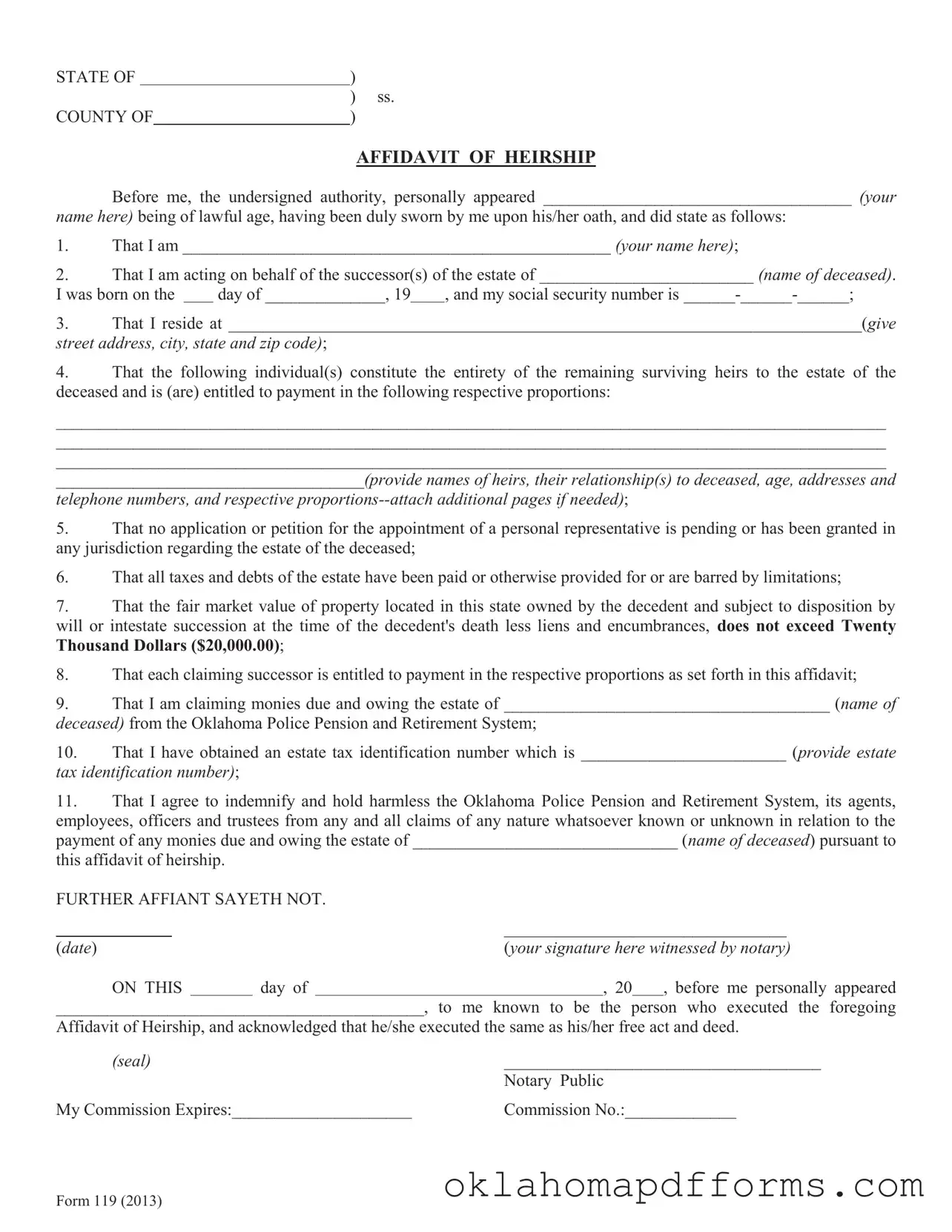

STATE OF |

) |

|

|

|

) ss. |

COUNTY OF |

|

) |

AFFIDAVIT OF HEIRSHIP

Before me, the undersigned authority, personally appeared ____________________________________ (your

name here) being of lawful age, having been duly sworn by me upon his/her oath, and did state as follows:

1.That I am __________________________________________________ (your name here);

2.That I am acting on behalf of the successor(s) of the estate of _________________________ (name of deceased).

I was born on the |

|

day of ______________, 19 |

, and my social security number is ______-______-______; |

|

|

|

|

|

3.That I reside at __________________________________________________________________________(give street address, city, state and zip code);

4.That the following individual(s) constitute the entirety of the remaining surviving heirs to the estate of the deceased and is (are) entitled to payment in the following respective proportions:

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

____________________________________(provide names of heirs, their relationship(s) to deceased, age, addresses and

telephone numbers, and respective proportions--attach additional pages if needed);

5.That no application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction regarding the estate of the deceased;

6.That all taxes and debts of the estate have been paid or otherwise provided for or are barred by limitations;

7.That the fair market value of property located in this state owned by the decedent and subject to disposition by will or intestate succession at the time of the decedent's death less liens and encumbrances, does not exceed Twenty Thousand Dollars ($20,000.00);

8.That each claiming successor is entitled to payment in the respective proportions as set forth in this affidavit;

9.That I am claiming monies due and owing the estate of ______________________________________ (name of deceased) from the Oklahoma Police Pension and Retirement System;

10.That I have obtained an estate tax identification number which is ________________________ (provide estate tax identification number);

11.That I agree to indemnify and hold harmless the Oklahoma Police Pension and Retirement System, its agents, employees, officers and trustees from any and all claims of any nature whatsoever known or unknown in relation to the payment of any monies due and owing the estate of _______________________________ (name of deceased) pursuant to this affidavit of heirship.

FURTHER AFFIANT SAYETH NOT. |

|

|

|

|

|

|

|

|

|

_________________________________ |

(date) |

|

|

|

(your signature here witnessed by notary) |

ON THIS |

|

day of |

|

|

, 20 , before me personally appeared |

|

|

|

|

|

|

|

|

|

___________________________________________, to me known to be the person who executed the foregoing

Affidavit of Heirship, and acknowledged that he/she executed the same as his/her free act and deed.

(seal) |

_____________________________________ |

|

Notary Public |

My Commission Expires:_____________________ |

Commission No.:_____________ |