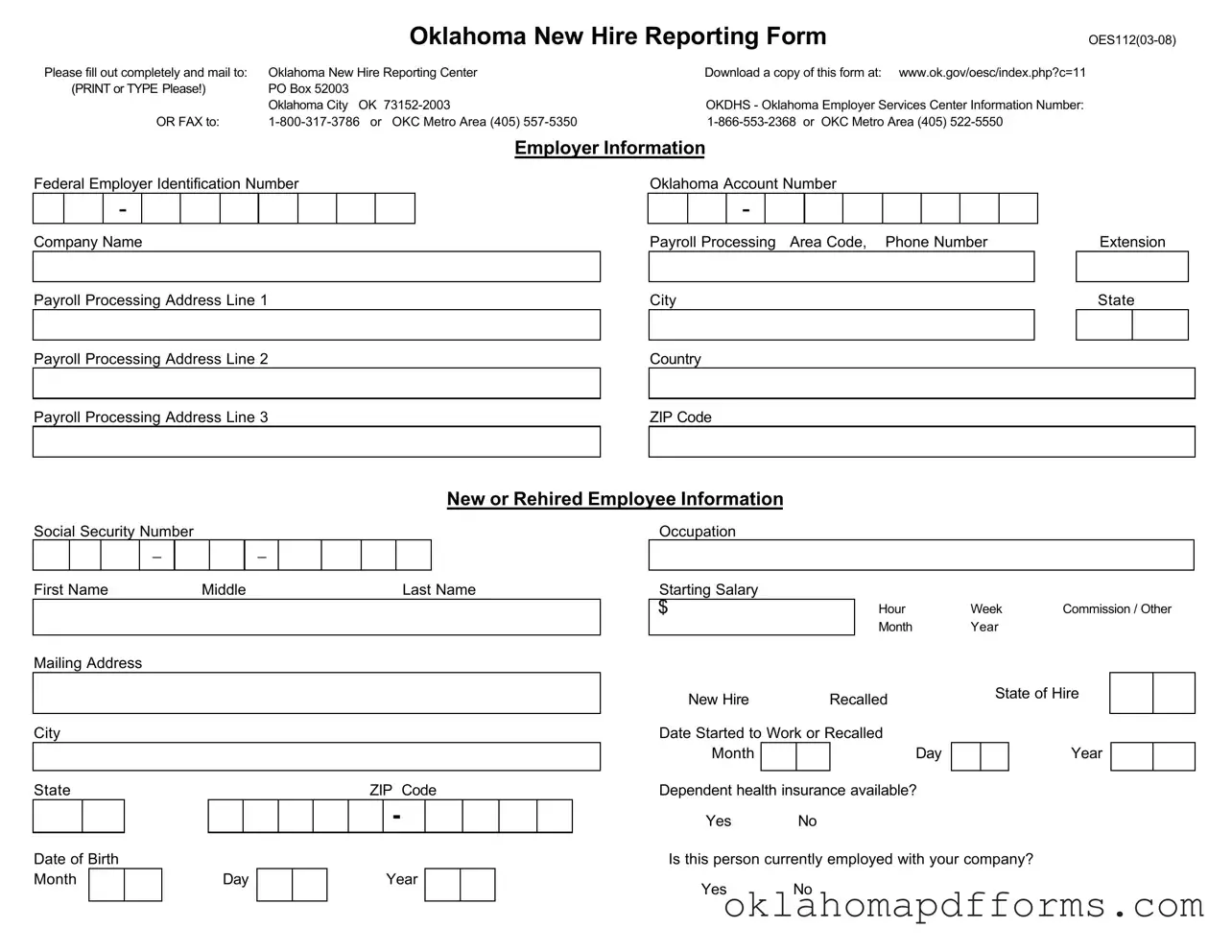

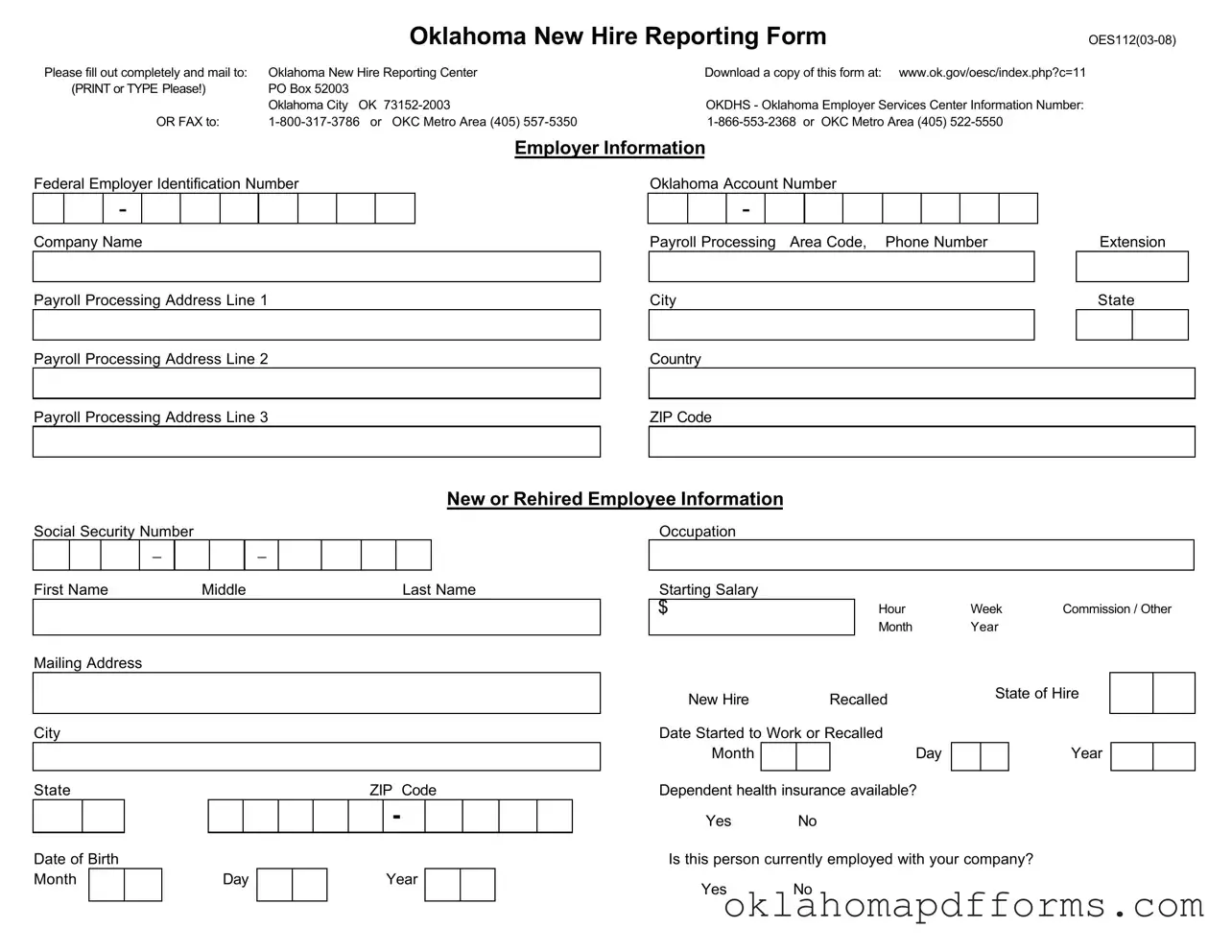

What is the Oklahoma New Hire Reporting form?

The Oklahoma New Hire Reporting form is a document that employers must complete when they hire or rehire an employee. This form helps the state track employment for various purposes, including child support enforcement and unemployment insurance. It is essential to ensure compliance with state regulations.

Who needs to fill out the New Hire Reporting form?

All employers in Oklahoma are required to fill out the New Hire Reporting form for each new or rehired employee. This includes businesses of all sizes and types, regardless of the industry. It is crucial to report any employee who begins work or returns to work after a break in employment.

How do I submit the New Hire Reporting form?

You can submit the form by mailing it to the Oklahoma New Hire Reporting Center at PO Box 52003, Oklahoma City, OK 73152-2003. Alternatively, you may fax the completed form to 1-800-317-3786 or, if you are in the Oklahoma City metro area, to (405) 557-5350.

What information is required on the form?

The form requires various details, including your Federal Employer Identification Number, company name, payroll processing address, and the Oklahoma Account Number. You must also provide information about the new or rehired employee, such as their Social Security Number, name, mailing address, date of birth, occupation, and starting salary.

Is there a deadline for submitting the New Hire Reporting form?

Yes, employers must submit the New Hire Reporting form within 20 days of the employee's start date. Timely reporting is essential to avoid potential penalties and ensure compliance with state laws.

Can I download the New Hire Reporting form online?

Yes, you can download a copy of the Oklahoma New Hire Reporting form from the Oklahoma Employment Security Commission's website at www.ok.gov/oesc/index.php?c=11. Ensure you print or type the information clearly when completing the form.

What happens if I fail to report a new hire?

Failure to report a new hire can lead to penalties for the employer. These penalties may include fines and potential issues with compliance regarding child support enforcement. It is essential to adhere to the reporting requirements to avoid these consequences.

Is there a fee associated with submitting the New Hire Reporting form?

No, there is no fee for submitting the Oklahoma New Hire Reporting form. Employers can complete and submit the form without incurring any costs. This service is provided to help maintain accurate employment records in the state.

What if I have more questions about the New Hire Reporting process?

If you have additional questions, you can contact the Oklahoma Employer Services Center at 1-866-553-2368 or (405) 522-5550 for assistance. They can provide guidance and clarify any concerns you may have regarding the New Hire Reporting process.