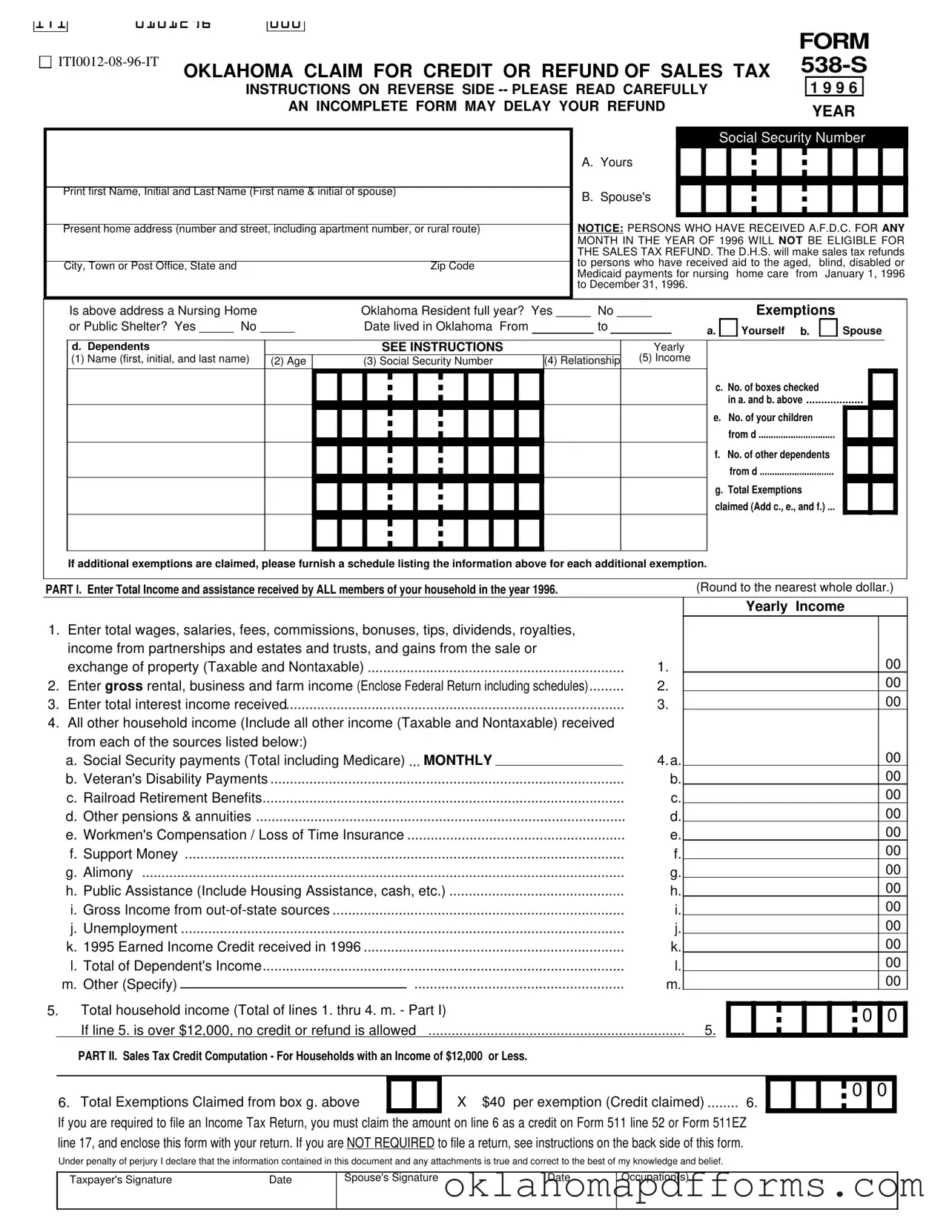

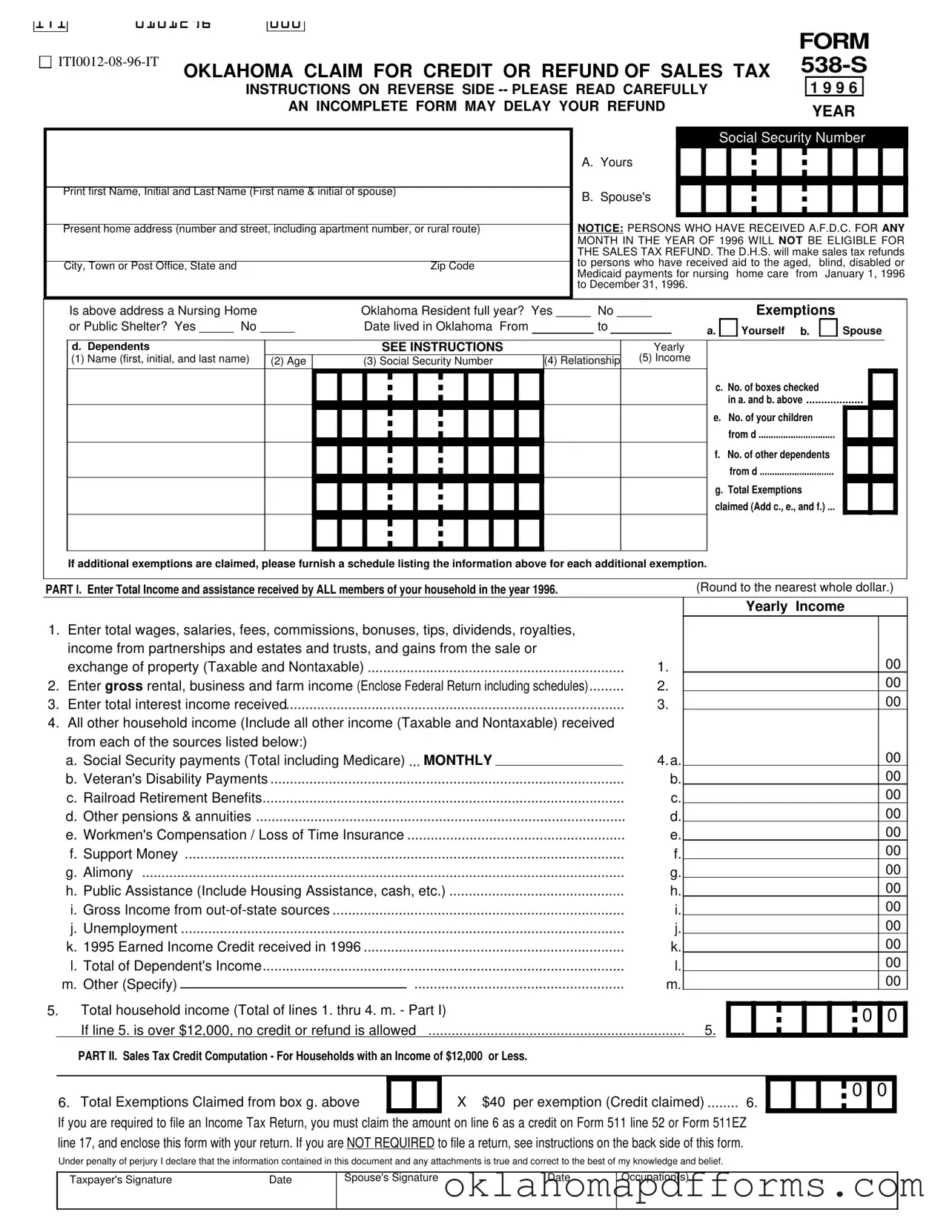

NOTICE

THE DEPARTMENT OF HUMAN SERVICES (D.H.S.) WILL MAKE SALES TAX REFUNDS TO PERSONS WHO HAVE CONTINUOUSLY RECEIVED AID TO THE AGED, BLIND, DISABLED OR MEDICAID PAYMENTS FOR NURSING HOME CARE FROM JANUARY 1, 1996 TO DECEMBER 31, 1996.

PERSONS WHO HAVE RECEIVED AID FOR DEPENDENT CHILDREN (A.F.D.C.) FOR ANY MONTH IN THE YEAR OF 1996 WILL NOT BE ELIGIBLE FOR THE SALES TAX CREDIT OR REFUND.

INSTRUCTIONS

Beginning in 1990, anyone who is an Oklahoma resident and lives in Oklahoma for the entire year and whose gross household income does not exceed Twelve Thousand Dollars ($12,000) may file for sales tax relief.

For 1996 the amount shall be Forty Dollars ($40) multiplied by the number of qualified personal exemptions and qualified dependents to which you would be entitled for Oklahoma Income Tax.

EXCEPTIONS:

There is no exemption for blindness.

There is no exemption for age sixty-five (65) or over.

A person convicted of a felony shall not be permitted to file a claim for sales tax relief for any period of time during which the person is an inmate in the custody of the Department of Corrections.

Individuals living in Oklahoma under a Visa will not qualify for the sales tax credit or refund.

If a taxpayer or spouse died during the tax year, they will not qualify for the sales tax credit or refund. If a taxpayer or spouse died after 12/31/96, but before this tax form was filed, the sales tax credit or refund for the deceased will be issued to their estate. Please indicate date of death.

If using an out-of-state address, you must enter the date you moved from Oklahoma.

To qualify as a dependent for the sales tax credit or refund, you must qualify and be claimed as a dependent for Federal Income Tax purposes. THE NAME, SOCIAL SECURITY NUMBER, AGE, RELATIONSHIP AND YEARLY INCOME (if any) MUST BE ENTERED FOR ALL DEPENDENTS. All other sales tax credit or refund requirements must also be met to qualify (Example: Resident of and lives in Oklahoma for entire year).

DEPENDENT CHILD: Enter Age and Social Security Number for all dependents. If nineteen (19) years of age, or over, enter age and “D” if disabled, or “S” if a Student. CHECK ALL SOCIAL SECURITY NUMBERS FOR ACCURACY.

OTHER DEPENDENT: A dependent on the Federal return other than your child.

For this form the “Gross Household Income” means the amount of income of every type, regardless of the source (except for gifts) received by ALL persons living in the same household, whether the income was taxable or not for income tax purposes. This includes pensions, annuities, social security, unemployment payments, veteran’s disability compensation, school grants or scholarships, public assistance payments, alimony, support money, workmen’s compensation, loss-of- time insurance payments, capital gains, and self-employment. If self-employed, enter the gross income from business, and enclose a copy of your Federal Return, including all schedules and any other type of income received. (Lines 1. through 4.m of Part 1.).

If you are required to file an Oklahoma State Income Tax Return, you must claim the amount of line 6., Part II, as a credit on your tax return -- Form 511 or 511EZ and enclose this form. Your tax return claiming the credit must be filed not later than April 15th following the close of the tax year. (Extensions do not apply to this form.) Complete, sign, and date this form and enclose it with your Oklahoma Individual Income Tax Return using the address on the tax return.

If you are NOT required to file an Oklahoma State Income Tax Return, this form must be received by the Oklahoma Tax Commission on or before the 30th day of June following the close of the taxable year. If you have withholding or made a payment on estimate and are filing for a refund on Form 511RF, you must enclose this form with the 511RF; otherwise, complete, sign, and date this form and mail your completed form to: Oklahoma Tax Commission, Income Tax, 2501 Lincoln Blvd., Oklahoma City, Ok 73194-0009

Yourself b.

Yourself b.

Spouse

Spouse 0

0  0

0