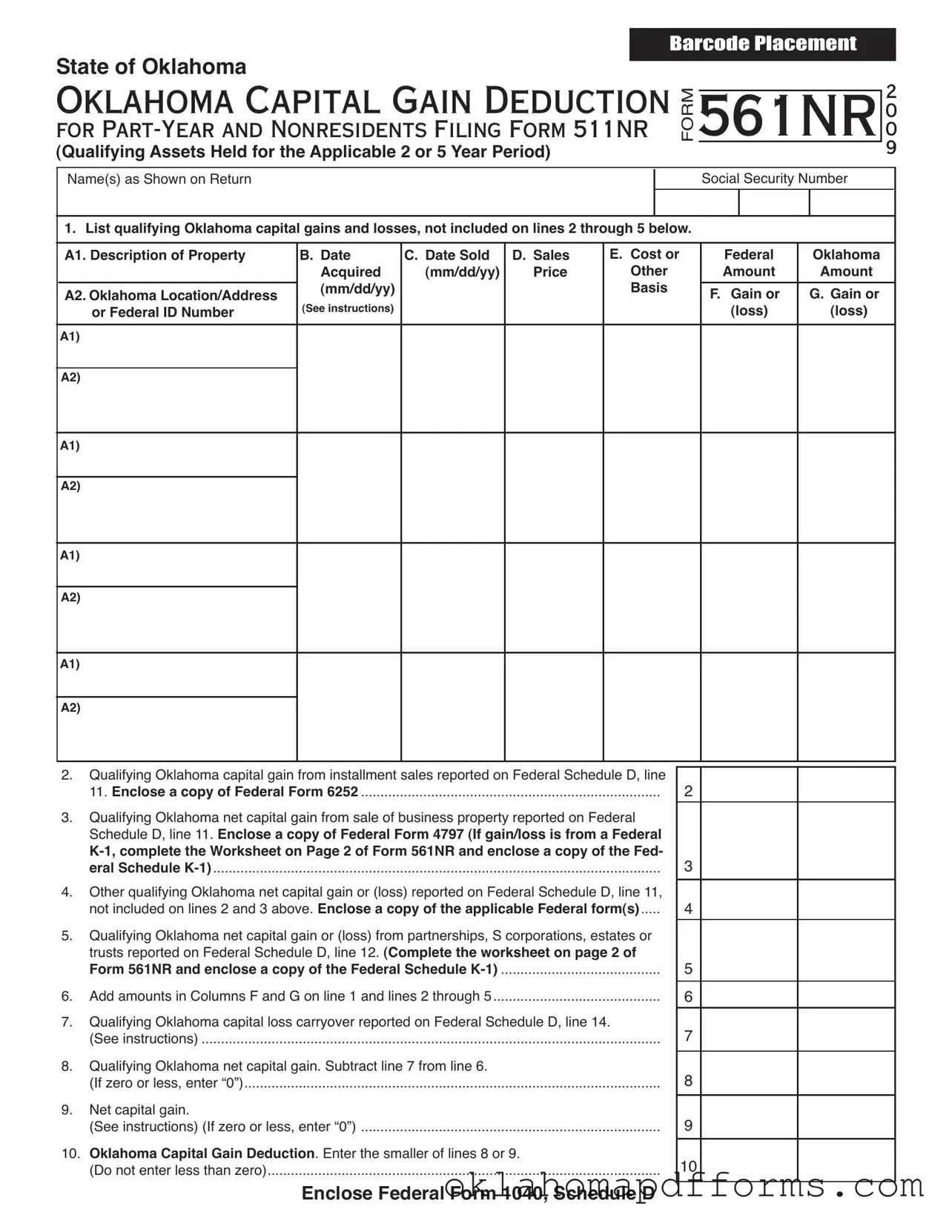

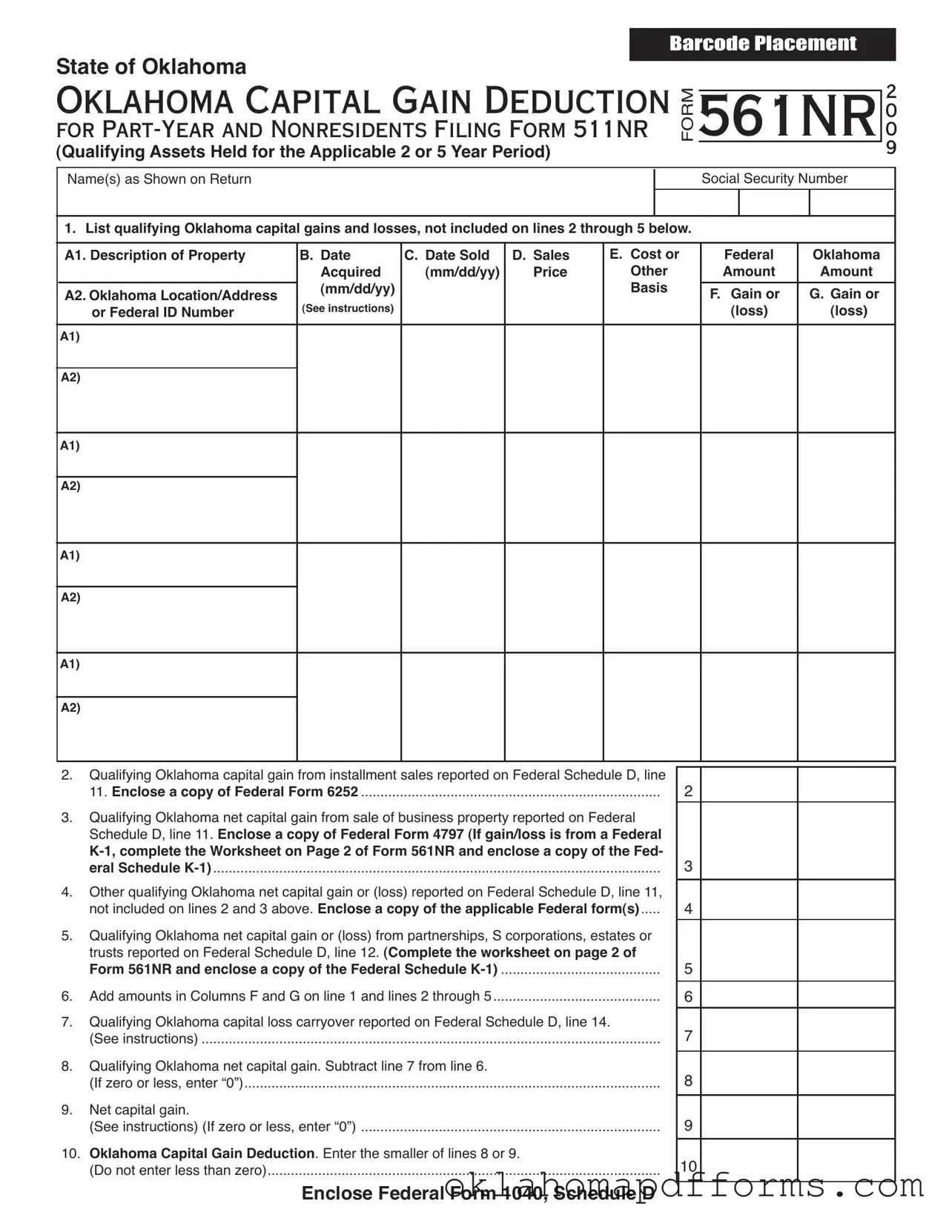

Form 561NR - Page 3

OKLAHOMA CAPITAL GAIN DEDUCTION FOR

PART-YEAR AND NONRESIDENTS FILING FORM 511NR

Title 68 O.S. Section 2358 and Rule 710:50-15-48

Speciic Instructions - continued

company or partnership whose stock or ownership interest was sold. Complete Columns B through F using the information from the corresponding columns of the Federal Schedule D or D-1. In Column B, enter the date the property was acquired. If you en- tered “VARIOUS” or “INHERITED” on your Federal Schedule D, enter the date you actually acquired the property. Do not include gains and losses reported on Form 561NR lines 2 through 5.

In Column G enter the qualifying Oklahoma capital gains and losses reported in Column F which were sourced to Oklahoma on Form 511NR, line 7 “Oklahoma Amount” column.

Line 2:

Column F: If Federal Form 6252 was used to report the installment method for gain on the sale of eligible property on the Fed- eral return, compute the capital gain deduction using the current year’s taxable portion of the installment payment. Enclose Fed- eral Form 6252. Capital gain from an installment sale is eligible for the Oklahoma capital gain deduction provided the property was held for the appropriate holding period as of the date sold.

In Column G enter the capital gain from an installment sale of eligible property reported in Column F which was sourced to Okla- homa on Form 511NR, line 7 “Oklahoma Amount” column.

Line 3:

Column F: Enter the qualifying Oklahoma net capital gain from the Federal Form 4797 which was reported on Federal Schedule D. Enclose a copy of the Federal Form 4797. If reporting a gain/loss from a Federal Schedule K-1, complete the worksheet on page 2 of Form 561NR and enclose a copy of the Federal Schedule K-1.

In Column G enter the other qualifying Oklahoma capital gain from Federal Form 4797 reported in Column F which was sourced to Oklahoma on Form 511NR, line 7 “Oklahoma Amount” column.

Line 4:

Column F: Enter other qualifying Oklahoma capital gains reported on Federal Schedule D, line 11. Enclose the applicable Fed- eral form(s). If not shown on the Federal form, enclose a schedule identifying the type and location of the property sold, the date of the sale, and the date the property was acquired.

In Column G enter the other qualifying Oklahoma capital gains reported in Column F which were sourced to Oklahoma on Form 511NR, line 7 “Oklahoma Amount” column.

Line 5:

Column F: Enter qualifying Oklahoma net capital gain or loss from partnerships, S corporations, trusts and estates. Complete the worksheet on page 2 of Form 561NR and enclose a copy of the Federal Schedule K-1.

In Column G enter the qualifying Oklahoma net capital gain or loss from low-through entities reported in Column F which was sourced to Oklahoma on Form 511NR, line 7 “Oklahoma Amount” column.

Line 7:

Column F: Enter the total qualifying Oklahoma capital loss carryover from the prior year’s return.

In Column G enter the qualifying Oklahoma capital loss carryover reported in Column F which was sourced to Oklahoma on Form 511NR, line 7 “Oklahoma Amount” column.

Line 9:

Column F: The Oklahoma capital gain deduction, in the “Federal Amount” column, may not exceed the net capital gain included in Federal adjusted gross income. The term “net capital gain” means the excess of the net long-term capital gains for the taxable year over the net short-term capital loss for such year. If a capital loss, enter “0”.

Column G: The Oklahoma capital gain deduction, in the “Oklahoma Amount” column, may not exceed the portion of the net capital gain sourced to Oklahoma. This is the net capital gain from Form 511NR, line 7 “Oklahoma Amount” column. If there is no net capital gain, enter “0”.

Note: The net capital gain must be decreased for any capital gain or increased for any capital loss from the sale of state and municipal bonds exempt from Oklahoma income tax.

Line 10:

Column F: Compare lines 8 and 9. Enter the smaller amount here and on Form 511NR, Schedule 511NR-B, line 13 “Federal Amount” column.