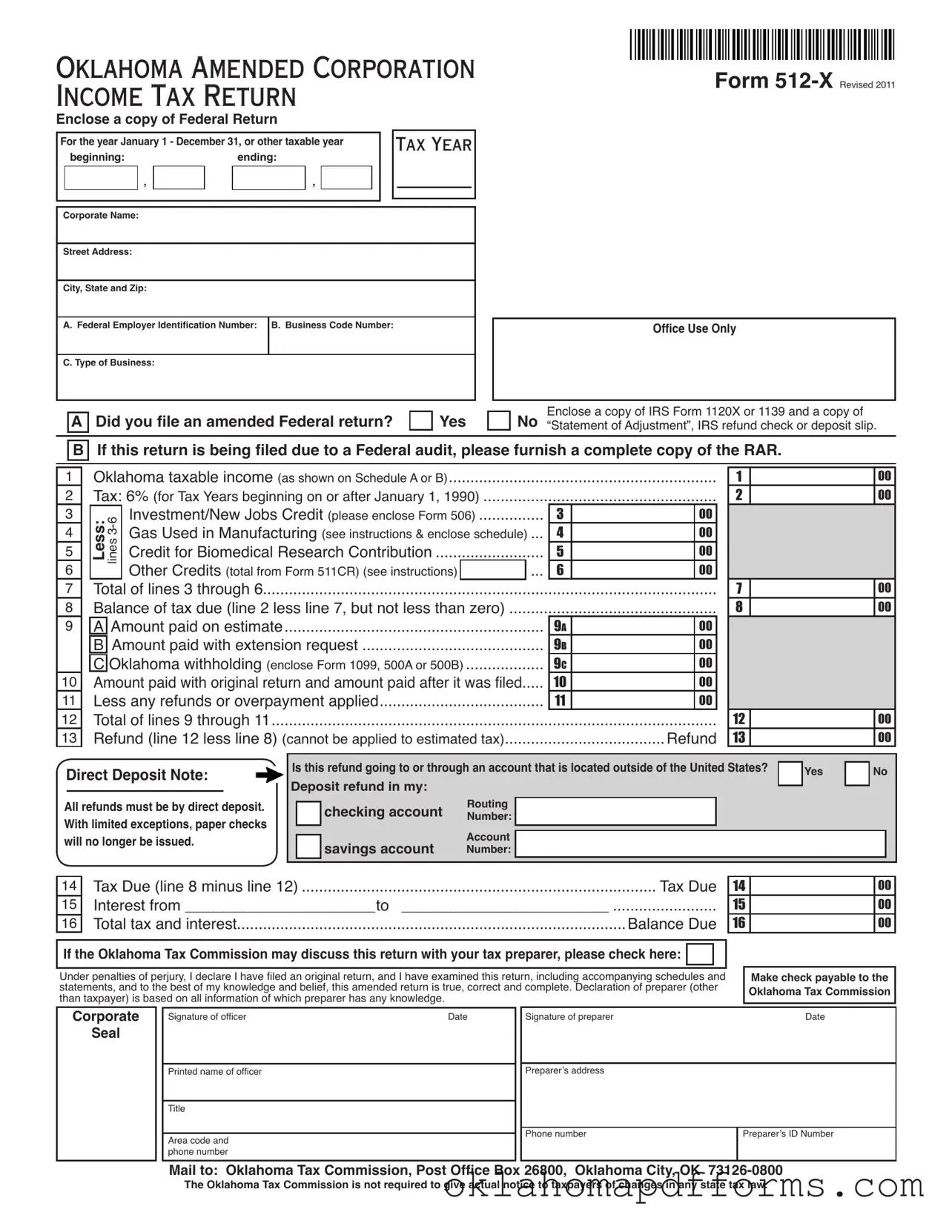

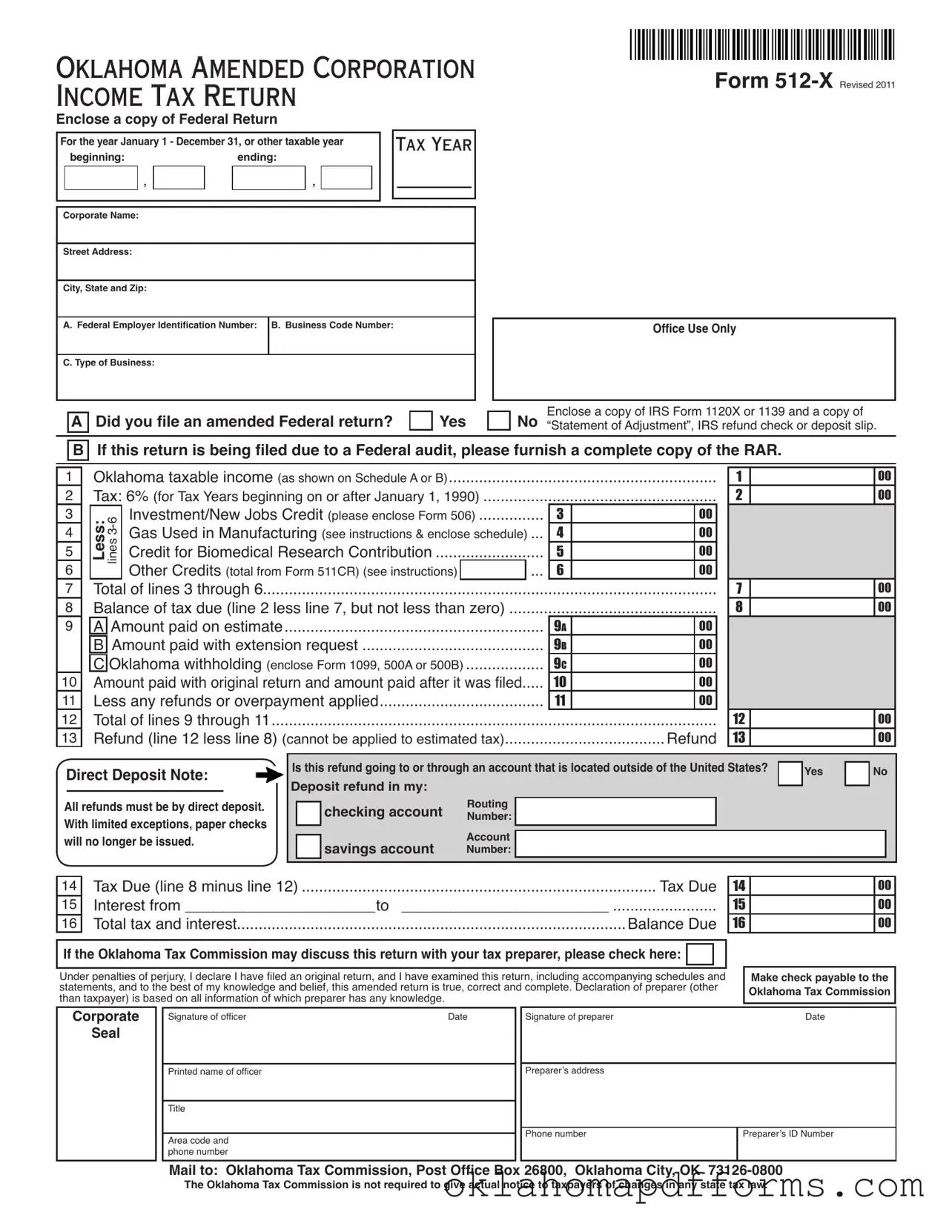

The Oklahoma 512-X form is similar to the IRS Form 1120X, which is the Amended U.S. Corporation Income Tax Return. Both forms allow corporations to amend their previously filed tax returns. When a corporation discovers errors or omissions in its original return, it can use Form 1120X to correct those mistakes at the federal level. This form requires the corporation to explain the reasons for the amendment and provide any supporting documentation, similar to the requirements of the Oklahoma 512-X form.

Another document that resembles the Oklahoma 512-X form is the IRS Form 1139, which is used to apply for a quick refund of an unused credit. Corporations that have overpaid their taxes or have credits that were not utilized can file this form to receive a refund. Like the 512-X, Form 1139 requires supporting documentation, including a copy of the original return, to substantiate the claim for a refund.

The Oklahoma Corporate Franchise Tax Return (Form 200) is also similar to the 512-X form. While the 512-X is specifically for amending income tax returns, Form 200 is used to report corporate franchise taxes. Both forms require detailed financial information about the corporation and may involve adjustments based on prior filings. Both documents emphasize the importance of accurate reporting and compliance with state tax laws.

Form 501 is another related document, as it is the Oklahoma Corporation Income Tax Return. Corporations must file this form annually to report their income and calculate their tax liability. Similar to the 512-X, Form 501 requires detailed financial information and may involve adjustments if the corporation has made errors in its previous filings.

The IRS Schedule A, which is part of the Form 1120, is akin to the Oklahoma 512-X as it outlines the income and deductions for corporations. Both documents require a breakdown of gross income and allowable deductions, allowing for a clear picture of the corporation's financial status. Accurate reporting on both forms is essential to determine the correct tax liability.

Form 511CR is another similar document that pertains to Oklahoma tax credits. Corporations can claim various credits that may reduce their tax liability. Like the 512-X, this form requires documentation to support the claims for credits, ensuring that the corporation complies with state tax regulations.

Form 1099 is also relevant, as it reports various types of income other than wages, salaries, and tips. Corporations may need to include information from Form 1099 when filing the 512-X if they have received income that affects their tax calculations. Both forms require careful attention to detail to ensure accurate reporting of income.

Additionally, the Oklahoma Schedule B is comparable to the 512-X, as it is used to compute taxable income for unitary businesses. Both documents require detailed calculations and may involve apportioning income based on the corporation's operations within and outside of Oklahoma. This ensures that the tax liability is accurately determined based on the corporation's activities.

The Oklahoma Business Personal Property Tax Return is similar in that it requires businesses to report their personal property for tax purposes. While the 512-X focuses on income tax, both forms necessitate accurate reporting of a business's financial situation and compliance with state tax laws, ensuring that all applicable taxes are paid.

For those looking to document their trailer transactions effectively, the convenient Trailer Bill of Sale template is an excellent resource. This document is designed to ensure a smooth transfer of ownership while safeguarding the interests of both the buyer and seller involved.

Lastly, the Oklahoma Sales Tax Return can be seen as analogous to the 512-X form. Both documents require businesses to report financial information and comply with state tax obligations. While the 512-X focuses on income tax, the Sales Tax Return addresses sales tax, yet both require a clear understanding of the business's financial activities and accurate reporting to avoid penalties.