Instructions for Form 511X

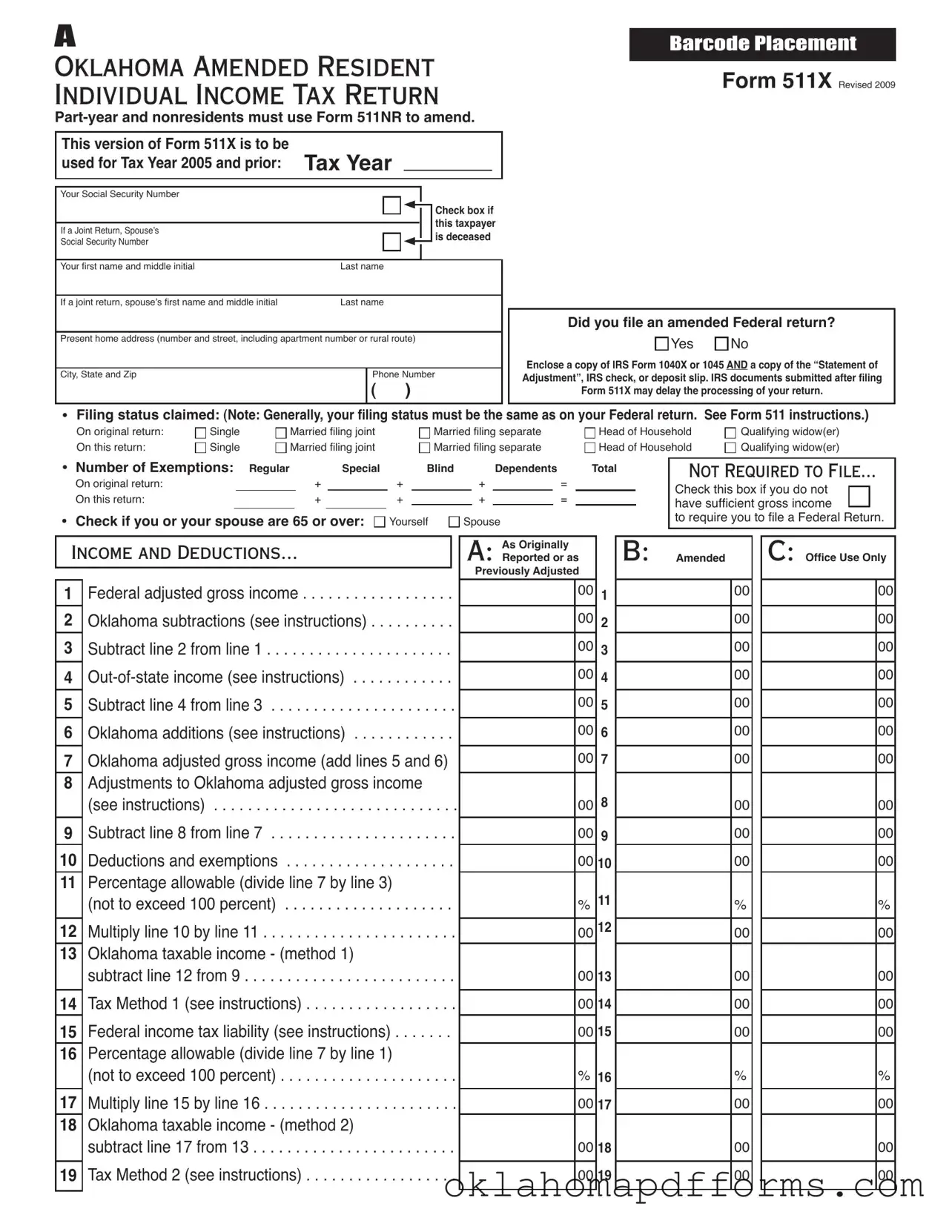

This form is for residents only. Part-year and nonresidents must use Form 511NR to amend.

When to File an Amended Return

Generally, to claim a refund your amended return must be iled within three years from the date tax, penalty and interest was paid. For most taxpayers, the three year period begins on the original due date of the Oklahoma tax return. Estimated tax and withholding are deemed paid on the original due date (excluding extensions).

If your Federal return for any year is changed, an amended Oklahoma return shall be iled within one year. If you amend your Federal return, it is recommended you obtain conirmation the IRS approved your Federal amendment before iling Oklahoma Form 511X. Filing Form 511X without such IRS conirmation may delay the processing of your return, however, this may be necessary to avoid the expiration of the statute of limitation.

File a separate Form 511X for each year you are amending. No amended return may encompass more than one single year.

If you discover you have made an error only on your Oklahoma return we may be able to make the corrections over the phone instead of iling Form 511X. For additional information, call our Taxpayer Assistance Division at (405) 521-3160. Within Oklahoma, call toll-free (800) 522-8165. Operating hours are from (CST) 7:30 a.m. until 4:30 p.m.

When completing this form, it is recommended you have the Resident Individual Income Tax Instructions booklet (511 Packet) for the tax year you are amending. The packet will provide detailed explanation. If you do not have a copy, one may be downloaded from our website (www.tax.ok.gov) beginning with tax year 1997 or you may order a packet for any tax year by calling our forms request line at (405) 521-3108. The request line is open 24 hours a day, 7 days a week.

Before You Begin

This version of Form 511X is for Tax Year 2005 and prior years. If you need to amend for Tax Year 2006 or thereafter, visit our website and download the Form 511X for 2006 and thereafter. You may also order the form at (405) 521-3108.

The tax rates did not change during the tax years of 1990 - 1998. The tax rates also remained unchanged for the tax years 1999 - 2001, for tax years 2002 - 2003 and for tax years 2004 - 2005. Thus, if you are amending a 2000 return, you may refer to the tax tables for any year from 1999 - 2001.

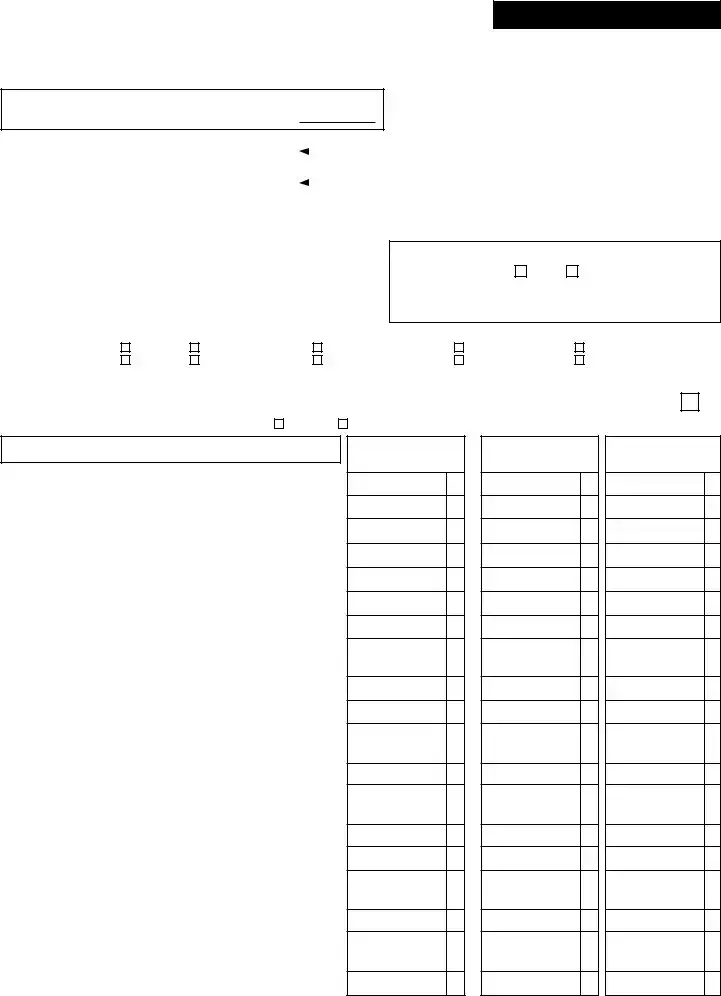

All entries in column “B” must be substantiated by an enclosed document or your refund may be delayed. After completing your amended return, see the “When You Are Finished” section of the instructions for a complete list of necessary docu- ments you must enclose with this return.

Any additional forms, necessary to complete this amended return, can be downloaded from our website (www.tax.ok.gov) beginning with tax year 1997 or can be ordered by calling our forms request line at (405) 521-3108.

Select Line Instructions

Column A: Enter the amounts from your original return. However, if you previously amended that return or it was changed by the Oklahoma Tax Commission, enter the adjusted amounts.

Column B: Enter the amended amounts and explain each change on Page 2. If you need more space, attach a statement. Also, attach any schedule or form relating to the change. For any item you do not change, enter the amount from Column A in Column B. All entries in Column B must be substantiated

by an enclosed document or your refund may be delayed. Column C: Do not use. This column is for Oklahoma Tax Commission use only.