FRX |

0600202 |

|

L. |

000 |

|

|

|

|

|

FRX0002-05-1999-BT |

|

Form 200 Revised 6-2006 |

|

|

|

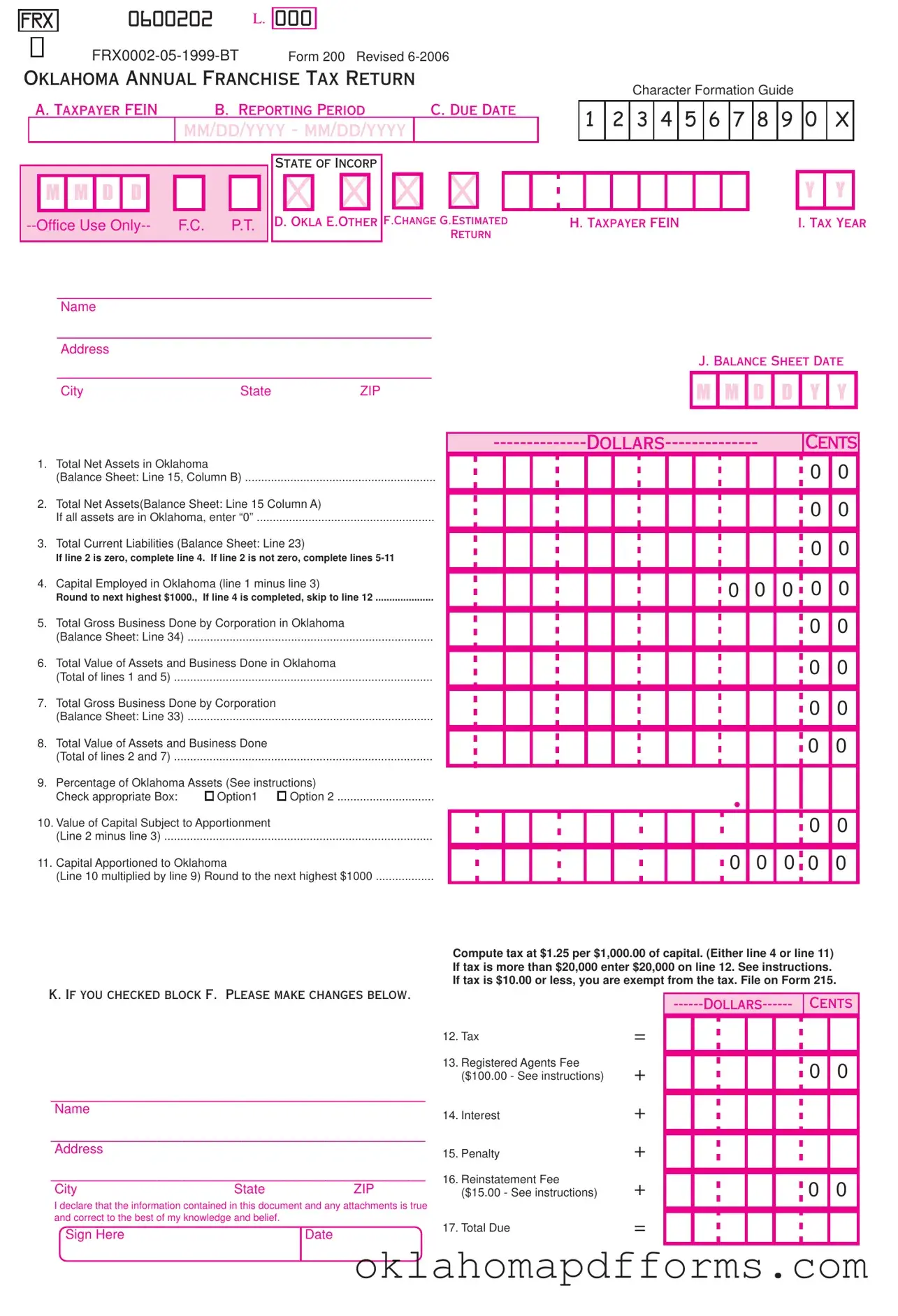

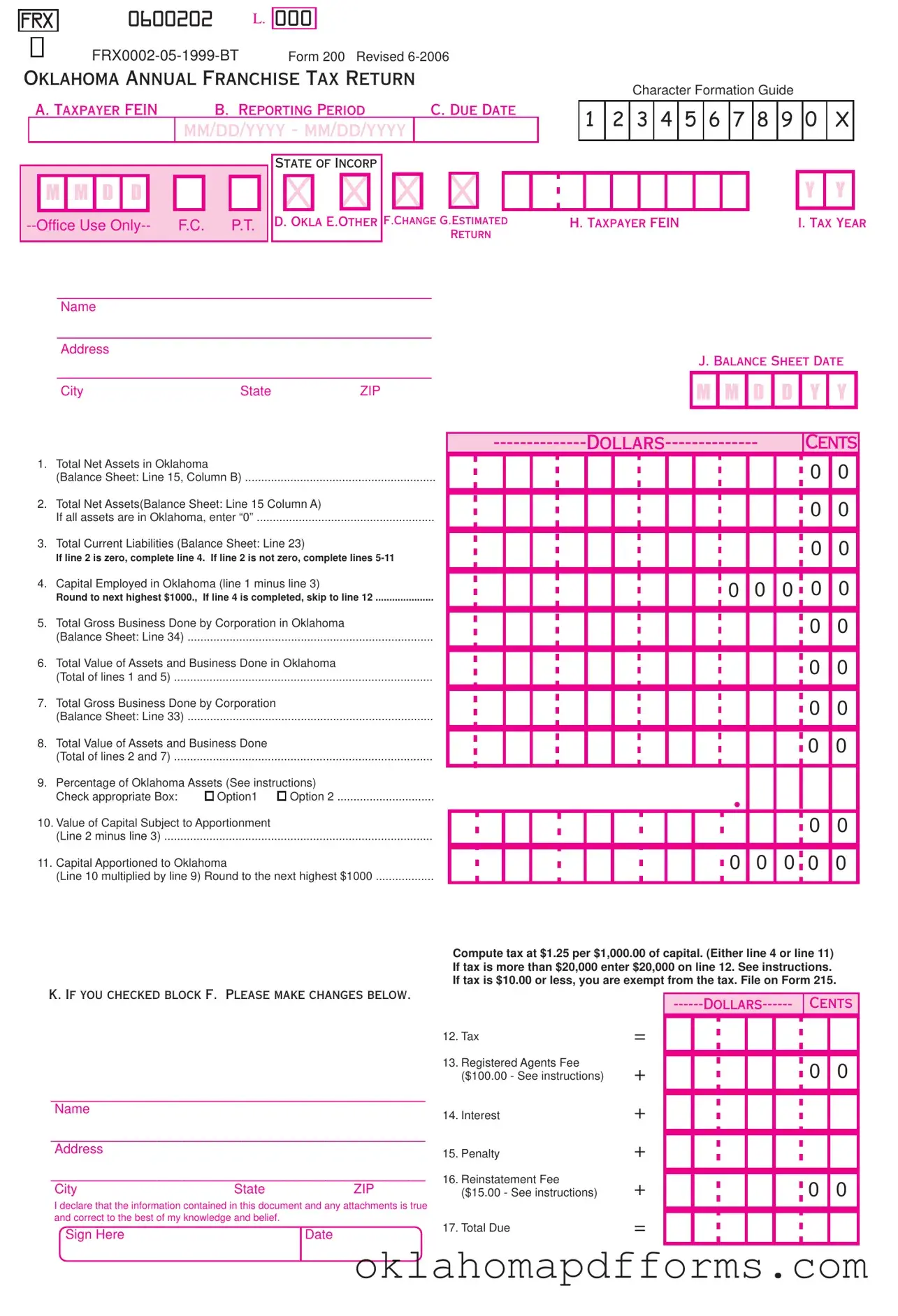

OKLAHOMA ANNUAL FRANCHISE TAX RETURN |

|

|

A. TAXPAYER FEIN |

B. REPORTING PERIOD |

C. DUE DATE |

|

|

|

MM/DD/YYYY - MM/DD/YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE OF INCORP

--Office Use Only-- |

F.C. |

P.T. |

D. OKLA E.OTHER F.CHANGE G.ESTIMATED |

|

|

|

RETURN |

Character Formation Guide

1 2 3 4 5 6 7 8 9 0 X

Y Y

H. TAXPAYER FEIN |

I. TAX YEAR |

_____________________________________________

Name

_____________________________________________

Address

_____________________________________________ |

|

J. BALANCE SHEET DATE |

|

|

|

|

|

|

|

City |

State |

ZIP |

M |

M |

D |

D |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

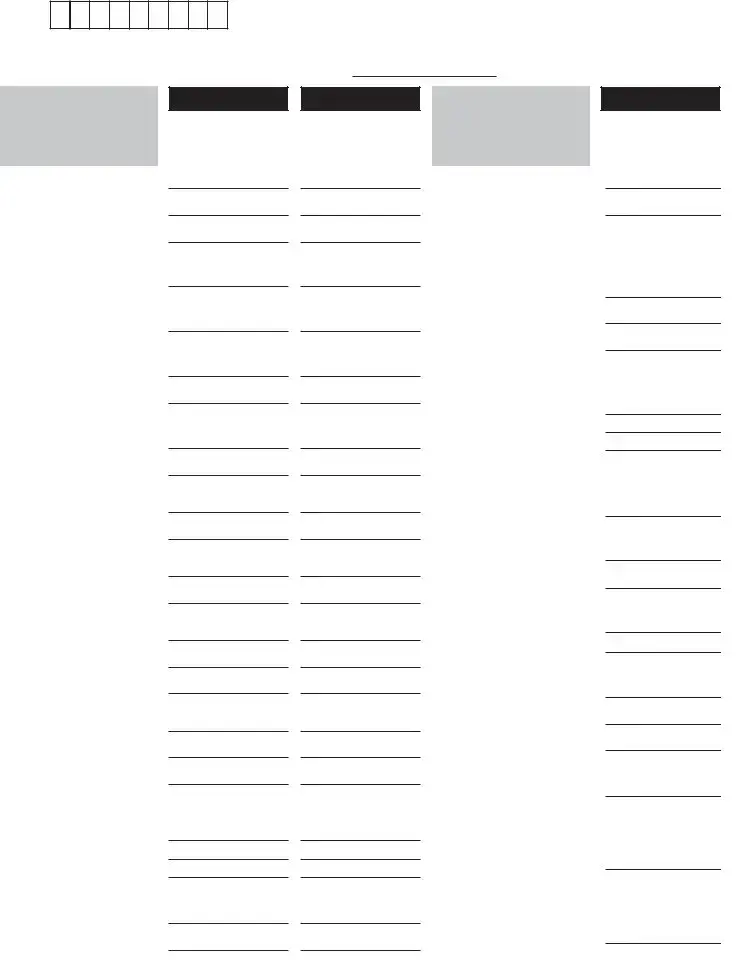

--------------DOLLARS-------------- |

|

|

|

|

CENTS |

1.Total Net Assets in Oklahoma

(Balance Sheet: Line 15, Column B) ...........................................................

2.Total Net Assets(Balance Sheet: Line 15 Column A)

If all assets are in Oklahoma, enter “0” .......................................................

3.Total Current Liabilities (Balance Sheet: Line 23)

If line 2 is zero, complete line 4. If line 2 is not zero, complete lines 5-11

4.Capital Employed in Oklahoma (line 1 minus line 3)

Round to next highest $1000., If line 4 is completed, skip to line 12 .....................

5.Total Gross Business Done by Corporation in Oklahoma

(Balance Sheet: Line 34) ............................................................................

6.Total Value of Assets and Business Done in Oklahoma

(Total of lines 1 and 5) ................................................................................

7.Total Gross Business Done by Corporation

(Balance Sheet: Line 33) ............................................................................

8.Total Value of Assets and Business Done

(Total of lines 2 and 7) ................................................................................

9.Percentage of Oklahoma Assets (See instructions)

Check appropriate Box: |

Option1 |

Option 2 |

10.Value of Capital Subject to Apportionment

(Line 2 minus line 3) ...................................................................................

11.Capital Apportioned to Oklahoma

(Line 10 multiplied by line 9) Round to the next highest $1000 ..................

0 0

0 0

0 0

0 0 0 0 0

0 0

0 0

0 0

0 0

•

0 0

0 0 0 0 0

Compute tax at $1.25 per $1,000.00 of capital. (Either line 4 or line 11) If tax is more than $20,000 enter $20,000 on line 12. See instructions. If tax is $10.00 or less, you are exempt from the tax. File on Form 215.

K. IF YOU CHECKED BLOCK F. PLEASE MAKE CHANGES BELOW.

_____________________________________________

Name

_____________________________________________

Address

_____________________________________________

I declare that the information contained in this document and any attachments is true and correct to the best of my knowledge and belief.

12.Tax

13.Registered Agents Fee

($100.00 - See instructions)

14.Interest

15.Penalty

16.Reinstatement Fee

($15.00 - See instructions)

17.Total Due

------------DOLLARS |

CENTS |

|

|

|

0 0

Name

Address

FEDERAL EMPLOYER’S

IDENTIFICATION NUMBER

SCHEDULE A: CURRENT OFFICER INFORMATION

CORPORATE OFFICERS EFFECTIVE AS OF MM-DD-YYYY ARE AS FOLLOWS:

(Date)

Examples: Reporting period 07/01/2006 – 06/30/2007—Schedule A date = 06/30/2006

Reporting period 01/01/2006 – 12/31/2006—Schedule A date = 12/31/2005

Schedule A: Current Officer Information

Enter the current officers effective date. Example: if the reporting period is 07/01/2006 through 06/30/2007, the effective date should be 06/30/2006. The officers listed should be those whose term was in effect as of 06/30/2006. If any of the officer information is incorrect, please make the necessary changes on the Schedule A. Be sure to update names, addresses, and Social Security Numbers.

President |

Social Security Number |

|

|

Home Address (street and number, city, state, ZIP code) |

Home Phone (area code and number) |

|

|

Vice President |

Social Security Number |

|

|

Home Address (street and number, city, state, ZIP code) |

Home Phone (area code and number) |

|

|

Secretary |

Social Security Number |

|

|

Home Address (street and number, city, state, ZIP code) |

Home Phone (area code and number) |

|

|

Treasurer |

Social Security Number |

|

|

Home Address (street and number, city, state, ZIP code) |

Home Phone (area code and number) |

Please include Social Security Numbers of officers.

If non-resident officer with no Social Security Number (SSN) note “NRA” for SSN.

710:1-3-6. Use of Federal Employer Identification Numbers, Social Security Numbers mandatory

All returns, applications, and forms required to be filed with the Oklahoma Tax Commission (Commission) in the administra- tion of this State’s tax laws shall bear the Federal Employer’s Identification Number(s) or the Social Security Account Number (or both) of the person, firm, or corporation filing the item and of all persons required by law or agency rule to be named or listed. If more than one number has been issued to the person, firm, or corporation, then all numbers will be required. [Source: Amended at 16 Ok Reg 2628, eff 6-25-99]

710:1-3-8. Confidentiality of records

All Federal Employer’s Identification and/or Social Security Account Numbers are deemed to be included in the confidential records of the Commission.

Please Enter Your Federal Employer’s Identification

Number

Here...

FORM # 203 SCH |

SCHEDULES B, C, D AND BALANCE SHEET |

REVISED 2-2006 |

(TO BE FILED WITH FORM 200: OKLAHOMA ANNUAL FRANCHISE RETURN)

This form contains Schedules B, C, and D and also a Balance Sheet for the completion of Form 200: Oklahoma Annual Franchise Tax Return. You may attach additional pages if further space is needed on Schedules C and D.

SCHEDULE B

GENERAL INFORMATION (TO BE COMPLETED IN DETAIL)

If the business is not a “corporation,” please list the type of business structure, the date of formation, and county in which filed.

Name and address of Oklahoma “registered agent”

|

|

|

|

|

|

|

|

|

|

|

|

Name of parent company and their FEI number, if applicable: |

|

|

|

|

FEI: |

|

Percent of your outstanding stock owned by the parent company, if applicable: |

|

|

% |

|

|

|

In detail, please list the nature of your business: |

|

|

|

|

|

|

|

Amount of authorized capital stock or shares: |

|

|

|

|

|

|

(a) Common: |

|

|

shares, par/book value of each share |

$ |

|

|

$ |

|

|

(b) First Preferred: |

|

shares, par/book value of each share |

$ |

|

|

$ |

|

|

Total capital stock or shares issued and outstanding at the end of fiscal year: ________________________ |

|

|

(a) Common: |

|

|

shares, par/book value of each share |

$ |

|

$ |

|

(b) First Preferred: |

|

shares, par/book value of each share |

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE C |

|

|

|

|

|

RELATED COMPANIES: SUBSIDIARIES AND AFFILIATES

•SUBSIDIARIES (Companies in which you own 15 percent or more of the outstanding stock)

Name of Subsidiary |

|

Federal Employer’s ID Number Percentage Owned (%) |

Financial Investment ($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

•AFFILIATES (Companies related other than by direct stock ownership)

Name of Affiliate |

|

Federal Employer’s ID Number How related? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE D

DETAILS OF CURRENT DEBT SHOWN ON BALANCE SHEET

|

|

|

|

Original Amount |

Original Date of Issuance |

|

Maturity Date |

|

of Instrument |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance remaining of amounts payable within 3 years of Date of Issuance

Please Enter Your Federal Employer’s Identification

Number

Here...

BALANCE SHEET AS OF THE LAST

ASSETS

INCOME TAX YEAR

COLUMN A

Total Everywhere as per

Books of Account.

If all Property is in

Oklahoma,

Do Not Use this Column.

ENDED

COLUMN B

Total in Oklahoma

as per Books

of Account.

LIABILITIES AND

STOCKHOLDERS’

EQUITY

COLUMN C

Total Everywhere as per

Books of Account.

1.Cash .......................................

2.Notes and accounts receiveable

3.Inventories .............................

4.Government obligations and other bonds ...........................

5.Other current assets

(please attach schedule) ........

6.Total Current Assests

(add lines 1A-5A and 1B-5B)

7.Mortgage and real estate loans

8.Other investments

(please attach schedule) ........

9.(a) Building .............................

(b)Less accumulated depreciation .......................

10.(a) Fixed depreciable assets .

(b)Less accumulated depreciation ......................

11.(a) Depletable assets ............

(b)Less accumulated depletion ...........................

12.Land .....................................

13.(a) Intangible assets .............

(b)Less accumulated amortization .....................

14.Other assets .........................

15.Net Assets ...........................

(Lines: 1-14)

16.Inter-company receivables:

(a)From parent company ....

(b)From subsidiary company

(c)From affiliated company .

17.Bank holding company stock in subsidiary bank .......

18.TOTAL ASSETS ..................

(Lines: 15-17)

19.Accounts payable ....................

20.Accrued payables ....................

21.Indebtedness payable three years or less after issuance

(see schedule D) .....................

22.Other current liabilities ............

23.Total Current Liabilities ........

(Lines: 19-22)

24.Inter-company payables

(a)To parent company ............

(b)To subsidiary company ......

(c)To affiliated company .........

25.Indebtedness maturing and payable in more than three years from the date of issuance

26.Loans from stockholders not payable within three years ......

27.Other liabilities ........................

28.Capital Stock

(a)Preferred stock ...................

(b)Common Stock ...................

29.Paid-in or capital surplus (attach reconciliation) ...............

30.Retained earnings ...................

31.Other capital accounts ............

32.Total Liabilities and

Stockholders’ Equity ............

(Lines: 23-31)

33.Total gross business done everywhere

(sales and service) ................

(from income tax return)

34.Total gross business done in Oklahoma

(sales and service) ................

(from income tax return)

Form 203-A

Revised 6-2006

OKLAHOMA ANNUAL FRANCHISE TAX RETURN INSTRUCTION SHEET

• REQUIREMENT FOR FILING RETURN

Every corporation organized under the laws of this state, or qualified to do or doing business in Oklahoma in a corporate or organized capacity by virtue of creation of organization under the laws of this state or any other state, territory, district, or a foreign country, including associations, joint stock companies and business trusts as defined by Oklahoma statutes unless exempt by statutes must file an Annual Franchise Tax Return Form 200.

The term “doing business” means and includes every act, power, or privilege exercised or enjoyed in this state as an incident to do or by virtue of powers and privileges acquired by the nature of all organizations falling within the purview of the Franchise Tax Code.

All Foreign (non-Oklahoma) Corporations including non-profits, are required to pay an Annual Registered Agent Fee of $100.00. Indicate this amount on Line 13 of the Form 200.

The Maximum annual franchise tax is $20,000.00. Corporations that owe the maximum tax may file on Form 215. If the tax computed is $10.00 or less, no tax payment is due. However, a Franchise Tax Return must be filed. When submitting the Franchise Tax Return, foreign corporations with a tax liability of $10.00 or less must also pay the registered agent fee.

Applications for refunds must include copies of your related Oklahoma Income Tax Returns. The use of the correct corporate name and Federal Employer Identification Number on your return and all correspondence will facilitate processing and handling.

• TIME FOR FILING AND PAYMENT INFORMATION

Oklahoma Franchise Tax is due and payable July 1st of each year. The report and tax will be delinquent if not paid on or before August 31. If you elected to change your filing date to be the same as the date of filing your corporate income tax, the report and tax will be delinquent if not paid by the fifteenth (15) day of the third month following the close of the corporate income tax year. A ten percent (10%) penalty and one and one-fourth percent 1 1/4%) interest per month is due on payments made after the due date.

If the Charter or other instrument is suspended, a fee of $15.00 is required for reinstatement. (Line 16 of Form 200.)

If you request an extension to file your corporate income tax return, a copy of your request to file an extension must accompany your franchise tax return. Extensions of time to file may be granted upon receipt of a tentative return and remittance based on an estimate of the tax due. However, the extension does not have the effect of waiving penalty or interest on remittances made after the due date.

If you wish to make an election to change your filing frequency for your next reporting period, please complete OTC Form 200F: Request to Change Franchise Tax Filing Period. You can download this form from the Oklahoma Tax Commission website @ www.tax.ok.gov.

• FRANCHISE TAX COMPUTATION

The basis for computing your Oklahoma Franchise Tax is the balance sheet as shown by your books of account at the close of your last preceding income tax accounting year, or if you have elected to change your filing to match the due date of your corporate income tax, the balance sheet for that corporate tax year.

The franchise tax for corporations doing business both within and outside of Oklahoma, is computed on the proportion to which property owned, or property owned and business done, within Oklahoma, bears to total property owned, or total property owned and total business done everywhere.

“Property owned” is the book value of the assets. For the purpose of determining apportionment as between Oklahoma and elsewhere, liabilities are not to be deducted from gross assets.

The term “business done” means and includes the engaging in any activity or the performing of any act or acts in this state that constitutes the doing or transacting of business. Business done in Oklahoma includes sales shipped from Oklahoma to another state in which the corporation is not doing business.

Inter-company Payable and Receivables between parent, subsidiary and/or affiliates, are to be eliminated from the calculations necessary to determine the amount of franchise tax due.

The Oklahoma franchise (excise) tax is levied and assessed at the rate of $1.25 per $1000 or fraction thereof on the amount of capital allocated or employed in Oklahoma.

FIRST STEP...

COMPLETE BALANCE SHEET AND SCHEDULES B, C & D

(Must be returned with annual return)

Line 1 through 3, cash, notes, accounts receivable, and inventories are to be reported at book value.

Line 4 United States, municipal, commercial and other bonds owned by the corporation.

Line 5 Prepaid expenses and deferred charges are to be included as assets at book value.

Line 8 Stock or other evidence of ownership in subsidiary organiza- tions as shown on the corporations books of account.

Lines 9b, 10b, 11b. If accumulated depreciation and depletion appear to be excessive, the excess may be disallowed.

Line 13 Patents, trademarks, copyrights, etc., and franchises are to be included as assets to the extent of their cost. In the case of a definite term franchise, the cost thereof may be amortized over its life. Good will is an asset and should be shown at book value. All intangibles including cash, are to be appor- tioned wholly to Oklahoma unless a commercial or business location for the intangibles has been established elsewhere.

Line 14 Life insurance, where the reporting taxpayer is beneficiary, is to be shown at cash surrender value.

Line 15 Total net amount of lines 6 through 14. Line 18 Total lines 15,16, and 17.

Line 20 Reserves for taxes are allowed to the extent such taxes are unpaid. Deferred credits are included in capital employed unless they can be shown to be actual liabilities.

Line 21 Current liability includes indebtedness payable in three (3) years or less after issuance.

Line 26 Stockholder loans must be repaid within three years of creation to be considered a current liability. Contingent assets or liabilities should not be included unless fully explained and the condition under which they become actual is clearly set forth.

Line 32 Total lines 23 through 31. The amounts as shown by the books of account shall be the measure of value of the assets and liabilities, except when the items on the books of account are in error or lack sufficient detail to truly reflect the amount of capital invested and employed in the business.

SECOND STEP...

COMPLETE THE OKLAHOMA ANNUAL FRANCHISE TAX RETURN

Item D Place an “X” in the box if you are incorporated in the State of Oklahoma.

Item E Place an “X” in the box if you are incorporated in a state other than Oklahoma.

Item F Place an “X” in the box if any of the preprinted information in Items A or B or the name or address is incorrect. Please make corrections in the space provided in Item H, J or K.

If Incorrect |

Then |

1. Taxpayer FEIN |

Write the correct federal employers |

|

|

identification number within the |

|

|

boxes in Block H. |

2. Reporting Period |

Place the last two digits of the year |

|

|

end which this return covers in the |

|

|

boxes in Block I. |

3. Corporate Name or Address |

Fill in only the corrected information |

|

|

in the space provided at the bottom |

|

|

of the form (Item K). |

Item G |

Place an “X” in the box if you have not completed a year end |

|

balance sheet and are therefore filing an estimated return. |

|

You must file an estimated return and remit tax due. |

Item H |

If your FEIN is not preprinted in Item A or is incorrect, please |

|

enter your FEIN. |

|

Item I |

If your reporting period is not printed in Item B or is incorrect, |

|

enter the tax year for which you are filing a return. |

Item J |

Enter your balance sheet date of your most recent income tax |

|

accounting year. (month/date/year) |

(Continued from lower left column)

Lines 1 through 11 (except 9) are derived from your balance sheet. Please put the date of the balance sheet in the date boxes provided (Item J).

Line 9 (Percent of Oklahoma Assets)

Select which option you will use to determine the apportion- ment of Oklahoma assets.

Option 1: Percent of Oklahoma assets and business done to total assets and business done. (line 6 divided by line 8). Round to four decimal points.

Option 2: Percent of Oklahoma assets to total net assets (line 1 divided by line 2). Round to four decimal points.

Line 12 (Tax)

Compute tax at $1.25 per $1,000.00 of capital. (Either line 4 or line 11) If tax is more than $20,000 enter $20,000 on line

12.If tax is $10.00 or less, you are exempt from the tax. File on Form 215.

Line 13 (Registered Agent Fee)

If your coproration originated in a state other than Oklahoma, the Oklahoma Secretary of State charges an annual regis- tered agent fee of $100.00 and is collected on the FRX return. Non-profit corporations originating in another state will be billed for the registered agents fee.

Line 14 (Interest)

If this return is postmarked after the due date the tax is subject to 1.25% interest per month from the due date until it is paid. Multiply the amount in Line 12 by .0125 for each month the report is late.

Line 15 (Penalty)

If this return is postmarked after the due date the tax is subject to a penalty of 10%. Multiply the amount in Line 12 by

.10 to determine the penalty. Line 16 (Reinstatement Fee)

If your corporate charter has been suspended, you must meet all outstanding filing and payment obligations in order to be reinstated. A $15.00 reinstatement fee is also required. Only one reinstatement fee is required even if multiple past due returns are being filed.

Line 17 (Total Due)

Total of Lines 12 through 16,

THIRD STEP...

Schedule A Officer Information

Enter the effective date of officers. Please refer to the examples on Schedule A. If any preprinted officer information (Schedule A) is incorrect, please make the necessary changes on Schedule A and mail with your tax return and payment. Be sure to update the corporate officers name, address and social security number. Failure to provide this information could result in the corporation being suspended.

FOURTH STEP...

Mail this return in the enclosed envelope. Please include your return, payment made payable to Oklahoma Tax Commission, balance sheet, and schedules A, B, C, and D.

Please Mail To:

Oklahoma Tax Commission

Franchise Tax

Post Office Box 26930

Oklahoma City, OK 73126-0930

Phone Number for Assistance – (405) 521-3160

Mandatory inclusion of Social Security and/or Federal Employer’s Identification numbers is required on forms filed with the Oklahoma Tax Commission pursuant to Title 68 of the Oklahoma Statutes and regulations thereunder, for identification purposes, and are deemed to be part of the confidential files and records of the Oklahoma Tax Commission.

The Oklahoma Tax Commission is not required to give actual notice to taxpayers of changes in state laws.