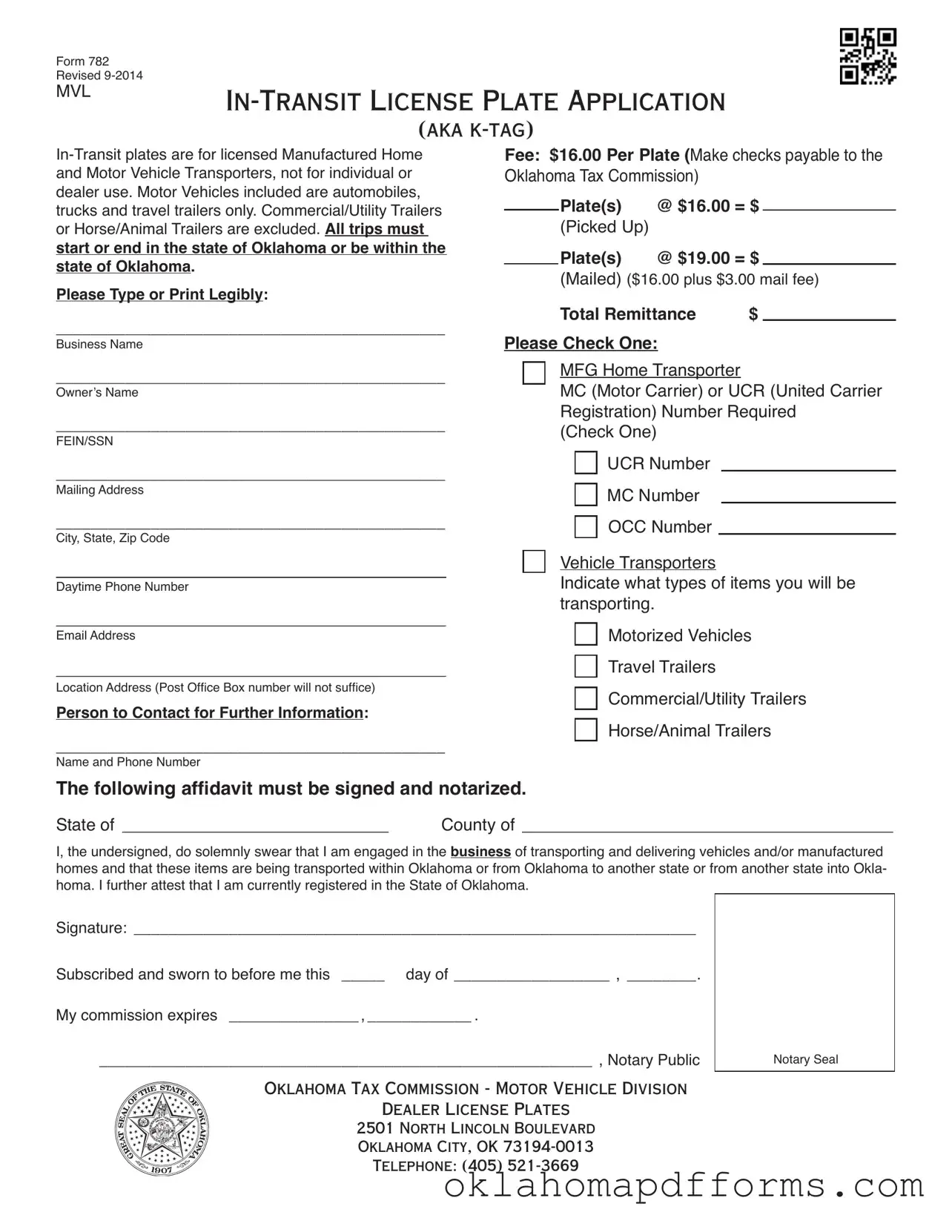

1.Payment must accompany the application. Make checks payable to the Oklahoma Tax Commission. A $50.00 penalty will be assessed for any dishonored check.

2.In-Transit plates are to be displayed on the vehicle/new manufactured home being pulled. The pulling unit must be properly registered in its own right.

3.Manufactured home transporters are required to have a Motor Carrier number (MC#) issued by the Federal Motor Carrier Safety Administration (FMCSA) or a United Carrier Registration number (UCR#) or an Oklahoma Corporation Commission number (also known as your OCC pin number) before an In-Transit plate can be issued.

4.Licensed Dealers must use dealer plates to transport when transporting vehicles or new Manufactured Homes. Any Used Manufactured Homes being transported must be registered and licensed with current Manufactured Home plates.

5.All information on the application must be veriied before an In-Transit plate will be issued.

6.All In-Transit plates will expire on December 31st of each year and cannot be renewed.

7.Those companies transporting commercial/utility trailers or horse/animal trailers from Oklahoma to another state may not use Oklahoma In-Transit tags. However, they may download from the Oklahoma Tax Commission website, a letter indicating that these items are not required to be registered and tagged in the state of Oklahoma. This letter is located at www.tax.ok.gov/mvforms/noncomletter.pdf.

47 OKLAHOMA STATUTES (OS) SECTION 1128 SS(D)

“Every person engaged in the business of transporting and delivering new or used vehicles by driving, either singly or by towbar, saddle mount or full mount method, engaging in drive-away operations as deined in Section 3 of Title 85 of the Oklahoma Statues, or any combination thereof, from the manufacturer or shipper to the dealer or consignee and using

the public highways of this state shall ile with the Commission a veriied application for in-transit license plates to iden-

tify such vehicles. The application shall provide for a general distinctive number for all vehicles so transported” “...Such in-transit plate shall be used by such person only on vehicles when so transported.” “...Provided, a used motor vehicle dealer shall use a used dealer license plate in lieu of the in-transit license plate for transporting a used motor vehicle, and,

in such cases, shall be exempt from making application for an in-transit license plate. Provided further, only a person who possesses a certiicate issued by the Interstate Commerce Commission or the Corporation Commission to engage in the business of transporting and delivering manufactured homes for hire may use the in-transit license plates obtained by

them as herein authorized for transporting new or used manufactured homes from one location to another location within Oklahoma or from a point in another state to a point in this state. Nothing contained in this section shall relieve any person

from the payment of license fees otherwise provided by law. When the Commission deems it advisable and in the public interest, it may require the holder of any in-transit license, or any person making application therefore, to ile a proper

surety bond in any amount it deems proper, not to exceed Ten Thousand Dollars ($10,000).”

47 OS SEC. 1-186

Vehicle Deined:

Every device in, upon or by which any person or property is or may be transported or drawn upon a highway, excepting devices moved by human power or used exclusively upon stationary rails or tracks, provided however the deinition of “vehicle” as used in this act1 shall not include implements of husbandry as deined in section 1-125 of this chapter.

LAWS 1961, P.321, § 1-186

1SECTION 1-101 ET SEQ. OF THIS TITLE.

OKLAHOMA TAX COMMISSION - MOTOR VEHICLE DIVISION

DEALER LICENSE PLATES

2501 NORTH LINCOLN BOULEVARD

OKLAHOMA CITY, OK 73194-0013

TELEPHONE: (405) 521-3669

WWW.TAX.OK.GOV