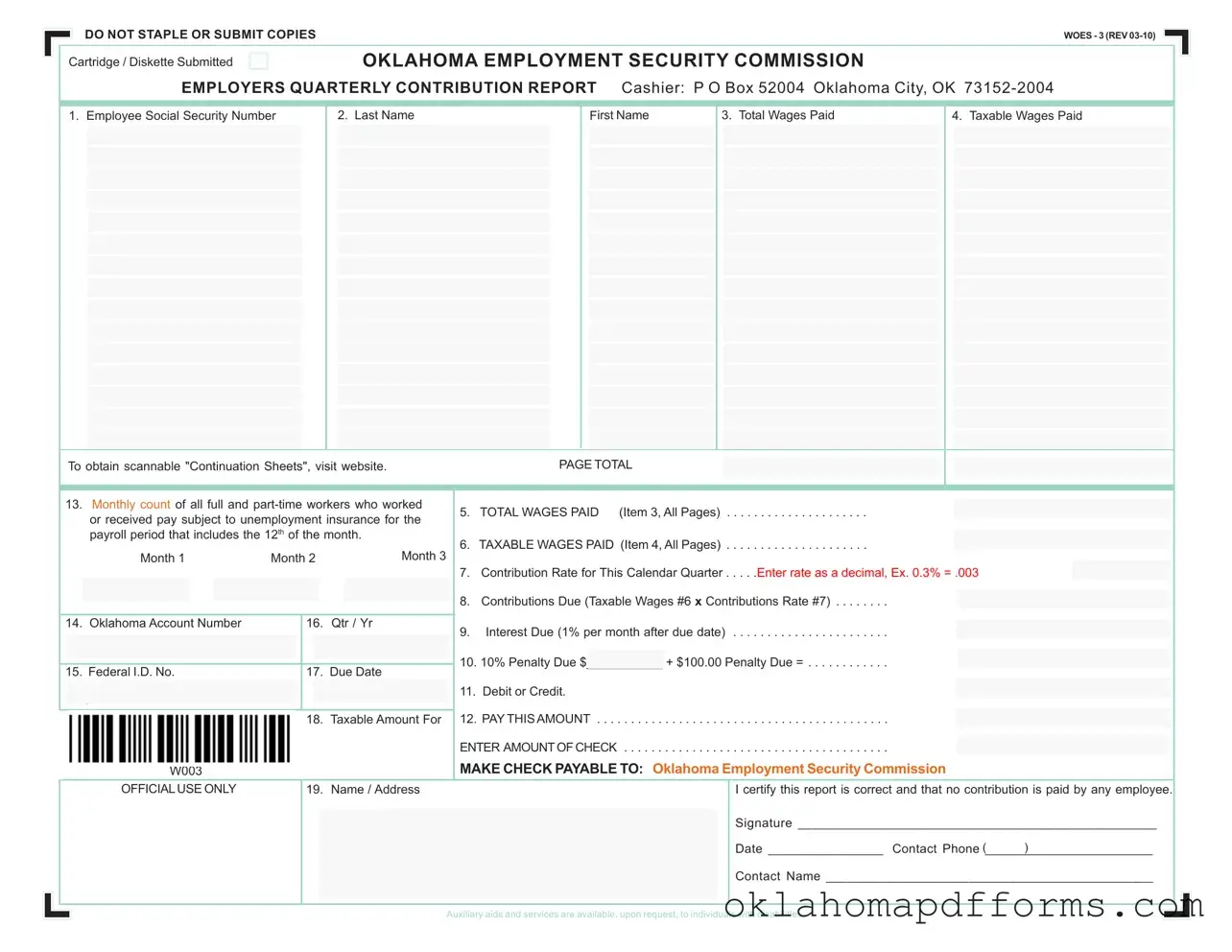

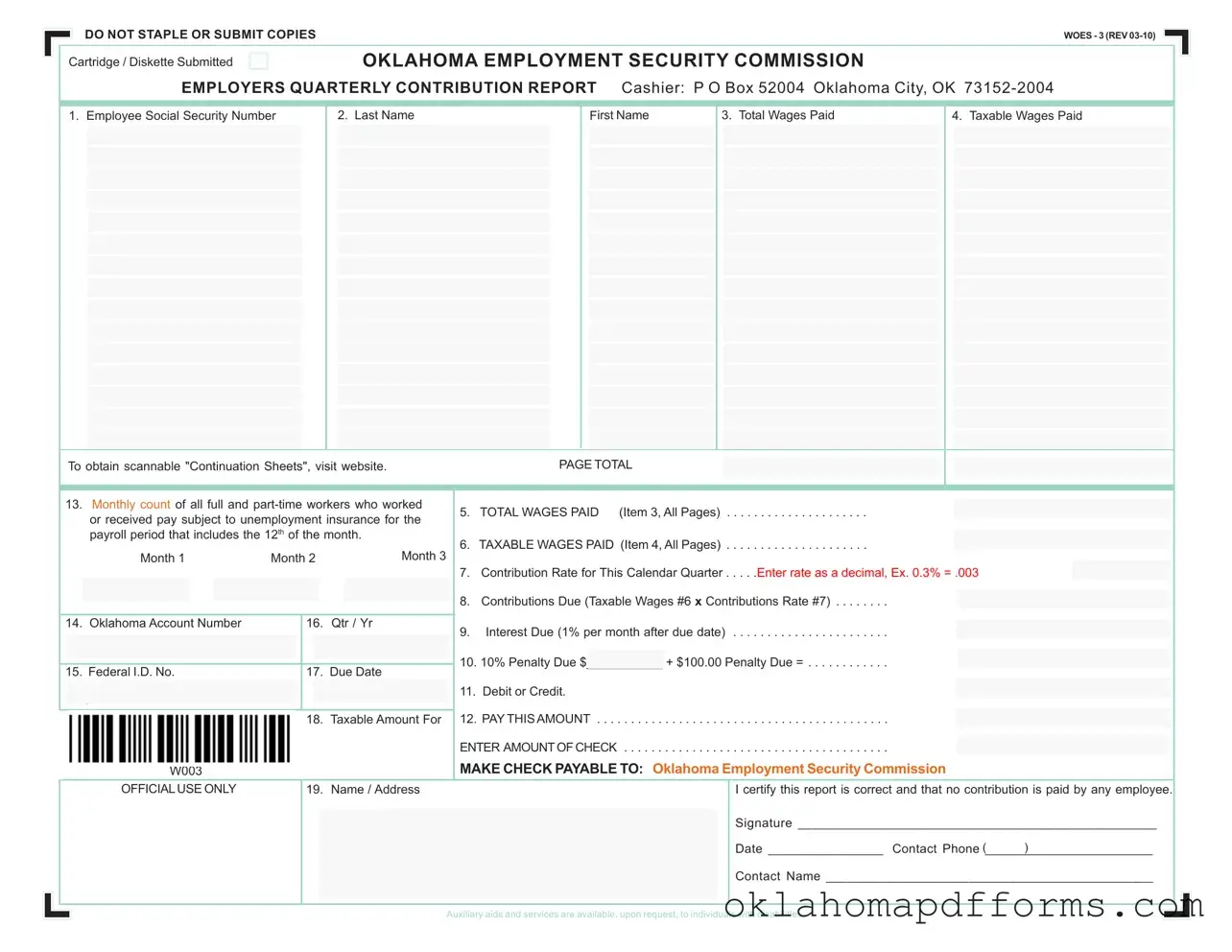

The Oklahoma Quarterly Contribution Report form shares similarities with the IRS Form 941, which is used by employers to report income taxes withheld from employee wages and the employer's share of Social Security and Medicare taxes. Both documents require employers to disclose the total wages paid to employees during a specific period. Additionally, they both involve calculations for taxes owed based on these wages, emphasizing the importance of accurate reporting to comply with federal and state tax laws.

Another comparable document is the State Unemployment Tax Act (SUTA) report, which employers must file to report wages subject to state unemployment taxes. Like the Oklahoma Quarterly Contribution Report, the SUTA report requires details about total wages and the number of employees. Both forms are designed to ensure that employers contribute appropriately to unemployment insurance programs, providing a safety net for workers who lose their jobs.

The Federal Unemployment Tax Act (FUTA) form is also similar, as it requires employers to report wages and calculate the federal unemployment tax owed. Both the FUTA and the Oklahoma Quarterly Contribution Report focus on the contributions made by employers to support unemployment benefits. The key difference lies in the jurisdiction; one is federal while the other is state-specific, yet both serve the same overarching purpose of funding unemployment assistance.

Employers may also encounter the W-2 form, which reports an employee's annual wages and the taxes withheld. While the W-2 is an annual summary, it complements the quarterly reporting of the Oklahoma Quarterly Contribution Report by providing a detailed account of individual earnings and tax contributions. Both documents are crucial for ensuring that employees receive proper credit for their earnings and tax contributions when filing their personal income tax returns.

The 1099-MISC form, used for reporting payments made to independent contractors, shares some similarities as well. While the Oklahoma Quarterly Contribution Report focuses on employees and their wages, both documents require accurate reporting of payments made during a specific period. They emphasize the importance of transparency in financial transactions, ensuring that all parties meet their tax obligations.

Additionally, the Employer's Annual Federal Unemployment Tax Return (Form 940) is relevant. This form summarizes the employer's federal unemployment tax liability for the year, similar to how the Oklahoma Quarterly Contribution Report summarizes quarterly contributions. Both forms help employers track their obligations and ensure compliance with unemployment tax laws.

For anyone looking to handle transactions involving all-terrain vehicles, understanding the intricacies of an ATV Bill of Sale can be invaluable. This form ensures clear documentation during the sale process while providing vital protections for both parties involved. To learn more about the specifics of this document, review the detailed overview found in the comprehensive ATV Bill of Sale resources available here.

The Employee Retirement Income Security Act (ERISA) reporting documents also bear resemblance. Employers who offer retirement plans must file certain forms to report plan participation and contributions. Like the Oklahoma Quarterly Contribution Report, these documents require detailed information about employee contributions and employer obligations, highlighting the importance of accurate record-keeping in employee benefits.

Finally, the Payroll Tax Report is another document with similarities. This report outlines the payroll taxes withheld from employee paychecks, including federal and state income taxes, Social Security, and Medicare. Like the Oklahoma Quarterly Contribution Report, it emphasizes the responsibility of employers to accurately report and remit taxes, ensuring compliance with tax regulations and the provision of employee benefits.