What is the Oklahoma Sales Tax Report form?

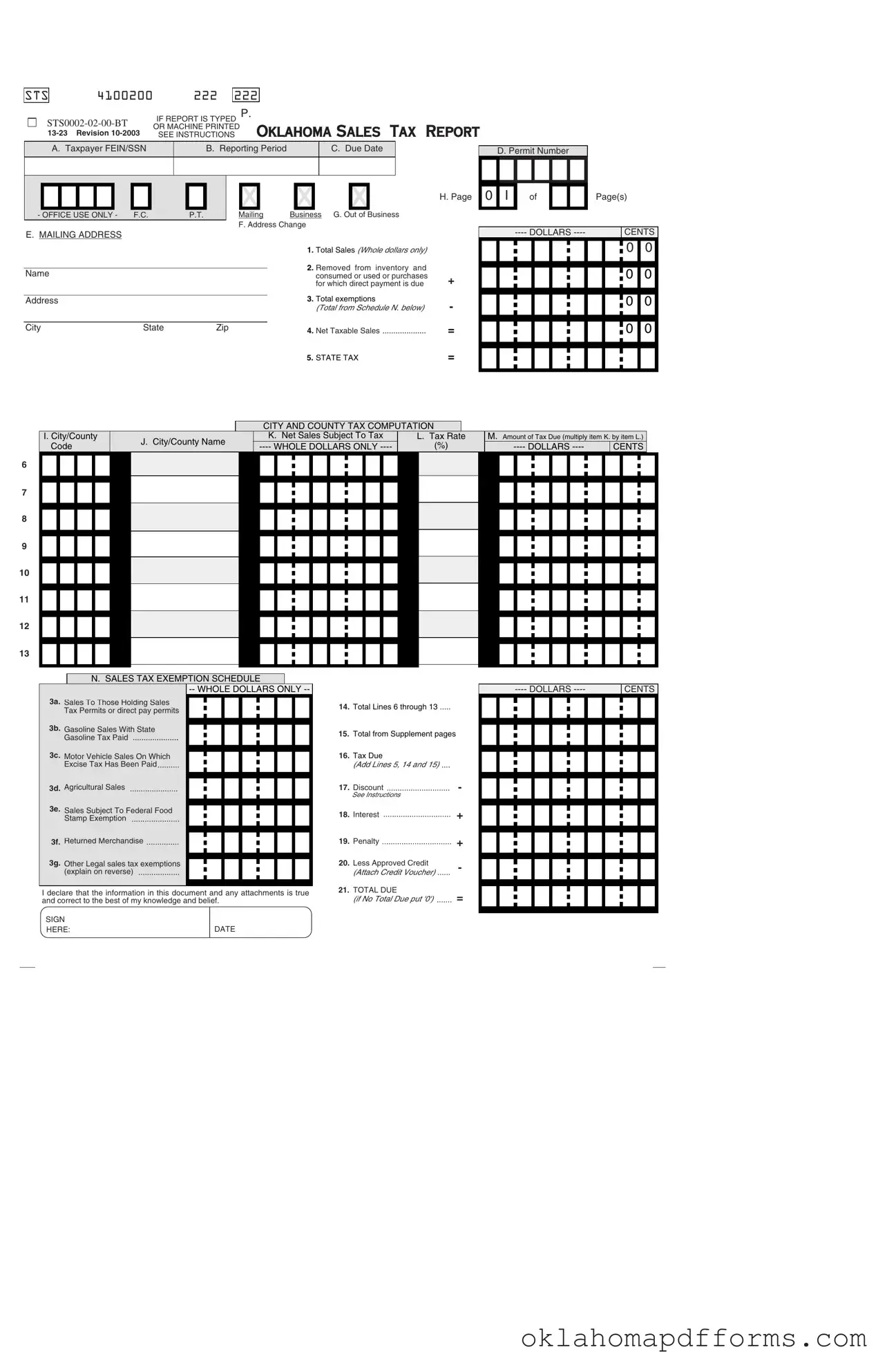

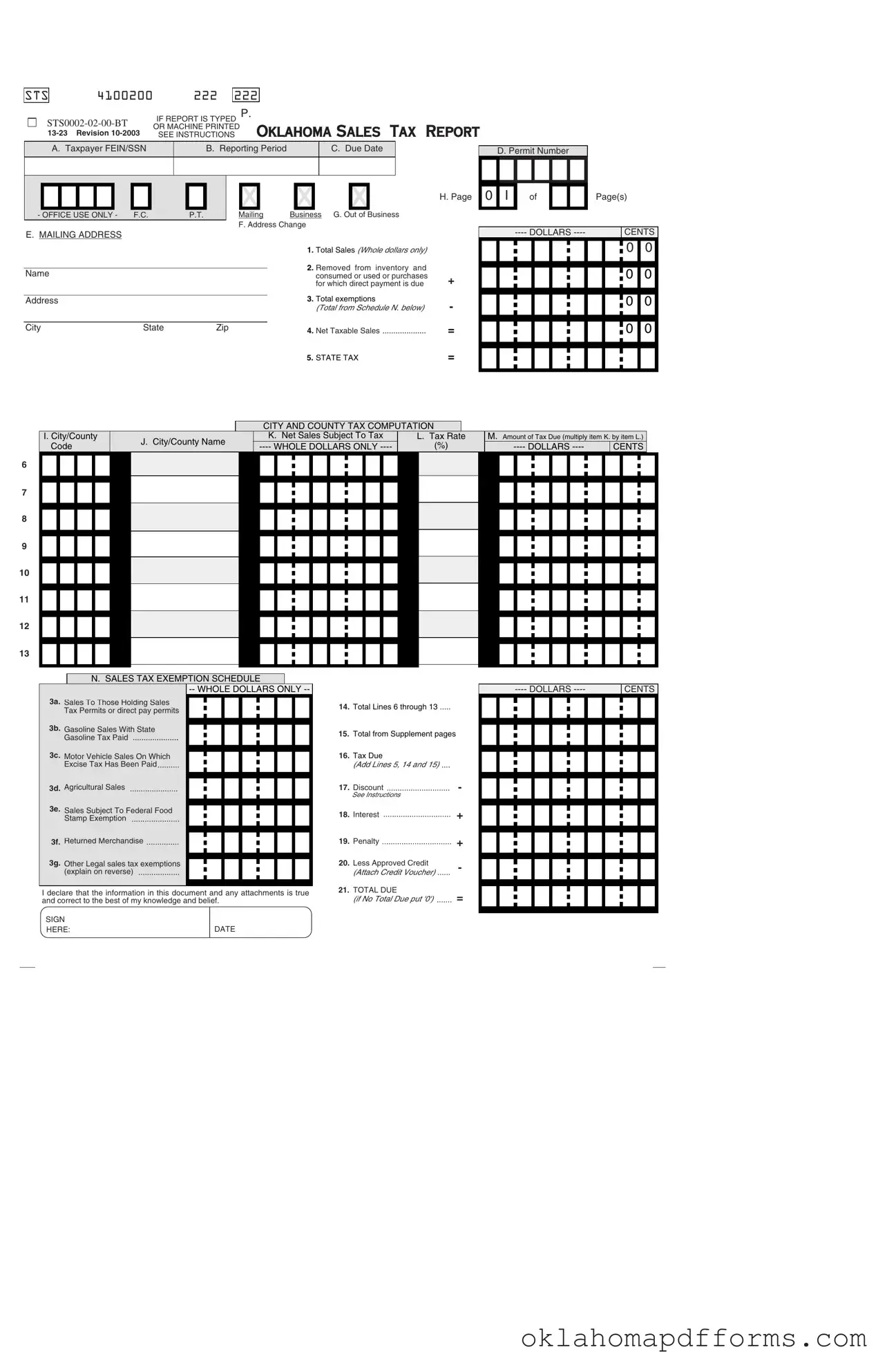

The Oklahoma Sales Tax Report form, also known as STS 4100200, is a document that vendors use to report sales tax collected during a specific reporting period. It includes various sections where businesses must enter their total sales, exemptions, and calculate the taxes due. This form is essential for compliance with Oklahoma tax laws and must be submitted even if no sales were made during the reporting period.

Who is required to file the Oklahoma Sales Tax Report?

Every vendor responsible for collecting and remitting Oklahoma sales tax must file this report. This obligation exists regardless of whether there were any taxable sales during the reporting period. Even if a business had no sales, it must still submit the form to the Oklahoma Tax Commission.

When is the Oklahoma Sales Tax Report due?

The report is due on or before the 20th day of the month following the end of the reporting period. The specific due date is indicated in Item C of the form. Timely submission is crucial to avoid penalties and interest on any taxes owed.

How do I complete the Oklahoma Sales Tax Report?

To complete the report, businesses should follow the instructions provided on the form carefully. Key sections require information such as taxpayer identification numbers, total sales, exemptions, and tax calculations. It is important to use whole dollars only, and any necessary corrections should be made clearly. If the report is typed, ensure to mark "XXX" over "222" in box P.

What if my business address has changed?

If there has been a change in your mailing or business address, you must indicate this on the form. Place an "X" in the appropriate box (Box F) and provide the new information in the designated area. Accurate information is vital for ensuring that correspondence from the Oklahoma Tax Commission reaches you.

What happens if I file late?

Filing the report after the due date can result in penalties and interest. If the report is postmarked after the due date, interest will accrue at a rate of 1.25% for each month or part thereof that the report is late. Additionally, a 10% penalty will apply if the report is not postmarked within 15 calendar days of the due date.

What are the exemptions listed on the form?

The form includes a Sales Tax Exemption Schedule where businesses can report various exemptions. Common exemptions include sales to those holding sales tax permits, gasoline sales with state gasoline tax paid, motor vehicle sales on which excise tax has been paid, and agricultural sales. Each exemption must be documented accurately to ensure compliance.

How do I calculate the total tax due?

The total tax due is calculated by adding the amounts from several lines on the form. Specifically, you will add the state tax from Line 5, the total city/county taxes from Line 14, and any additional amounts from Line 15. Afterward, apply any discounts, interest, or penalties to arrive at the final total due on Line 21.

Where do I send my completed Sales Tax Report?

Once completed, the report should be mailed to the Oklahoma Tax Commission at the address provided on the form: P.O. BOX 26850, Oklahoma City, OK 73126-0850. It is important to include a separate check for any tax due, making sure to reference your Taxpayer Number on the check for proper identification.

Who can I contact for assistance with the Oklahoma Sales Tax Report?

If you need assistance while completing the Oklahoma Sales Tax Report, you can call the Oklahoma Tax Commission at (405) 521-3160. They can provide guidance on filling out the form, understanding tax obligations, and any other questions you may have regarding sales tax compliance.