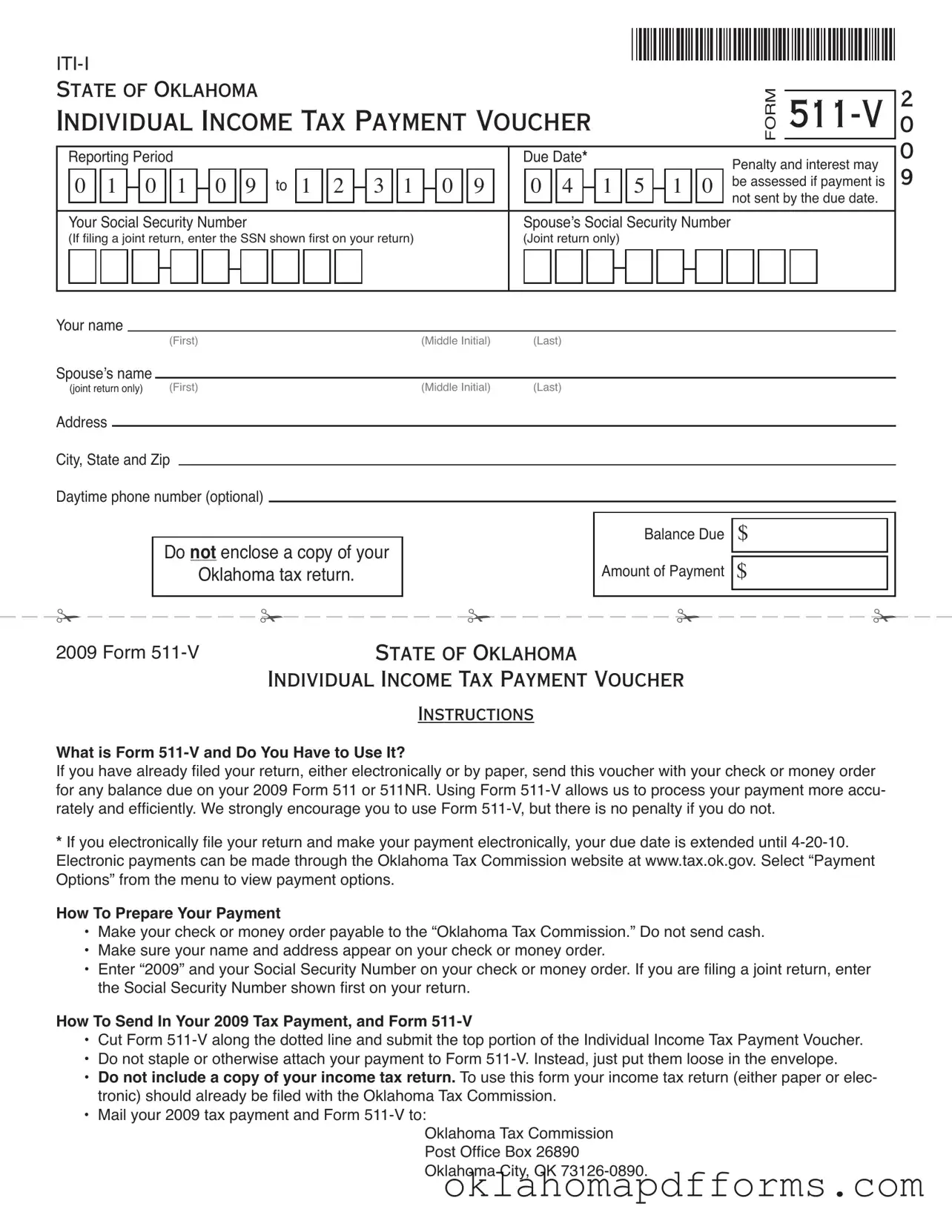

What is the Oklahoma 511 V form?

The Oklahoma 511 V form is an Individual Income Tax Payment Voucher. It is used to submit any balance due for your income tax return. If you have filed your return, either electronically or on paper, you can use this form to send your payment to the Oklahoma Tax Commission.

Do I have to use the 511 V form?

Using the 511 V form is encouraged, but it is not mandatory. If you choose not to use it, you can still send your payment directly without any penalties. However, using the form helps ensure your payment is processed accurately and efficiently.

How do I prepare my payment?

Make your check or money order payable to the "Oklahoma Tax Commission." Be sure to include your name and address on the payment. Also, write "2009" along with your Social Security Number on the payment. If filing jointly, use the Social Security Number of the first person listed on your return.

When is the payment due?

The due date for your payment is the same as the due date for your tax return. If you filed electronically and made your payment electronically, your due date is extended until April 20, 2010.

How do I send in my payment and the 511 V form?

Cut the form along the dotted line and submit the top portion of the voucher. Do not staple your payment to the form. Instead, place both items loose in the envelope. Do not include a copy of your income tax return.

Where do I mail my payment and the 511 V form?

Mail your payment and the 511 V form to the following address: Oklahoma Tax Commission, Post Office Box 26890, Oklahoma City, OK 73126-0890.

Can I pay electronically?

Yes, if you file your return electronically, you can also make your payment electronically through the Oklahoma Tax Commission website. Visit www.tax.ok.gov and select "Payment Options" to view available methods.

What happens if I miss the payment deadline?

If you miss the payment deadline, you may be subject to penalties and interest on the amount due. It's important to make your payment on time to avoid these additional charges.

Is there a penalty for not using the 511 V form?

No, there is no penalty for not using the 511 V form. However, using it can help ensure your payment is processed correctly and on time.

What if I have questions about the 511 V form?

If you have questions about the 511 V form or your payment, you can contact the Oklahoma Tax Commission for assistance. They can provide guidance and answer any specific inquiries you may have.