|

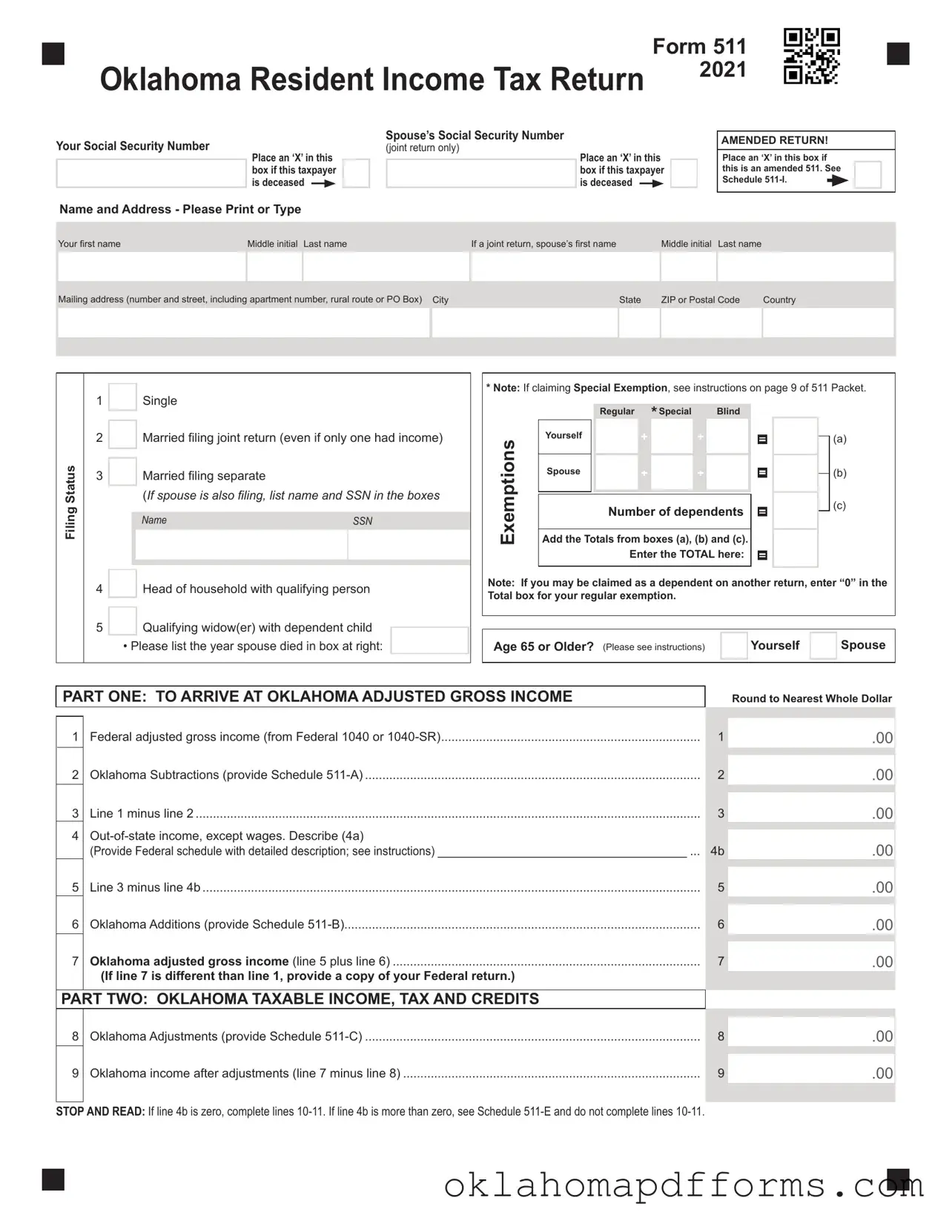

Form 511 |

|

|

|

Oklahoma Resident Income Tax Return |

2021 |

|

|

|

|

Your Social Security Number

Place an ‘X’ in this box if this taxpayer is deceased

Spouse’s Social Security Number

(joint return only)

Place an ‘X’ in this box if this taxpayer is deceased

AMENDED RETURN!

Place an ‘X’ in this box if this is an amended 511. See Schedule 511-I.

Name and Address - Please Print or Type

Your first name |

Middle initial Last name |

If a joint return, spouse’s first name |

Middle initial Last name |

|

|

|

|

|

|

|

|

|

|

Mailing address (number and street, including apartment number, rural route or PO Box) City |

|

State |

ZIP or Postal Code |

Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

Single |

|

|

|

|

|

|

|

2 |

|

Married filing joint return (even if only one had income) |

|

|

Status |

3 |

|

Married filing separate |

|

|

|

|

|

|

|

(If spouse is also filing, list name and SSN in the boxes |

Filing |

|

|

|

|

|

|

NAME |

SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

Head of household with qualifying person |

|

|

|

5 |

|

Qualifying widow(er) with dependent child |

|

|

|

|

|

|

|

|

|

• Please list the year spouse died in box at right: |

|

|

|

|

|

|

|

*Note: If claiming Special Exemption, see instructions on page 9 of 511 Packet.

|

|

|

Regular *Special |

|

Blind |

|

|

|

|

|

|

Exemptions |

Yourself |

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add the |

Totals from |

boxes (a), |

(b) |

and (c). |

|

|

|

|

|

|

|

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

(b) |

|

|

|

Number of dependents |

|

|

|

|

|

(c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter the TOTAL here: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: If you may be claimed as a dependent on another return, enter “0” in the Total box for your regular exemption.

Age 65 or Older? (Please see instructions) |

|

Yourself |

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

PART ONE: TO ARRIVE AT OKLAHOMA ADJUSTED GROSS INCOME

Round to Nearest Whole Dollar

|

|

|

Federal adjusted gross income (from Federal 1040 or 1040-SR) |

1 |

.00 |

|

|

|

Oklahoma Subtractions (provide Schedule 511-A) |

2 |

.00 |

|

|

|

Line 1 minus line 2 |

3 |

.00 |

Out-of-state income, except wages. Describe (4a) |

|

|

|

|

(Provide Federal schedule with detailed description; see instructions) ____________________________________ ... |

4b |

.00 |

|

|

|

Line 3 minus line 4b |

5 |

.00 |

|

|

|

Oklahoma Additions (provide Schedule 511-B) |

6 |

.00 |

|

|

|

Oklahoma adjusted gross income (line 5 plus line 6) |

7 |

.00 |

(If line 7 is different than line 1, provide a copy of your Federal return.) |

|

|

|

|

|

PART TWO: OKLAHOMA TAXABLE INCOME, TAX AND CREDITS

|

|

|

Oklahoma Adjustments (provide Schedule 511-C) |

8 |

.00 |

|

|

|

Oklahoma income after adjustments (line 7 minus line 8) |

9 |

.00 |

|

|

|

|

|

|

STOP AND READ: If line 4b is zero, complete lines 10-11. If line 4b is more than zero, see Schedule 511-E and do not complete lines 10-11.

2021 Form 511 - Resident Income Tax Return - Page 2

The Oklahoma Tax Commission is not required to give actual notice to taxpayers of changes in any state tax law.

Name(s) shown on Form 511:

Your Social Security Number:

PART TWO: OKLAHOMA TAXABLE INCOME, TAX AND CREDITS continued

10 |

Oklahoma itemized deductions (from Schedule 511-D, line 11) or Oklahoma standard deduction |

|

|

|

|

|

|

|

|

|

|

|

(Single or Married Filing Separate: $6,350 • Married Filing Joint or Qualifying Widow(er): $12,700 • |

|

|

|

.00 |

|

|

Head of Household: $9,350) |

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

11 |

Exemptions: Enter the total number of exemptions claimed on page 1 |

|

|

................X $1,000 |

11 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

12 |

Total deductions and exemptions (add lines 10 and 11 or amount from Sch. 511-E, line 5) |

|

|

12 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

13 |

Oklahoma Taxable Income (line 9 minus line 12) |

|

|

13 |

.00 |

|

14 |

(a) Oklahoma Income Tax from Tax Table (see pages 28-39 of instructions) or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if using Farm Income Averaging, enter tax from Form 573, line 22 and |

|

|

|

|

|

|

|

|

|

|

|

|

|

. 00 |

|

|

|

|

.....................................................................................enter a “1” in box on line 14 |

|

|

|

|

14a |

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) If paying the Health Savings Account additional 10% tax, add additional tax here |

|

|

|

|

|

|

|

|

and enter a “2” in box on line 14. If recapturing the Oklahoma Affordable |

|

|

|

|

|

|

|

|

Housing Tax Credit, add recaptured credit here and enter a “3” in box on line 14. |

|

|

|

|

|

|

|

|

If making an Oklahoma installment payment pursuant to IRC Section 965(h) and |

|

|

|

|

|

|

|

|

68 O.S. Sec. 2368(K), add the installment payment here |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

........................................................................and enter a “4” in the box on line 14 |

|

|

|

|

14b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oklahoma Income Tax (line 14a plus line 14b) |

|

|

|

14 |

.00 |

|

STOP AND READ: If line 7 is equal to or larger than line 1, complete lines 15 and 16. If line 7 is smaller than line 1, complete Schedules 511-F and 511-G.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

15 |

Oklahoma child care/child tax credit (see instructions) |

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

Oklahoma earned income credit (see instructions) |

|

|

|

|

|

|

|

|

16 |

.00 |

|

|

17 |

Credit for taxes paid to another state (provide Form 511TX) |

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

18 |

Form 511CR - Other Credits Form. List 511CR line number claimed here: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

Income Tax (line 14 minus lines 15-18) Do not enter less than zero |

|

|

|

19 |

|

|

|

|

|

|

|

.00 |

|

|

|

|

DO NOT PAY THIS AMOUNT. PAYMENT IS FIGURED ON LINE 42. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART THREE: TAX, CREDITS AND PAYMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

20 |

Use tax due on Internet, mail order, or other out-of-state purchases |

|

|

|

|

|

|

20 |

|

|

|

|

(For use tax table, see page 14 of the Packet) If you certify that no use tax is due, place an ‘X’ here: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21 |

Balance (add lines 19 and 20) |

................................................................................................................................ |

|

|

|

|

|

|

|

|

|

|

|

|

|

21 |

|

|

22 |

Oklahoma withholding (provide all W-2s, 1099s or other withholding statements).. |

22 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

2021 estimated tax payments ............. (qualified farmer |

|

) |

|

|

|

23 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

2021 payment with extension |

|

|

|

|

|

|

|

24 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 |

Low Income Property Tax Credit (provide Form 538-H) |

|

|

|

25 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

Sales Tax Relief Credit (provide Form 538-S) |

|

|

|

|

|

26 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27 |

Natural Disaster Tax Credit (provide Form 576) |

|

|

|

|

|

27 |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

28 |

Credits from Form |

a) |

|

577 |

............ |

b) |

|

|

578 |

28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

Amount paid with original return plus additional paid after it was filed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

(amended return only) |

|

|

|

|

|

|

|

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2021 Form 511 - Resident Income Tax Return - Page 3

The Oklahoma Tax Commission is not required to give actual notice to taxpayers of changes in any state tax law.

Name(s) shown on Form 511:

Your Social Security Number:

PART THREE: TAX, CREDITS AND PAYMENTS contined

|

|

|

|

|

|

.00 |

30 |

Payments and credits (add lines 22-29 from page 2) |

30 |

31 |

Overpayment, if any, as shown on original return and/or prior amended return(s) or |

|

|

|

|

|

|

|

as previously adjusted by Oklahoma (amended return only) |

31 |

.00 |

32 |

Total payments and credits (line 30 minus 31) |

32 |

|

.00 |

PART FOUR: REFUND |

|

|

|

|

|

|

|

.00 |

33 |

If line 32 is more than line 21, subtract line 21 from line 32. This is your overpayment |

.......................................... |

33 |

34 |

Amount of line 33 to be applied to 2022 estimated tax (original return only) |

|

|

|

|

|

|

|

.00 |

|

|

|

(For further information regarding estimated tax, see page 5 of the 511 Packet.) |

34 |

|

|

|

|

|

|

|

Schedule 511-H provides you with the opportunity to make a financial gift from your refund to a variety of Oklahoma organizations. Please place the line number of the organization from Schedule 511-H in the box below. If you give to more than one organization, put a “99” in the box. Provide Schedule 511-H ..

35 |

Donations from your refund (total from Schedule 511-H) |

35 |

.00 |

|

|

36 |

Total deductions from refund (add lines 34 and 35) |

|

|

36 |

|

|

|

.00 |

37 |

Amount to be refunded to you (line 33 minus line 36) |

|

|

37 |

|

|

|

.00 |

Direct Deposit Note:

Verify your account and routing numbers are correct. If your direct deposit fails to process or you do not choose direct deposit, you will receive a debit card. See the 511 Packet for direct deposit and debit card information.

Is this refund going to or through an account that is located outside of the United States? |

Yes |

No |

|

Deposit my refund in my:

|

checking account |

Routing |

|

Number: |

|

|

|

savings account |

Account |

|

|

Number: |

|

|

PART FIVE: AMOUNT YOU OWE

|

|

|

|

|

|

|

|

.00 |

38 |

...................................................If line 21 is more than line 32, subtract line 32 from line 21. This is your tax due |

|

|

38 |

|

|

|

|

|

|

|

|

|

39 |

Donation: Public School Classroom Support Fund (original return only) |

|

|

39 |

.00 |

|

|

|

|

|

|

|

|

|

40 |

Underpayment of estimated tax interest (annualized installment method |

|

|

|

) .. |

40 |

.00 |

|

|

|

|

(If you have an underpayment of estimated tax (line 40) & overpayment (line 33), see instructions.) |

|

|

|

|

|

41 |

For delinquent payment add penalty of 5% |

$ _____________________________ |

|

|

|

|

|

|

|

|

plus interest of 1.25% per month |

$ _____________________________ |

41 |

.00 |

|

|

|

|

|

|

|

|

|

42 |

Total tax, donation, penalty and interest (add lines 38-41) |

|

|

|

|

42 |

.00 |

|

|

Place an ‘X’ in this box if the Oklahoma Tax Commission |

|

|

|

|

|

|

|

|

|

|

|

|

Under penalty of perjury, I declare the information contained in this document, and all |

|

|

|

|

|

|

|

|

|

|

attachments and schedules, is true and correct to the best of my knowledge and belief. |

may discuss this return with your tax preparer |

|

|

|

|

|

|

|

|

Taxpayer’s signature |

Date |

Taxpayer’s occupation

Daytime Phone (optional)

Spouse’s occupation

Daytime Phone (optional)

Paid Preparer’s signature |

Date |

Paid Preparer’s address and phone number

Paid Preparer’s PTIN

Do not staple documentation to this form. To attach items, please use a paper clip. Mailing Address for this form: PO Box 26800, Oklahoma City, OK 73126-0800

2021 Form 511 - Resident Income Tax Return - Page 5

Note: Provide this page ONLY if you have an amount shown on a schedule.

Name(s) shown on Form 511:

Your Social Security Number:

Schedule 511-D: Oklahoma Itemized Deductions |

See instructions for details on |

qualifications and required documents. |

|

|

If you claimed itemized deductions on your Federal return, you must claim Oklahoma Itemized Deductions.

1 Federal itemized deductions from Federal Sch. A, line 17 |

1 |

|

00 |

2State and local sales or income taxes from Federal Sch. A, line 5a

(If Federal Sch A, line 5e is limited, enter that portion of Federal Sch A,

|

.........................................................................line 5a included in line 5e) |

2 |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

.........................................................................................................................................Line 1 minus line 2 |

|

|

|

3 |

|

00 |

|

|

|

|

|

|

|

|

|

|

|

4 |

Medical and Dental expenses from Federal Sch. A, line 4 |

4 |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Gifts to Charity from Federal Sch. A, line 14 |

5 |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Line 3 minus lines 4 and 5 |

|

|

|

6 |

|

00 |

7 |

Is line 6 more than $17,000? |

|

|

|

|

|

|

|

|

|

|

YES. Your itemized deductions are limited. Complete lines 9-11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NO. Your itemized deductions are not limited. Skip lines 9 and 10. Go to line 11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

Maximum amount allowed for itemized deductions. (exception, lines 9 and 10) |

|

8 |

17,000 |

00 |

|

|

|

|

|

|

|

|

|

|

|

9 |

Medical and Dental expenses from Federal Sch. A, line 4 |

|

|

|

9 |

|

00 |

10 |

Gifts to Charity from Federal Sch. A, line 14 |

|

|

|

|

10 |

|

|

|

|

|

|

00 |

11 |

Oklahoma Itemized Deductions |

|

|

|

|

|

|

|

|

|

|

If you responded YES on line 7: Add lines 8, 9 and 10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you responded NO on line 7: enter the amount from line 3 |

|

|

|

11 |

|

00 |

Enter your Oklahoma Itemized Deductions on line 10 of Form 511 unless you have income from out-of-state on line 4 of Form 511. If you have an amount on line 4 of Form 511, complete Schedule 511-E “Deductions and Exemptions” to determine the amount to enter on line 12 of Form 511.

Schedule 511-E: Deductions and Exemptions See instructions for details on

qualifications and required documents.

Use this schedule if you have income from out-of-state (Form 511, line 4). Your exemptions and deductions must be prorated on the ratio of Oklahoma Adjusted Gross Income to Federal Adjusted Gross Income reduced by allowable adjustments except out-of-state income. If you claimed itemized deductions on your federal return, complete Schedule 511-D before completing this schedule.

1 |

Oklahoma itemized deductions (Schedule 511-D, line 11) |

|

|

|

|

or Oklahoma standard deduction |

1 |

|

00 |

2 |

Exemptions ($1,000 x number of exemptions claimed at top of Form 511) |

2 |

|

|

|

00 |

3 |

Total (add lines 1 and 2) |

3 |

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

4 |

Divide the amount on line 7 of Form 511 by the amount on line 3 of Form 511 |

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.............................Enter the percentage from the above calculation here (do not enter more than 100%) |

|

% |

|

|

|

|

|

|

|

|

|

|

|

5Total allowable deductions and exemptions. Multiply line 3 by percentage on line 4,

enter total here and on line 12 of Form 511. (Leave lines 10 - 11 of Form 511 blank.) |

5 |

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2021 Form 511 - Resident Income Tax Return - Page 6

Note: Provide this page ONLY if you have an amount shown on a schedule.

Name(s) shown on Form 511:

Your Social Security Number:

Schedule 511-F: Child Care/Child Tax Credit |

See instructions for details on qualifications |

and required documents. |

|

|

If your Federal Adjusted Gross Income is $100,000 or less and you are allowed either a credit for child care expenses or the child tax credit on your Federal return, you are allowed a credit against your Oklahoma tax. Your Oklahoma credit is the greater of:

•20% of the credit for child care expenses allowed by the IRS Code. or

•5% of the child tax credit allowed by the IRS Code.

This includes both the nonrefundable child tax credit and the refundable additional child tax credit.

The credit must be prorated based on the ratio of Oklahoma Adjusted Gross Income to Federal Adjusted Gross Income. If your Federal Adjusted Gross Income is greater than $100,000, no credit is allowed.

Provide a copy of your Federal return and, if applicable, the Federal child care credit schedule.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

..................................Enter your Federal child care credit |

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

.......................................................Multiply line 1 by 20% |

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Enter your Federal child tax credit |

|

|

|

|

|

|

|

|

|

.........(total of child tax credit & additional child tax credit) |

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Multiply line 3 by 5% |

4 |

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

................................................................................................Enter the larger of line 2 or line 4 |

|

|

|

|

5 |

|

00 |

6 |

Divide the amount on line 7 of Form 511 by the amount on line 1 of Form 511 |

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

Enter the percentage from the above calculation here (do not enter more than 100%) |

|

6 |

|

% |

7 |

Multiply line 5 by line 6. This is your Oklahoma child care/child tax credit. |

|

|

|

|

|

Enter total here and on line 15 of Form 511 |

|

|

|

|

7 |

|

00 |

|

|

|

|

|

|

|

|

|

|

|

Schedule 511-G: Earned Income Credit |

See instructions for details on qualifications and |

|

required documents. |

|

You are allowed a credit equal to 5% of the Earned Income Credit allowed on your Federal return. The credit must be prorated on the ratio of Oklahoma Adjusted Gross Income to Federal Adjusted Gross Income. Provide a copy of your Federal return.

|

|

|

|

|

|

|

|

|

|

|

1 |

.....................................................................................................Federal earned income credit |

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

...................................................................................................................Multiply line 1 by 5% |

|

00 |

|

|

|

|

|

|

|

|

|

|

|

3 |

Divide the amount on line 7 of Form 511 by the amount on line 1 of Form 511 |

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

Enter the percentage from the above calculation here (do not enter more than 100%) |

3 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

4 |

Oklahoma earned income credit |

|

|

|

|

........................................(multiply line 2 by line 3, enter total here and on line 16 of Form 511) |

|

00 |

|

|

|

|

|

|

|

|

|

|

|

2021 Form 511 - Resident Income Tax Return - Page 7 - Note: Provide this page ONLY if you have an amount shown on a schedule or are filing an amended return.

Name(s) shown on Form 511:

Your Social Security Number:

Schedule 511-H: Donations from Refund (Original return only)

This schedule allows you to make a donation from your refund to a variety of Oklahoma organizations. Information regarding each program, its mission, how funds are utilized, and mailing addresses are shown in Schedule 511-H Information. If you are not receiving a refund, but would like to make a donation to one of these organizations, Schedule 511-H Information lists the mailing address to mail your donation to the organization. If you are not receiving a refund and wish to donate to Public School Classroom Support Fund, see line 39 of Form 511.

Place an ‘X’ in the box associated with the dollar amount you wish to have deducted from your refund and donated to that organization.

Then carry that figure over into the column at the right. When you carry your figure back to line 35 of Form 511, please list the line number of the organization to which you donated. If you donate to more than one organization, please write a “99” in the box at line 35 of Form 511.

See Packet 511, pages 25 and 26 for Schedule 511-H Information.

1Support of Programs for Volunteers to Act

|

as Court Appointed Special Advocates |

|

|

|

|

|

|

|

|

|

|

|

for Abused or Neglected Children |

|

$2 |

|

$5 |

|

$ |

|

1 |

|

00 |

2 |

Y.M.C.A. Youth and Government Program |

|

$2 |

|

$5 |

|

$ |

|

2 |

|

00 |

3 |

Support Wildlife Diversity Fund |

$2 |

$5 |

$ |

3 |

|

00 |

4Support of Programs for Regional Food Banks

|

in Oklahoma |

|

$2 |

|

$5 |

|

$ |

|

4 |

|

00 |

5 |

Public School Classroom Support Fund |

|

$2 |

|

$5 |

|

$ |

|

5 |

|

00 |

6 |

Oklahoma Pet Overpopulation Fund |

|

$2 |

|

$5 |

|

$ |

|

6 |

|

00 |

7 |

Support the Oklahoma AIDS Care Fund |

$2 |

$5 |

$ |

7 |

|

00 |

8Support Oklahoma Silver Haired Legislature and Alumni

|

Association Program |

$2 |

|

$5 |

$ |

8 |

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

9 Total donations (add lines 1-8, enter total here and on line 35 of Form 511) |

|

|

9 |

|

00 |

Schedule 511-I: Amended Return Information

Did you file an amended Federal return? |

Yes |

If Yes, provide a copy of the IRS Form 1040X or 1045 AND proof of IRS acceptance, such as a copy of the IRS “Statement of Adjustment,” IRS check or deposit slip. IRS documents submitted after filing this Oklahoma amended return may delay processing.

Explain the changes to income, deductions, and/or credits below. Enter the line reference number for which you are reporting a change and give the reason. If more space is needed, provide a separate schedule.

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________