|

|

|

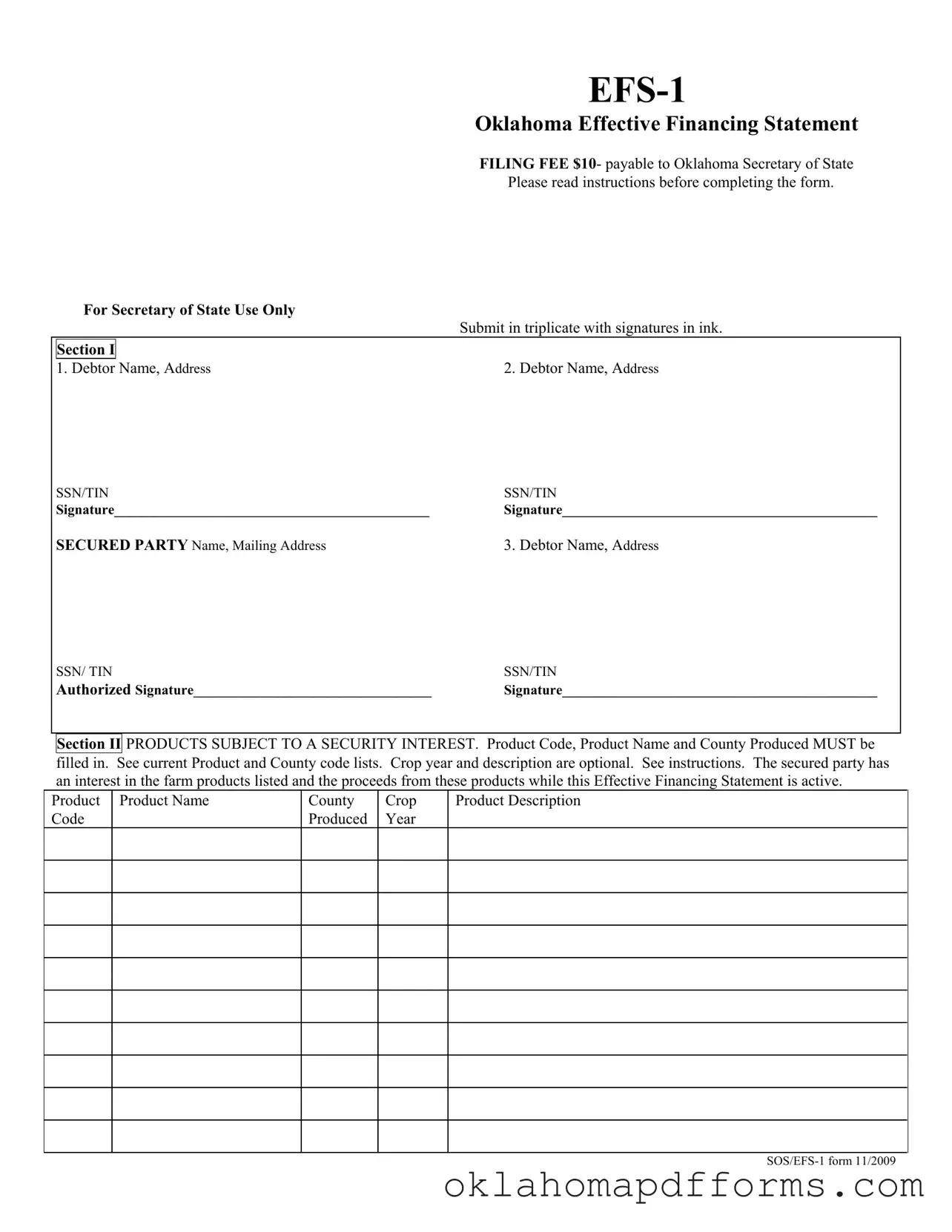

EFS-1 |

|

|

|

Oklahoma Effective Financing Statement |

|

|

|

FILING FEE $10- payable to Oklahoma Secretary of State |

|

|

|

Please read instructions before completing the form. |

|

For Secretary of State Use Only |

|

|

|

|

Submit in triplicate with signatures in ink. |

|

Section I |

|

|

|

1. Debtor Name, Address |

2. Debtor Name, Address |

|

SSN/TIN |

SSN/TIN |

|

Signature_____________________________________________ |

Signature_____________________________________________ |

|

SECURED PARTY Name, Mailing Address |

3. Debtor Name, Address |

|

SSN/ TIN |

SSN/TIN |

|

Authorized Signature__________________________________ |

Signature_____________________________________________ |

|

|

|

|

Section II PRODUCTS SUBJECT TO A SECURITY INTEREST. Product Code, Product Name and County Produced MUST be filled in. See current Product and County code lists. Crop year and description are optional. See instructions. The secured party has an interest in the farm products listed and the proceeds from these products while this Effective Financing Statement is active.

Product |

Product Name |

County |

Crop |

Product Description |

Code |

|

Produced |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions for Completing the EFS-1 Form

This statement must be typed or legibly printed. Submit the EFS in triplicate to receive a filed stamped confirmation copy. For faster return of the confirmation copy, include a self-addressed stamped envelope. Please sign original signatures in ink. Original signatures are required on at least one statement. Additional statements may have photo copied or carbon signatures.

Section I

DEBTOR NAME: A debtor is any person or business subjecting an Oklahoma-produced agricultural product to a security interest. A debtor can be an individual, partnership, corporation, limited liability company, trust or any other business entity.

List only one individual, business or DBA per debtor block. A debtor may not be listed more than once on the EFS-1 form. For individuals, list the last name followed by the first name and middle name or initial. Put nicknames in parenthesis. For businesses, list the first word or character that is not an article or punctuation mark. The DBA must be listed as a separate debtor with an ID number and a signature.

ADDRESS: A street address, rural route or post office box, city, state and zip code must be entered.

SOCIAL SECURITY NUMBER OR FEDERAL TAX IDENTIFICATION NUMBER: For individuals, their social security number must be listed. For each business, the Tax ID number must be listed. For a business without a Tax ID number, the owner’s social security number may be listed for one business.

SIGNATURE: Each debtor block MUST have a signature. For businesses, an authorized representative must sign his or her

name.

SECURED PARTY: Name, mailing address and Tax ID number must be completed. If an individual is listed as the secured party, he or she must sign. For a business, an authorized representative must sign. One secured party per filing.

Section II (See Product and County Code lists for help in completing this section)

PRODUCT CODE: The three-digit product code for each farm product must be listed. To cover all products, each product must be listed on the EFS form. There is no blanket code to cover all products.

PRODUCT NAME: The product name from the product list must be entered. There is a limit of 20 product listings per EFS

filing.

COUNTY PRODUCED: The two-digit county code where the farm product is produced must be listed. This must be an Oklahoma county. The code “00” may be used to blanket all 77 Oklahoma counties.

CROP YEAR: No entry is required if all crop years are covered. If no crop year is listed, the EFS is applicable for every crop year for the duration of the lien. If fewer than all crop years are covered, the four-digit crop year must be listed

DEFINITION: For a crop grown in the soil: the calendar year in which it is harvested or to be harvested. For animals: the calendar year in which they are born or acquired.

For poultry or eggs: the calendar year in which they are sold or to be sold.

PRODUCT DESCRIPTION: No entry is required if all of a product is covered. If less than all of a product is covered, describe the product or location to distinguish it from other such products owned by the debtor that are not subject to the security interest. Please describe only the product listed. The filing is applicable only for the product description listed. Brand symbols cannot be included unless they can be typed on a normal keyboard.

DURATION OF FILING: An EFS is effective for five years from the filing date of the EFS-1, unless a termination is filed. To extend the expiration date by five years, a continuation (EFS-2) may be filed within the six months before the EFS will expire. PURPOSE OF FILING: Notice is provided to registered buyers of agricultural products that you have a lien against the collateral listed so a two-party check may be issued. The EFS does not perfect your security interest in the collateral.

ATTACHMENTS: If there is more debtor or product information than can be listed on the first EFS form, write SEE ATTACHMENT at the top of the first form, and use additional EFS forms. On additional forms, write ATTACHMENT on the top of each form. Submit three copies of each attachment form when filing. There is no additional fee for filing the EFS with attachments.

FILING FEE: $10.00 |

For information, please visit us at www.sos.ok.gov |

|

Or call 405-521-2474 |

MAIL FORMS TO: |

Secretary of State, Central Filing System for Agricultural Liens |

|

2300 N Lincoln Blvd Room 101 |

|

Oklahoma City, OK 73105-4897 |

All EFS-1 filings accepted by the Central Filing System on or before the 20th day of each month will be reflected on the agricultural lien list distributed to registered buyers by the end of that month. All EFS-1 filings accepted after the 20th will be reflected on the following month’s lien list.

Jun-11