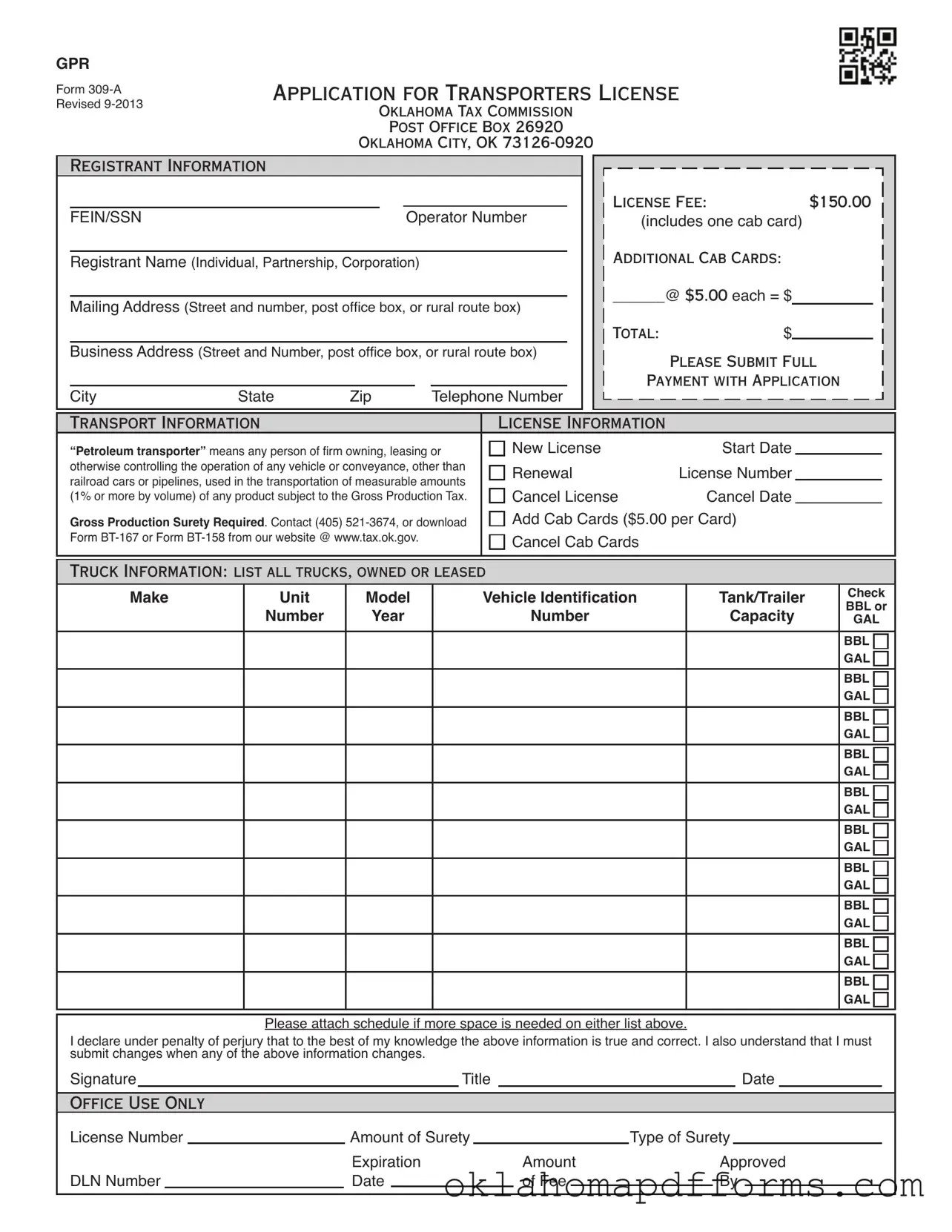

What is the Oklahoma 309A form?

The Oklahoma 309A form, also known as the Application for Transporters License, is a document required for individuals or businesses that transport petroleum products in Oklahoma. This form is necessary to comply with state regulations and to obtain the appropriate licensing for transporting measurable amounts of products subject to the Gross Production Tax.

Who needs to fill out the 309A form?

Any person or entity that owns, leases, or controls vehicles used for transporting petroleum products must complete this form. This includes individuals, partnerships, and corporations engaged in the transportation of these products within the state.

What information is required on the form?

The form requires detailed information about the registrant, including the Federal Employer Identification Number (FEIN) or Social Security Number (SSN), the name of the business or individual, mailing and business addresses, and contact information. Additionally, details about the trucks being used for transportation, such as make, model, year, and capacity, must be provided.

What is the cost associated with the 309A form?

The application fee for the transporter’s license is $150, which includes one cab card. If you need additional cab cards, they are available for $5 each. It’s important to submit the full payment along with your application to avoid delays in processing.

What is a cab card, and why do I need it?

A cab card is a document that must be displayed in the vehicle transporting petroleum products. It serves as proof that the transporter is licensed and compliant with state regulations. Each vehicle in your fleet must have its own cab card, hence the option to purchase additional ones if needed.

How do I submit changes to the information provided on the form?

If any of the information on your application changes after submission, it is your responsibility to report those changes to the Oklahoma Tax Commission. This includes updates to your contact information, business structure, or vehicle details. Timely updates help maintain compliance and avoid penalties.

What happens if I need to cancel my license?

If you need to cancel your transporter’s license, you can do so by submitting a cancellation request to the Oklahoma Tax Commission. It’s advisable to contact their office directly for specific instructions and any required documentation to ensure the cancellation is processed correctly.

Is there a surety bond required for the license?

Yes, a gross production surety bond is required as part of the licensing process. This bond serves as a financial guarantee that you will comply with state regulations regarding the transportation of petroleum products. You can contact the Oklahoma Tax Commission for more details on the bond requirements.

How can I contact the Oklahoma Tax Commission for assistance?

You can reach the Oklahoma Tax Commission by calling (405) 521-3674. They can provide guidance on filling out the form, understanding the requirements, and any other inquiries you may have regarding the transporter’s license.

Where can I find additional forms related to the 309A?

Additional forms, such as Form BT-167 or Form BT-158, can be downloaded from the Oklahoma Tax Commission’s website at www.tax.ok.gov. These forms may be necessary for additional processes related to your transporter’s license.