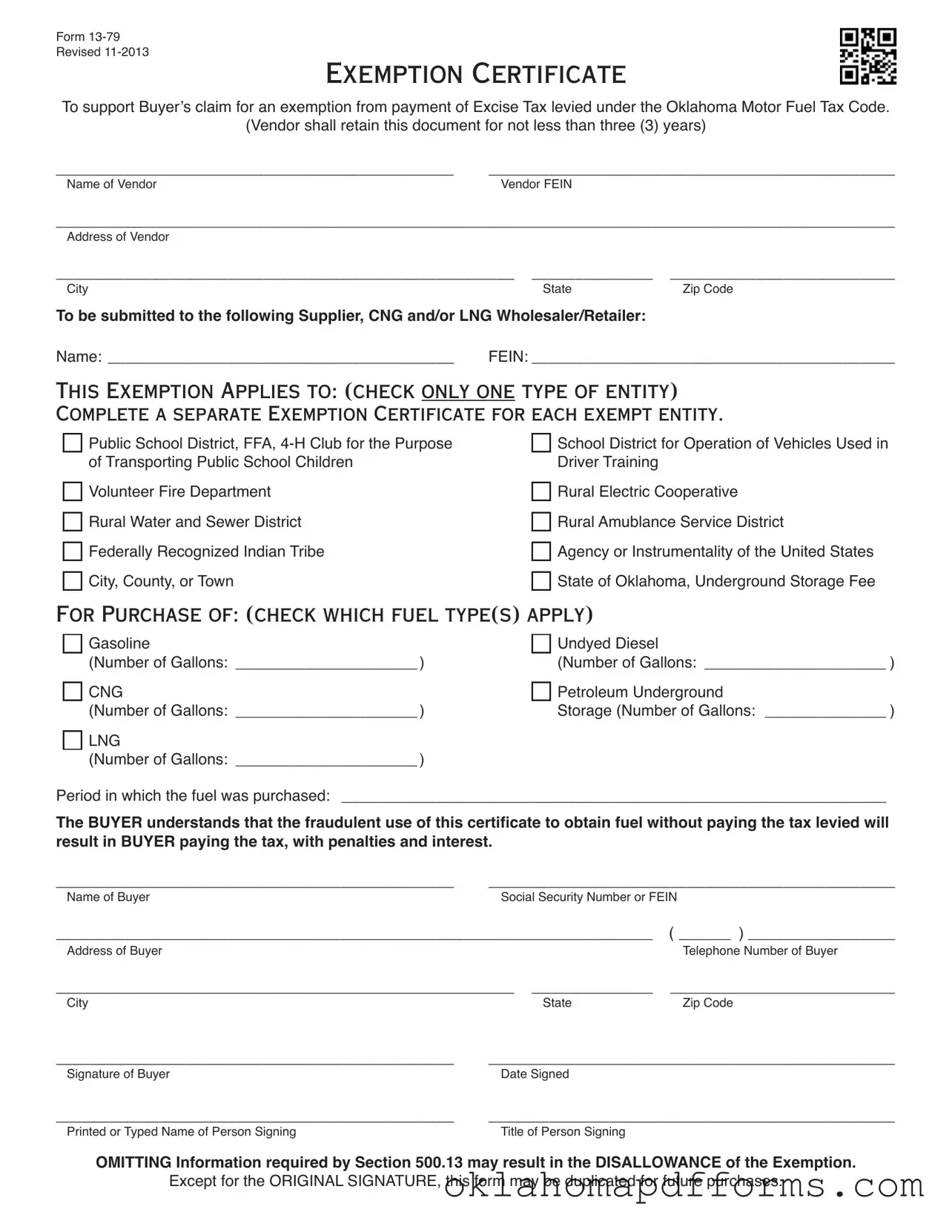

What is the Oklahoma 13 79 form?

The Oklahoma 13 79 form is an Exemption Certificate used by buyers to claim an exemption from the excise tax imposed under the Oklahoma Motor Fuel Tax Code. This form is essential for specific entities, allowing them to purchase fuel without paying the excise tax.

Who needs to fill out the Oklahoma 13 79 form?

This form is required for certain entities, including public school districts, volunteer fire departments, rural electric cooperatives, and federally recognized Indian tribes, among others. Each exempt entity must complete a separate form for each purchase.

How long must the vendor retain the Oklahoma 13 79 form?

Vendors are required to keep the completed Oklahoma 13 79 form for a minimum of three years. This retention period is crucial for compliance and auditing purposes.

What information is needed to complete the form?

To complete the form, you will need to provide the vendor's name, address, and FEIN. Additionally, the buyer's name, address, Social Security number or FEIN, and the type and amount of fuel purchased must be included.

Can the Oklahoma 13 79 form be duplicated?

Yes, except for the original signature, the form can be duplicated for future purchases. This allows for easier handling of multiple transactions without needing to fill out a new form each time.

What types of fuel can be purchased using the Oklahoma 13 79 form?

The form can be used for various fuel types, including gasoline, undyed diesel, compressed natural gas (CNG), liquefied natural gas (LNG), and petroleum underground storage. Buyers must indicate the specific fuel type(s) they are purchasing.

What happens if the form is used fraudulently?

If the Oklahoma 13 79 form is used fraudulently, the buyer will be responsible for paying the excise tax, along with any applicable penalties and interest. It is important to use this form accurately and honestly to avoid legal consequences.

Is there a specific period for which the fuel purchase must be indicated?

Yes, the buyer must specify the period during which the fuel was purchased on the form. This information helps ensure proper tracking and compliance with tax regulations.

What could happen if required information is omitted from the form?

Omitting necessary information as specified by Section 500.13 may lead to the disallowance of the exemption. It is crucial to complete the form fully to ensure the exemption is honored.

What is the significance of the buyer's signature on the form?

The buyer's signature is essential as it verifies the authenticity of the information provided. It also confirms that the buyer understands the implications of using the form and agrees to comply with all regulations.