|

|

|

|

|

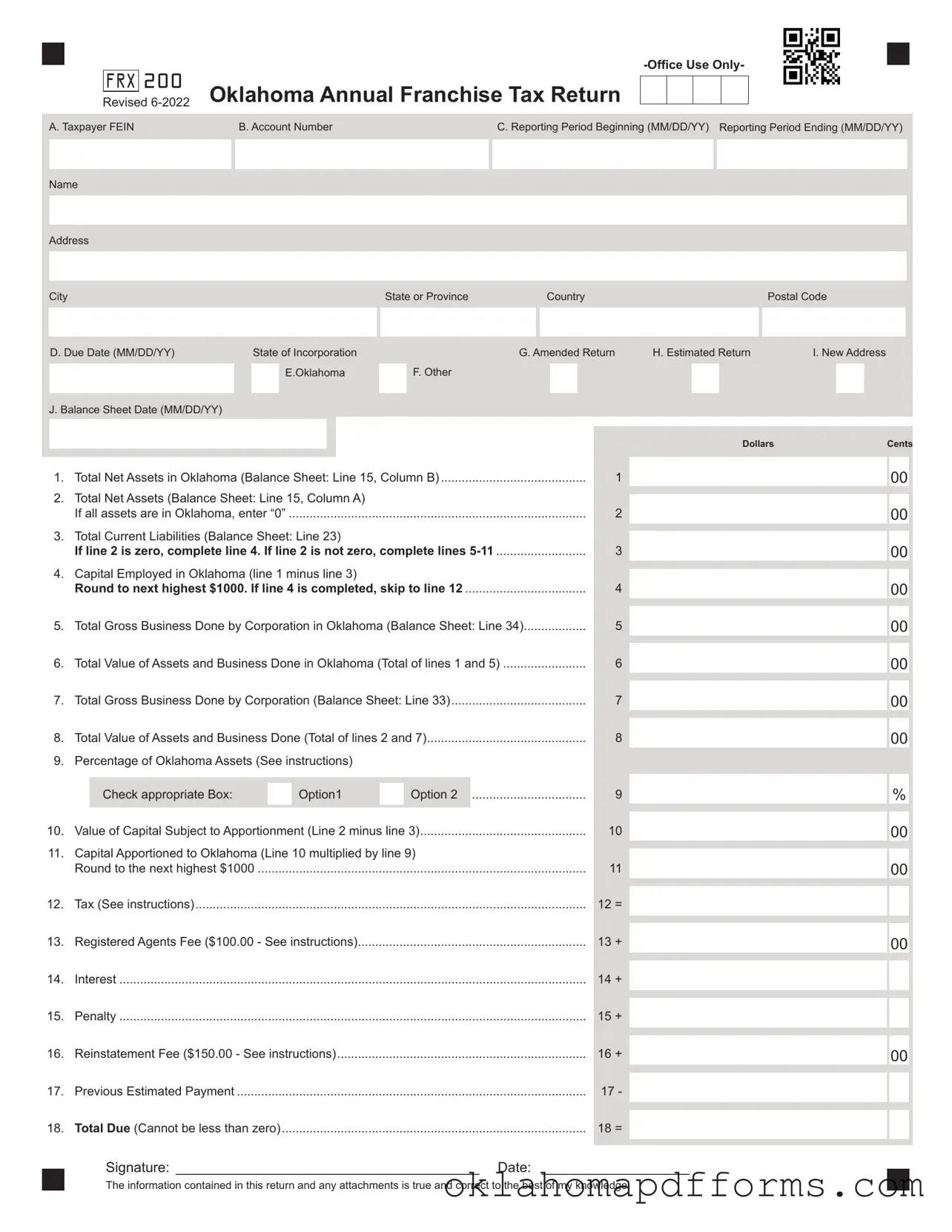

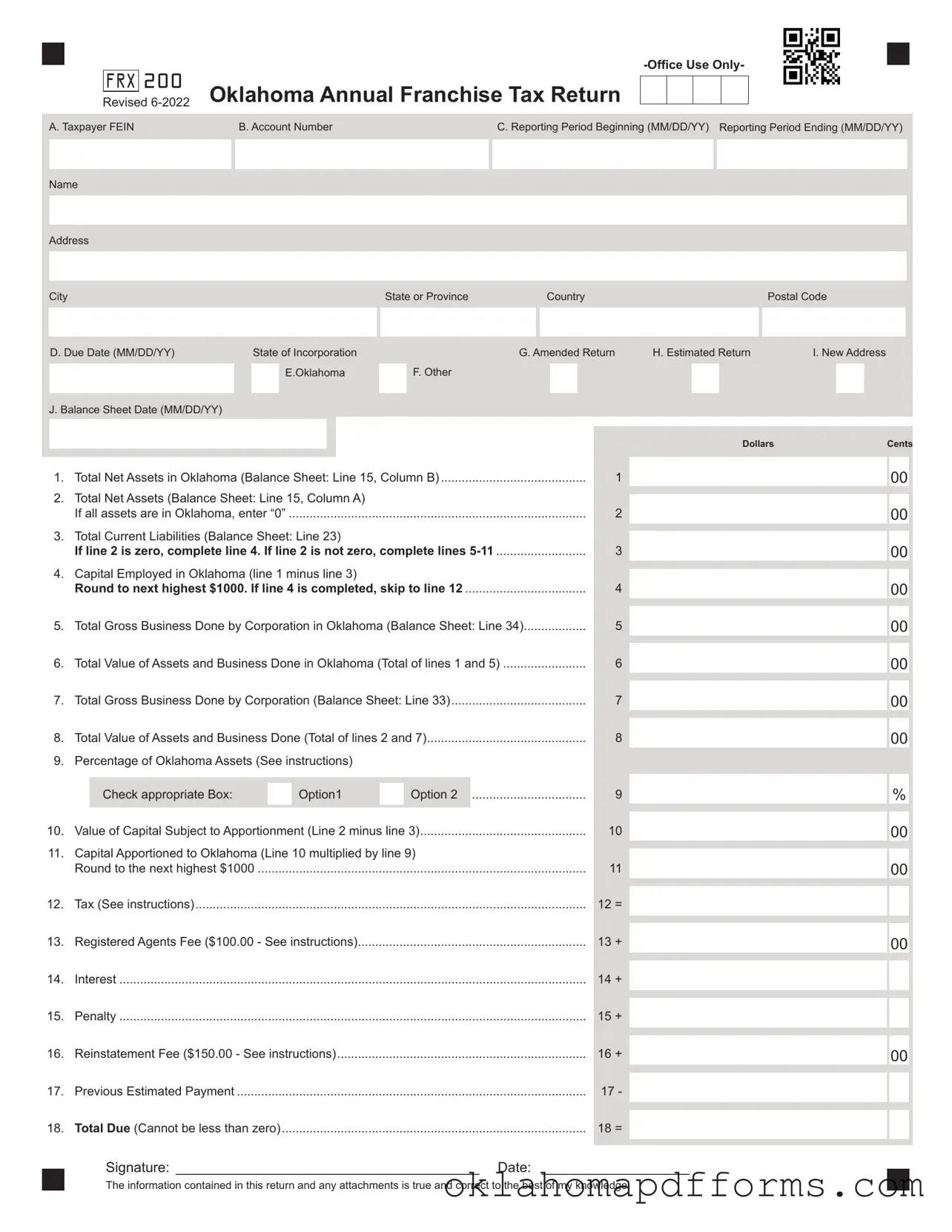

Oklahoma Annual Franchise Tax Return |

|

|

|

|

|

FRX |

200 |

|

|

|

|

|

|

|

|

|

|

|

|

Schedule A: Current Officer Information |

|

|

|

|

Page 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTE: Inclusion of Officers Is Mandatory. |

|

|

|

Taxpayer Name |

|

FEIN |

Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate Officers Effective as of  Are as Follows:

Are as Follows:

(Date)

Example: Reporting period 07/01/2016 – 06/30/2017—Schedule A date = 06/30/2016

Schedule A: Current Officer Information

Enter the current officers effective date. The officers listed below should be those whose term was in effect as of June 30. Be sure to include names, addresses, and Social Security Numbers. A letter will be sent to all officers listed advising them they have been identified as an officer of the filing corporation. Officers listed in error will be advised to contact the corporation, not the Oklahoma Tax Commission to resolve. Officers may be updated or corrected when filing your annual franchise return via OkTAP.

|

1. First Name |

|

Middle Initial |

Last Name |

|

Social Security Number |

|

|

|

|

|

|

|

|

|

|

Home Address (street and number) |

|

|

|

|

|

Daytime Phone (area code and number) |

|

|

|

|

|

|

|

|

|

|

City |

State or Province |

Country |

Postal Code |

Title |

|

|

|

|

|

|

|

|

|

|

2. First Name |

|

Middle Initial |

Last Name |

|

Social Security Number |

|

|

|

|

|

|

|

|

|

|

Home Address (street and number) |

|

|

|

|

|

Daytime Phone (area code and number) |

|

|

|

|

|

|

|

|

|

|

City |

State or Province |

Country |

Postal Code |

Title |

|

|

|

|

|

|

|

|

|

|

3. First Name |

|

Middle Initial |

Last Name |

|

Social Security Number |

|

|

|

|

|

|

|

|

|

|

Home Address (street and number) |

|

|

|

|

|

Daytime Phone (area code and number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State or Province |

Country |

Postal Code |

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. First Name |

|

Middle Intial |

Last Name |

|

Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Address (street and number) |

|

|

|

|

|

Daytime Phone (area code and number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State or Province |

Country |

Postal Code |

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please include Social Security Numbers of officers.

710:1-3-6. Use of Federal Employer Identification Numbers and other identification numbers mandatory.

All returns, applications, and forms required to be filed with the Oklahoma Tax Commission (Commission) in the administration of this State’s tax laws shall bear the Federal Employer’s Identification Number(s), the Taxpayer Identification Number, and/or other gov- ernment issued identification number of the person, firm, or corporation filing the item and of all persons required by law or agency rule to

be named or listed.

[Source: Amended at 32 Ok Reg 1330, eff 8-27-15]

710:1-3-8. Confidentiality of records - All Federal Employer’s Identification and/or Social Security Account Numbers are deemed to be included in the confidential records of the Commission.

Oklahoma Annual Franchise Tax Return

Schedules B, C and D

This page contains Schedules B, C, and D for the completion of Form 200: Oklahoma Annual Franchise Tax Return. Attach additional pages if further space is needed on Schedules C and D.

Schedule B

General Information (to be completed in detail)

If the business is not a “corporation,” list the type of business structure, the date of formation, and county in which filed.

Name and address of Oklahoma “registered agent”

Name of parent company if applicable: |

|

|

|

|

FEIN: |

|

Percent of outstanding stock owned by the parent company, if applicable: |

|

|

|

% |

|

|

|

In detail, please list the nature of business: |

|

|

|

|

|

|

|

• Amount of authorized capital stock or shares: |

|

|

|

|

|

|

(a) Common: |

|

shares, par/book value of each share |

$ |

|

$ |

|

|

(b) First Preferred: |

|

shares, par/book value of each share |

$ |

|

$ |

|

|

• Total capital stock or shares issued and outstanding at the end of fiscal year: |

|

|

|

|

|

|

(a) Common: |

|

shares, par/book value of each share |

$ |

|

$ |

|

|

(b) First Preferred: |

shares, par/book value of each share |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule C

Related Companies: Subsidiaries and Affiliates

•subsidiaries (Companies in which you own 15 percent or more of the outstanding stock)

Name of Subsidiary |

|

FEIN |

|

Percentage Owned (%) |

|

Financial Investment ($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

•affiliates (Companies related other than by direct stock ownership)

Name of Affiliate |

|

FEIN |

|

How related? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule D |

|

|

|

|

|

|

|

|

Details of Current Debt shown on Balance Sheet |

|

Balance remaining of |

|

|

|

|

|

|

Original Amount |

amounts payable within 3 |

Name of Lender |

Original Date of Issuance Maturity Date |

of Instrument |

years of Date of Issuance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 200 - Page 5

Oklahoma Annual Franchise Tax Return Information

• Requirement for Filing Return

Every corporation organized under the laws of this state, or qualified to do or doing business in Oklahoma in a corporate or organized

capacity by virtue or creation of organization under the laws of this state or any other state, territory, district, or a foreign country, including

associations, joint stock companies and business trusts as defined by Oklahoma statutes unless exempt by statutes must file an Annual Franchise Tax Return Form 200.

The term “doing business” means and includes every act, power, or privilege exercised or enjoyed in this state as an incident to do or by virtue of powers and privileges acquired by the nature of all organizations falling within the purview of the Franchise Tax Code.

All Foreign (non-Oklahoma) Corporations including non-profits, must pay an Annual Registered Agent Fee of $100.00. Indicate this amount

on Line 13 of the Form 200.

The maximum annual franchise tax is $20,000.00. Maximum filers should complete and file Form 200 including a schedule of current corporate officers and balance sheet.

If a taxpayer computes the franchise tax due and determines that it amounts to $250.00 or less, the taxpayer is exempt from the tax and a

“no tax due” Form 200 is required to be filed. A schedule of corporate officers must still be filed and, for foreign corporations, the $100.00 registered agents fee is still due.

Applications for refunds must include copies of related Oklahoma Income Tax Returns. The use of the correct corporate name and FEIN on your return and all correspondence will facilitate in timely processing and handling.

• Time for Filing and Payment Information

Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form 200-F has been filed. The report and tax will be delinquent if not paid on or before September 15. A ten percent (10%) penalty and one and one-fourth percent (1.25%) interest per month is due on payments made after the due date.

NOTE: Effective November 1, 2017, corporations who remit the maximum amount of $20,000.00 in the preceding tax year, the tax will be due and payable on May 1st of each year and delinquent if not paid on or before June 1st. These corporations are not eligible to file Form 200-F.

If the Charter or other instrument is suspended, a fee of $150.00 is required for reinstatement. (Line 16 of Form 200.)

If you wish to make an election to change your filing frequency, or to file using the Oklahoma Corporate Income Tax Form 512 or 512-S, complete Franchise Election Form 200-F: . You may file this form online or download it at tax.ok.gov. Form 200-F must be filed no later

than July 1.

• Franchise Tax Computation

The basis for computing Oklahoma Franchise Tax is the balance sheet as shown by your books of account at the close of the last preceding

income tax accounting year, or electing to change filing to match the due date of the corporate income tax, the balance sheet for that corporate tax year.

The franchise tax for corporations doing business both within and outside of Oklahoma, is computed on the proportion to which property owned, or property owned and business done, within Oklahoma, bears to total property owned, or total property owned and total business done everywhere.

“Property owned” is the book value of the assets. For the purpose of determining apportionment as between Oklahoma and elsewhere, liabilities are not to be deducted from gross assets.

The term “business done” means and includes the engaging in any activity or the performing of any act or acts in this state that constitutes the doing or transacting of business. Business done in Oklahoma includes sales shipped from Oklahoma to another state in which the corporation is not doing business.

Inter-company Payable and Receivables between parent, subsidiary and/or affiliates, are to be eliminated from the calculations necessary to determine the amount of franchise tax due.

Oklahoma franchise (excise) tax is levied and assessed at the rate of $1.25 per $1,000.00 or fraction thereof on the amount of capital allocated or employed in Oklahoma.

• Online Filing

Oklahoma Taxpayer Access Point (OkTAP) makes it easy to file and pay. Visit us at tax.ok.gov to file your Franchise Tax Return, Officer

Listings, Balance Sheets and Franchise Election Form 200-F.

Are as Follows:

Are as Follows: