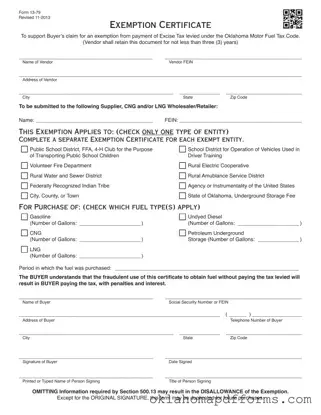

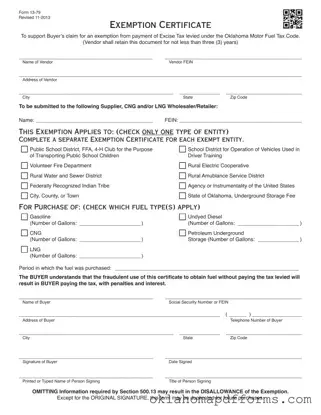

The Oklahoma 13 79 form serves as an Exemption Certificate that allows certain entities to claim exemption from the payment of Excise Tax under the Oklahoma Motor Fuel Tax Code. This form is crucial for vendors and buyers who qualify...

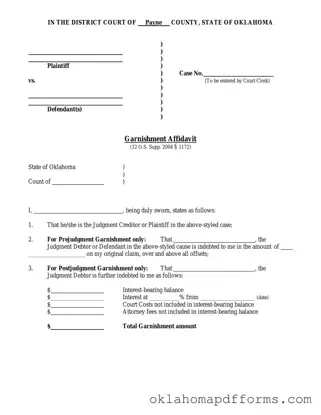

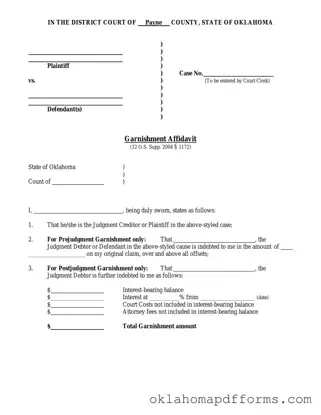

The Oklahoma 20 form is a legal document used in the garnishment process within the state of Oklahoma. This form allows a judgment creditor to initiate garnishment proceedings against a judgment debtor's earnings or property. Understanding the Oklahoma 20 form...

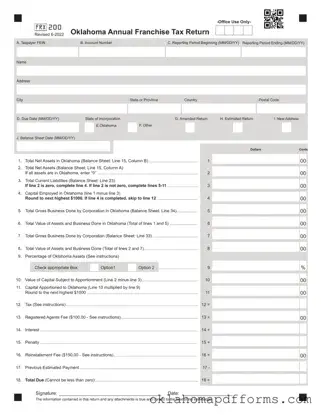

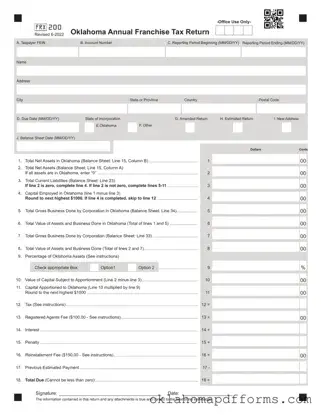

The Oklahoma 200 form is the Annual Franchise Tax Return required for corporations operating in Oklahoma. This form is essential for reporting the financial status of a corporation and determining the franchise tax owed to the state. Completing the Oklahoma...

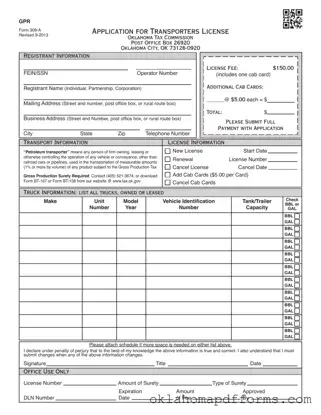

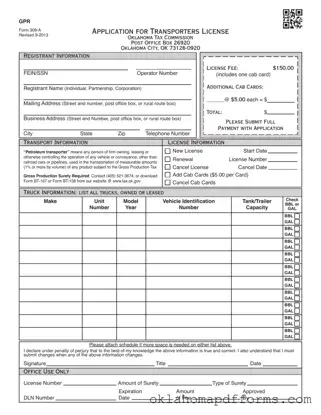

The Oklahoma 309A form is an application used to obtain a transporter’s license for individuals or businesses involved in the transportation of petroleum products. This form requires registrants to provide essential information, including their name, address, and vehicle details, as...

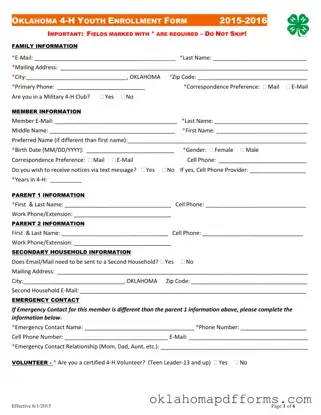

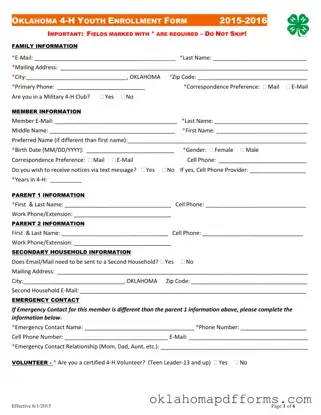

The Oklahoma 4-H Youth Enrollment Form is a crucial document for young individuals wishing to participate in the 4-H program. This form collects essential information about the youth member, their family, and their interests in various projects. Completing this form...

The Oklahoma 501 form is an annual information return required by the Oklahoma Tax Commission for reporting various types of income payments. This form serves as a summary of reports that organizations and individuals must submit, ensuring compliance with state...

The Oklahoma 511 form is the Resident Income Tax Return used by individuals to report their income and calculate their tax obligations in Oklahoma. This form is essential for ensuring compliance with state tax laws and is required for both...

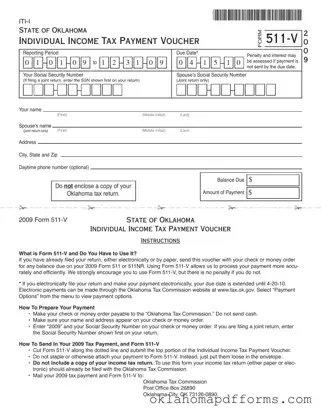

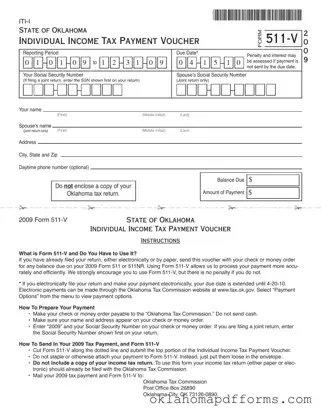

The Oklahoma 511 V form is an Individual Income Tax Payment Voucher designed to facilitate the payment of any balance due on your state income tax return. If you've already filed your return, whether electronically or on paper, this form...

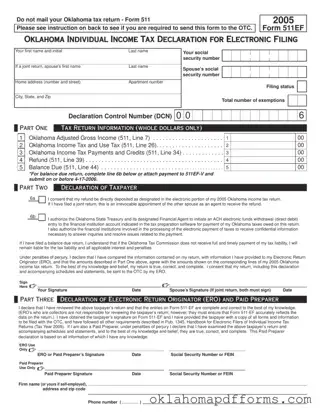

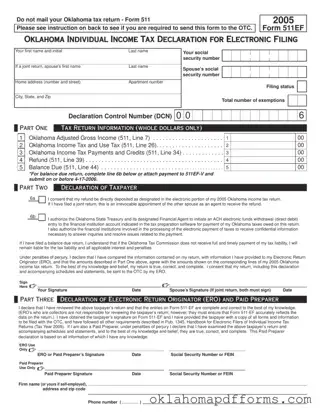

The Oklahoma 511Ef form is the declaration for electronic filing of individual income tax returns in Oklahoma. This form allows taxpayers to submit their income tax information electronically while ensuring compliance with state regulations. Understanding the requirements and implications of...

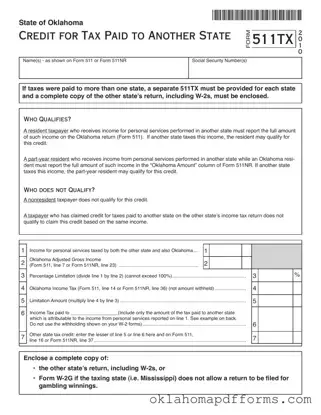

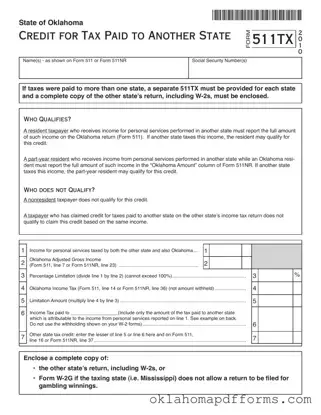

The Oklahoma 511Tx form is a tax document used by Oklahoma residents to claim a credit for taxes paid to another state on income earned from personal services. This form is essential for individuals who have worked in another state...

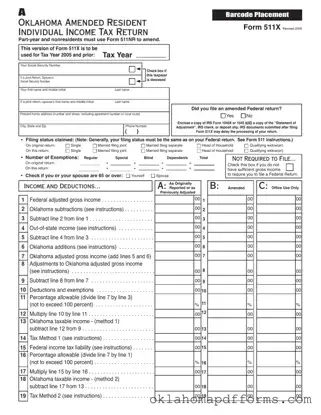

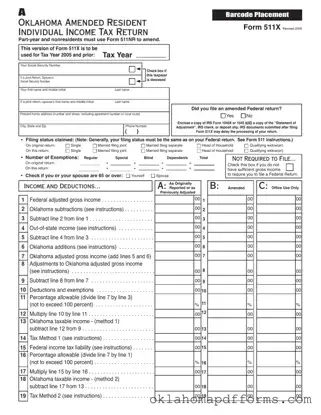

The Oklahoma 511X form is an amended resident individual income tax return used by residents of Oklahoma to correct errors on their original tax filings. This form is specifically for tax years 2005 and earlier. If you are a part-year...

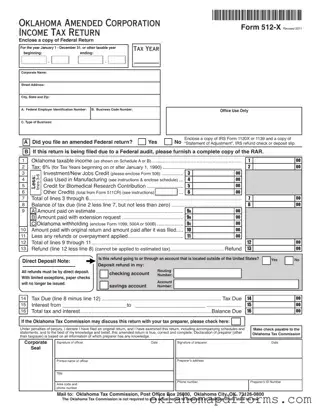

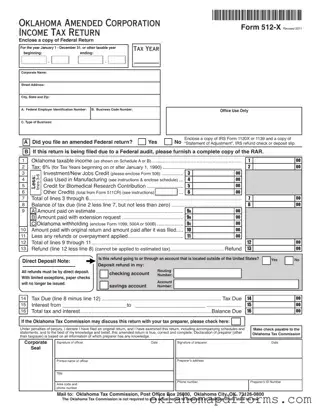

The Oklahoma 512 X form is an amended corporation income tax return used by businesses to correct previously filed tax returns. This form allows corporations to report changes in their taxable income and claim any applicable credits or deductions. Completing...