Fill Your Oklahoma 753 Form

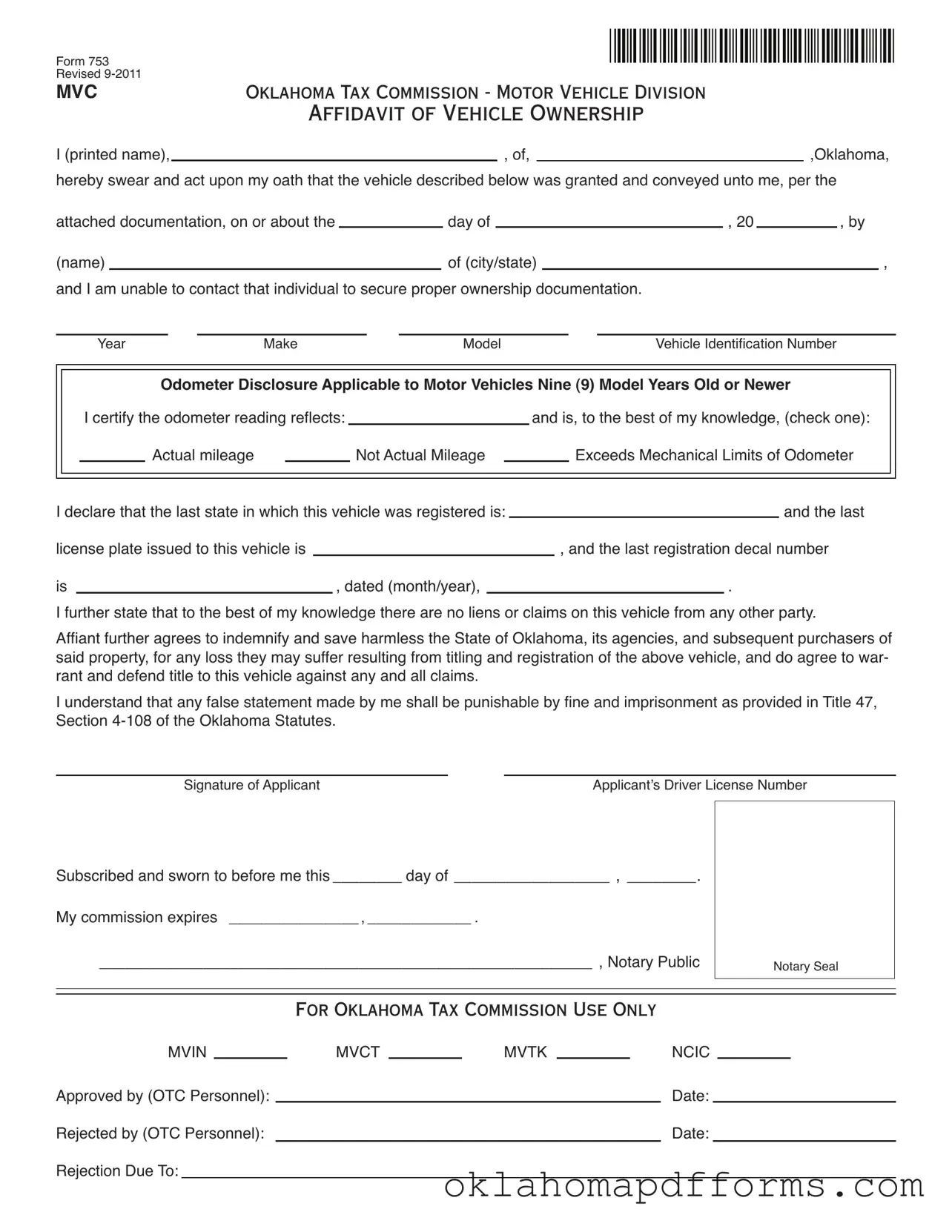

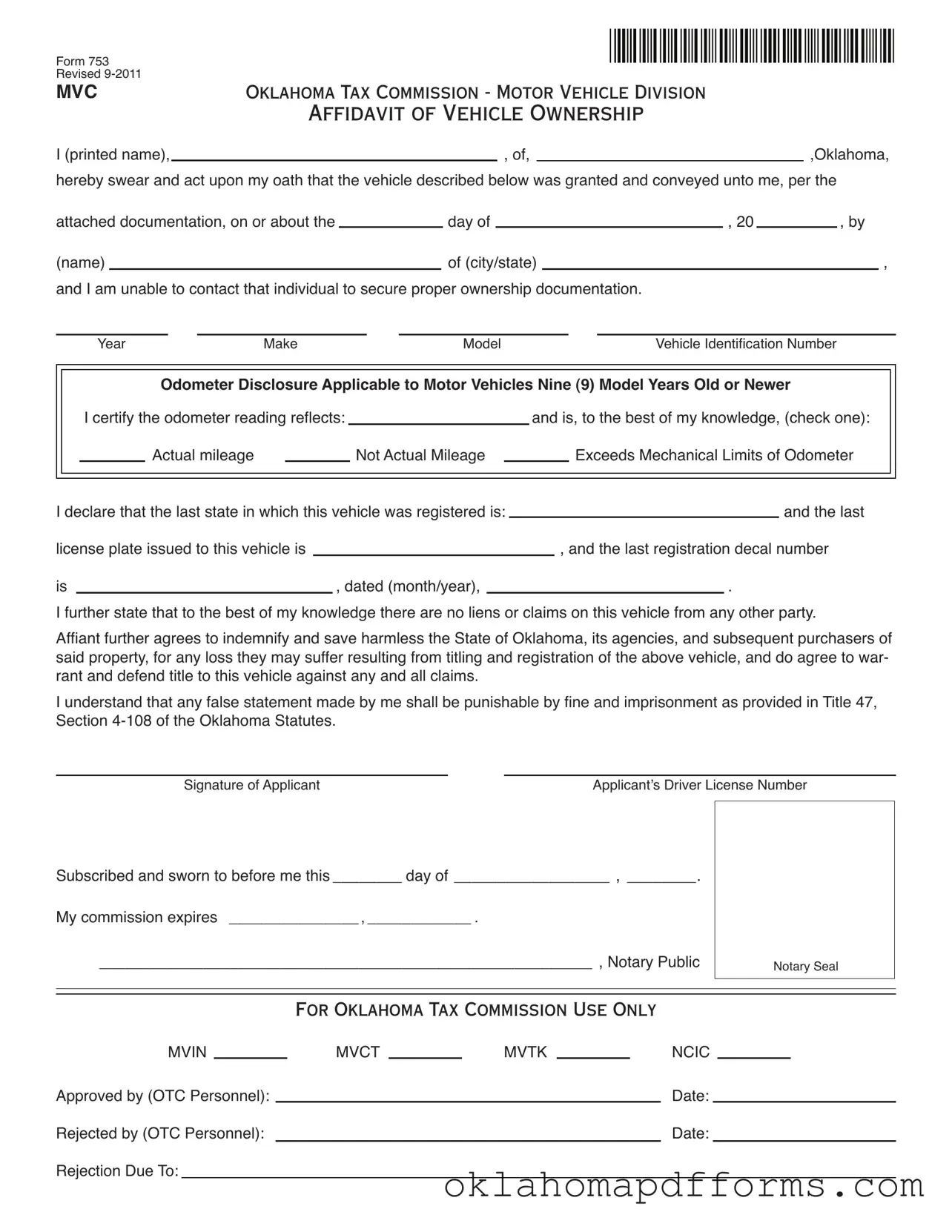

The Oklahoma 753 form is an affidavit of vehicle ownership that individuals in Oklahoma can use when they are unable to obtain proper documentation from a previous owner. This form serves as a legal declaration, allowing the applicant to assert ownership of a vehicle while providing essential details such as the vehicle's identification number and odometer reading. By completing this form, applicants agree to indemnify the state and future purchasers against any claims related to the vehicle's title.

Open Document Now

Fill Your Oklahoma 753 Form

Open Document Now

Open Document Now

or

▼ Oklahoma 753

Your form isn’t ready yet

Fill out Oklahoma 753 digitally in just minutes.