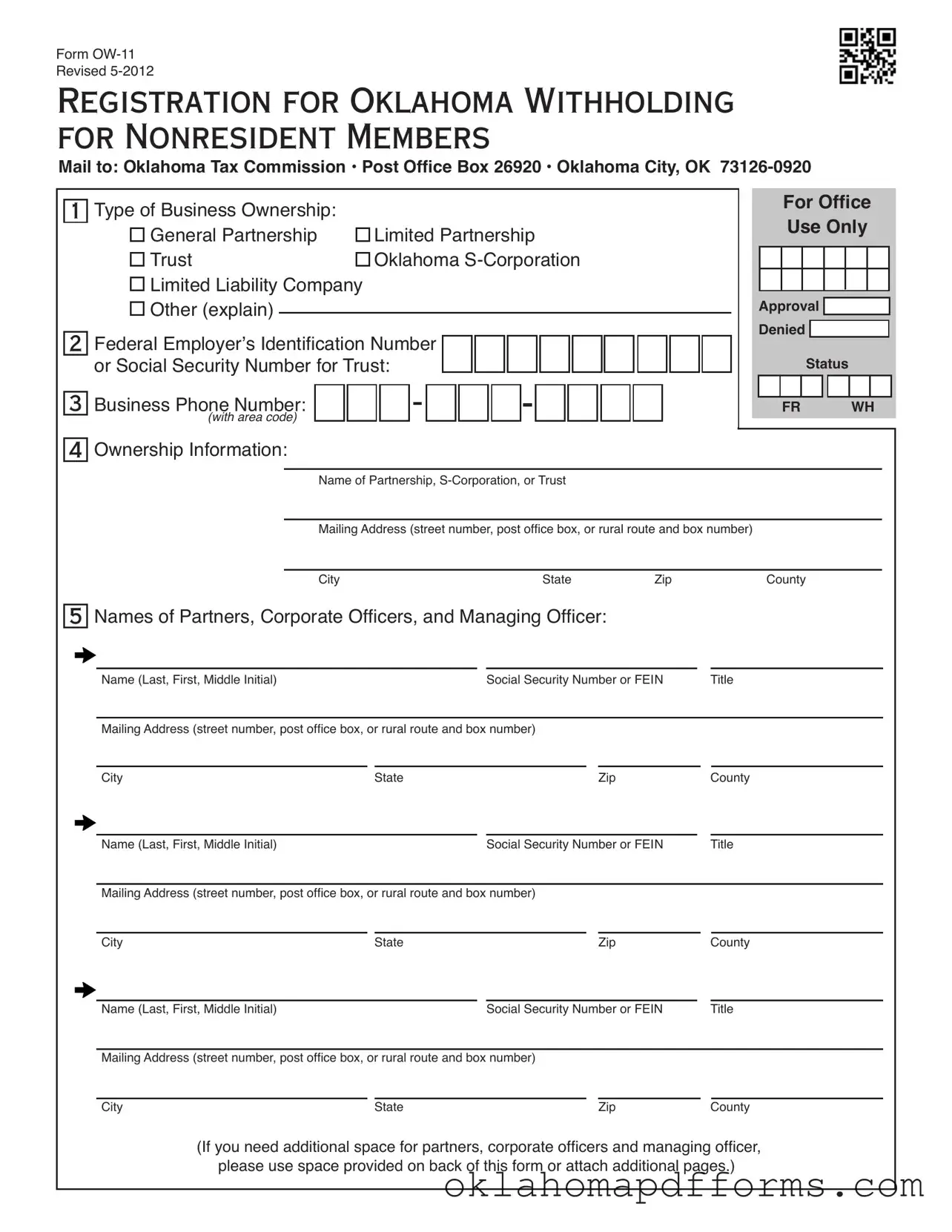

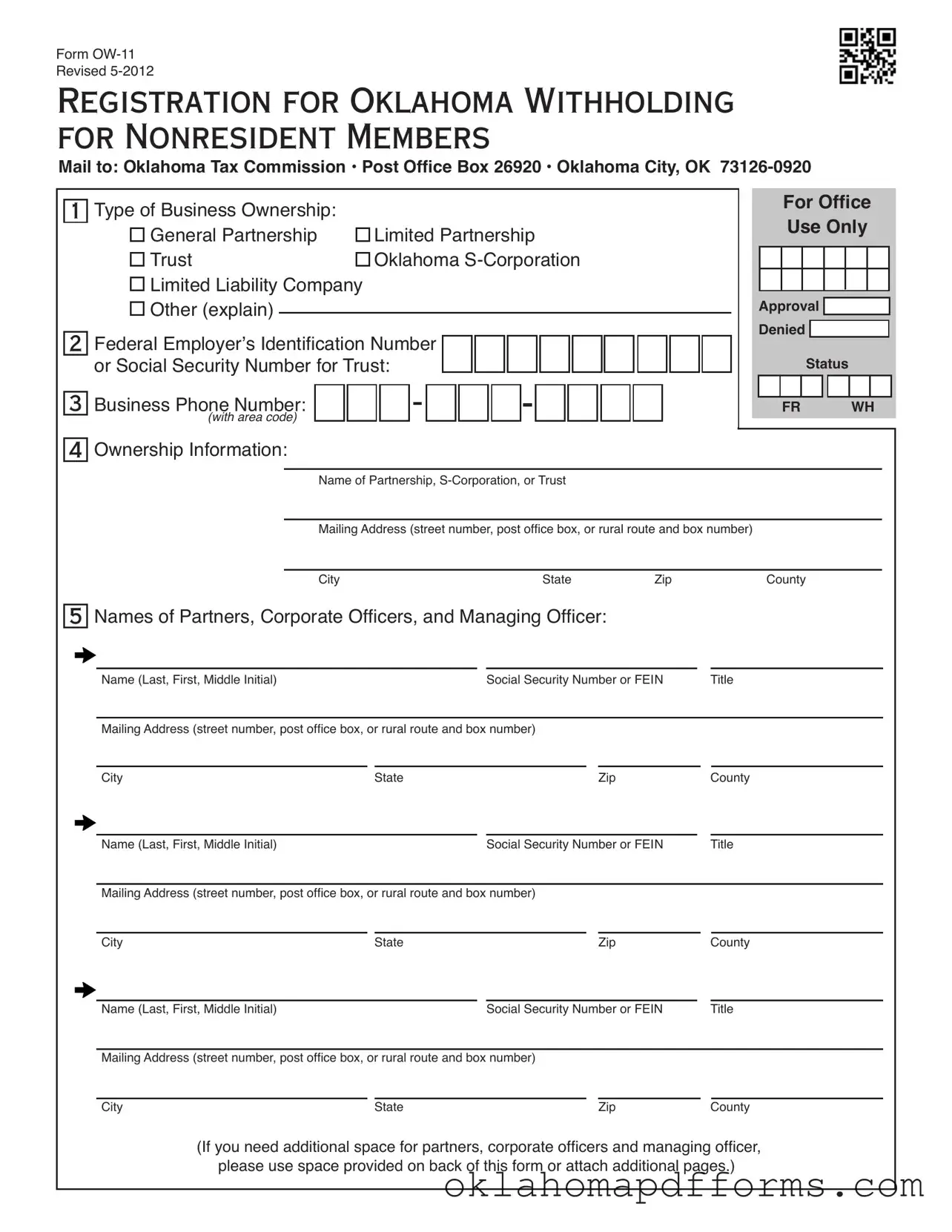

The Oklahoma OW-11 form serves as a registration for withholding taxes for nonresident members. A similar document is the IRS Form W-4. This form is used by employees to inform their employer of the amount of federal income tax to withhold from their paychecks. Like the OW-11, it requires personal information, including the Social Security number and details about the taxpayer's filing status. Both forms aim to ensure proper tax withholding, but the W-4 is focused on individual employees while the OW-11 targets business entities.

In addition to the forms previously mentioned, it is important to recognize the role of the Trailer Bill of Sale form in trailer transactions. This document not only facilitates the legal transfer of ownership but also helps in providing clarity and transparency in the sale process. For those interested in obtaining a detailed template or further information about this critical form, UsaLawDocs.com is an excellent resource to consult.

Another comparable document is the IRS Form W-9. This form is used by individuals and businesses to provide their Taxpayer Identification Number (TIN) to others who will report payments made to them. Both the W-9 and the OW-11 require the submission of a TIN, which is crucial for tax reporting purposes. The OW-11 specifically addresses nonresident members in Oklahoma, whereas the W-9 is more general and applicable nationwide.

The Oklahoma Form 511-C is also similar to the OW-11. This form is used by nonresidents to report Oklahoma income tax. Like the OW-11, it involves detailed information about the taxpayer and their income sources. Both forms are essential for ensuring compliance with Oklahoma tax laws, focusing on the obligations of nonresidents in the state.

Form 941, the Employer's Quarterly Federal Tax Return, is another document that shares similarities with the OW-11. Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Both forms require detailed ownership and identification information, ensuring that tax obligations are met. However, Form 941 focuses on federal taxes, while the OW-11 is specific to state withholding.

The IRS Form 1099-MISC is also relevant. This form is used to report payments made to independent contractors and other non-employees. Both the 1099-MISC and the OW-11 deal with the reporting of income to the government. However, the OW-11 is about registering for withholding, while the 1099-MISC is about reporting payments already made.

Form 1040, the U.S. Individual Income Tax Return, is another important document. This form is used by individuals to file their annual income tax returns. While the OW-11 is used to register for withholding, the 1040 is the final step in the tax process where individuals report their income and calculate their tax liability. Both forms require personal information and are essential for compliance with tax laws.

The Oklahoma Corporate Income Tax Return (Form 512) is similar in that it requires businesses to report income and pay taxes. Like the OW-11, it involves detailed information about the business structure and ownership. However, the OW-11 is specifically for withholding registration, while Form 512 is for reporting income and calculating corporate tax obligations.

Form 1065, the U.S. Return of Partnership Income, is another document that shares common ground with the OW-11. This form is used by partnerships to report income, deductions, and credits. Both forms require detailed ownership information and are vital for tax compliance. The OW-11 focuses on withholding requirements, while Form 1065 deals with overall income reporting.

Lastly, the Oklahoma Sales Tax Permit Application is similar as it requires businesses to register for tax purposes. Both documents involve providing ownership details and identifying the business structure. However, the OW-11 focuses on withholding taxes for nonresidents, while the sales tax permit is about collecting sales tax from customers.

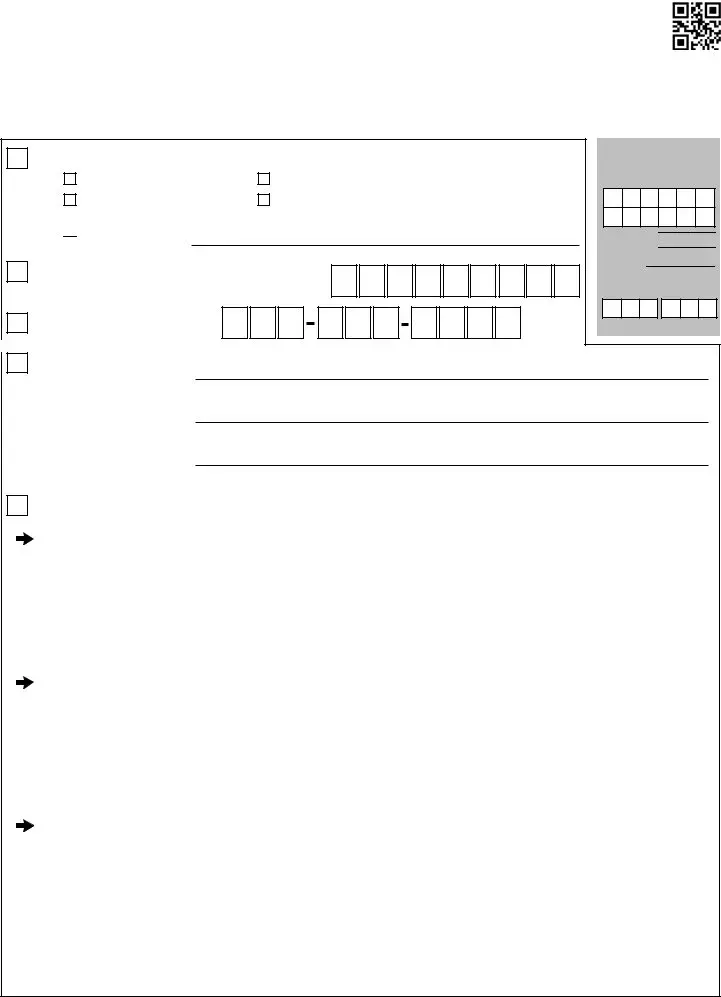

Limited Liability Company

Limited Liability Company

Other (explain)

Other (explain)