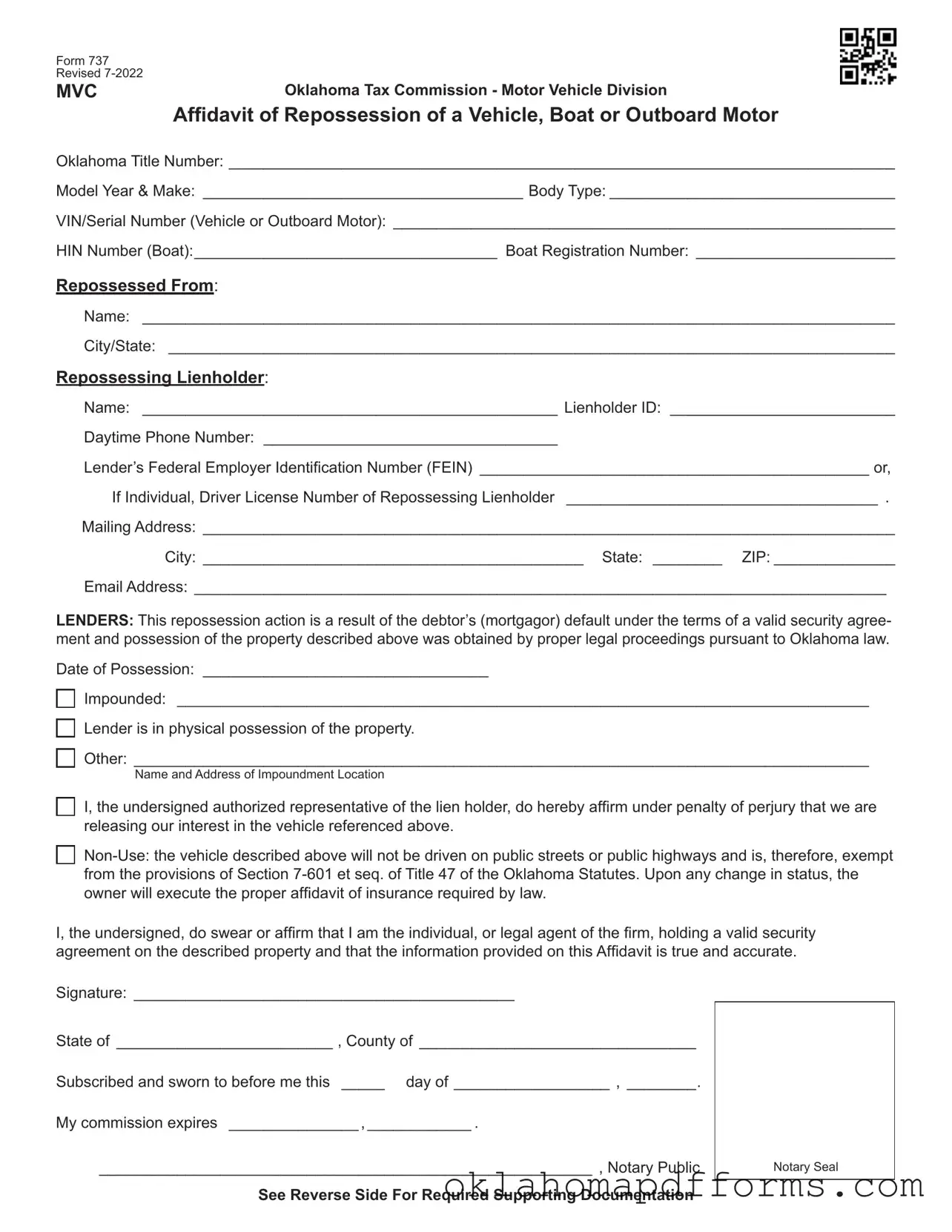

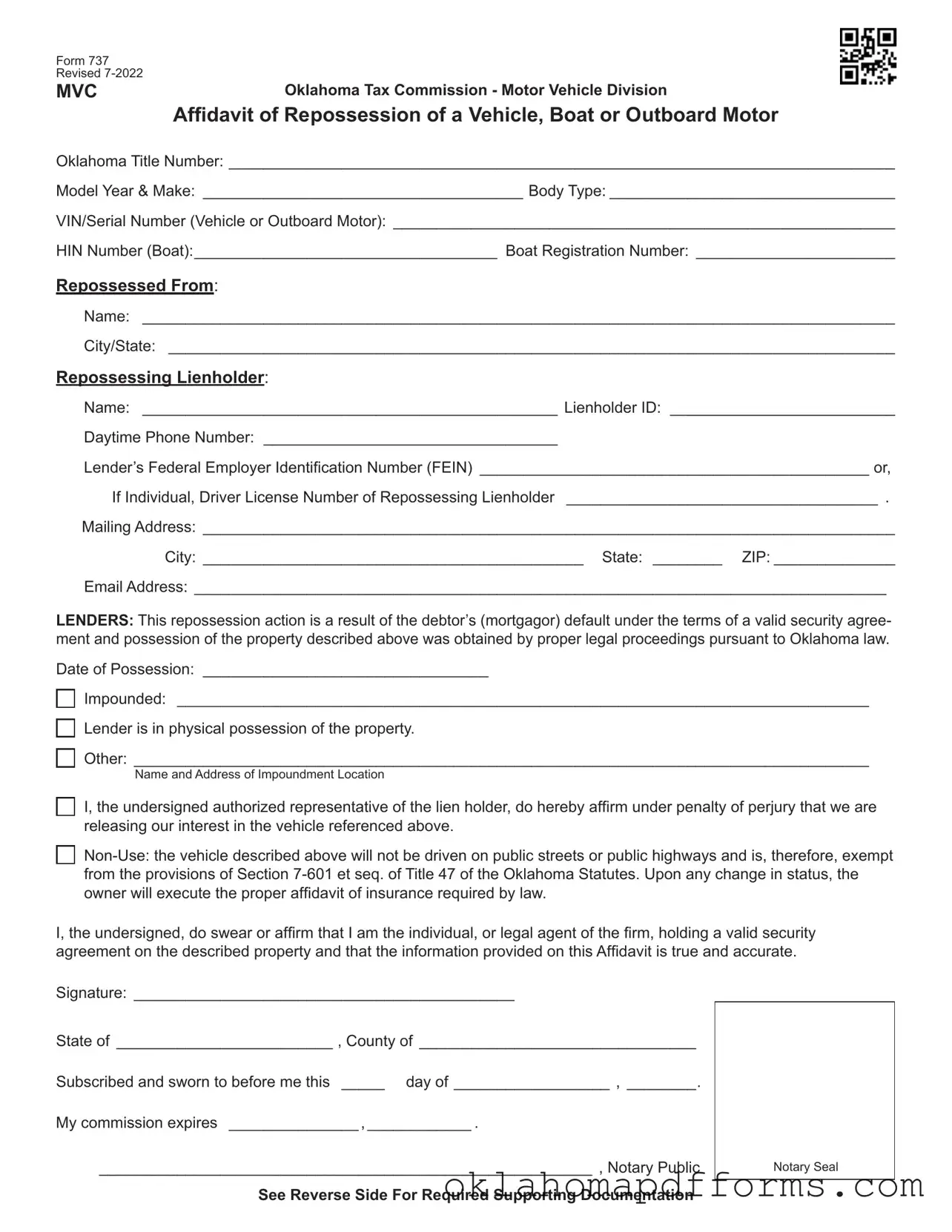

Form 737

Revised 7-2022

MVC |

Oklahoma Tax Commission - Motor Vehicle Division |

|

Affidavit of Repossession of a Vehicle, Boat or Outboard Motor |

Oklahoma Title Number: _____________________________________________________________________________

Model Year & Make: _____________________________________ Body Type: _________________________________

VIN/Serial Number (Vehicle or Outboard Motor): __________________________________________________________

HIN Number (Boat):___________________________________ Boat Registration Number: _______________________

Repossessed From:

Name: _______________________________________________________________________________________

City/State: ____________________________________________________________________________________

Repossessing Lienholder:

Name: ________________________________________________ Lienholder ID: __________________________

Daytime Phone Number: __________________________________

Lender’s Federal Employer Identification Number (FEIN) _____________________________________________ or,

If Individual, Driver License Number of Repossessing Lienholder ____________________________________ .

Mailing Address: ________________________________________________________________________________

City: ____________________________________________ State: ________ ZIP: ______________

Email Address: ________________________________________________________________________________

LENDERS: This repossession action is a result of the debtor’s (mortgagor) default under the terms of a valid security agree- ment and possession of the property described above was obtained by proper legal proceedings pursuant to Oklahoma law.

Date of Possession: _________________________________

Impounded: ________________________________________________________________________________

Lender is in physical possession of the property.

Other: _____________________________________________________________________________________

Name and Address of Impoundment Location

I, the undersigned authorized representative of the lien holder, do hereby affirm under penalty of perjury that we are releasing our interest in the vehicle referenced above.

I, the undersigned authorized representative of the lien holder, do hereby affirm under penalty of perjury that we are releasing our interest in the vehicle referenced above.

Non-Use: the vehicle described above will not be driven on public streets or public highways and is, therefore, exempt

from the provisions of Section 7-601 et seq. of Title 47 of the Oklahoma Statutes. Upon any change in status, the owner will execute the proper affidavit of insurance required by law.

I, the undersigned, do swear or affirm that I am the individual, or legal agent of the firm, holding a valid security agreement on the described property and that the information provided on this Affidavit is true and accurate.

I, the undersigned authorized representative of the lien holder, do hereby affirm under penalty of perjury that we are

I, the undersigned authorized representative of the lien holder, do hereby affirm under penalty of perjury that we are