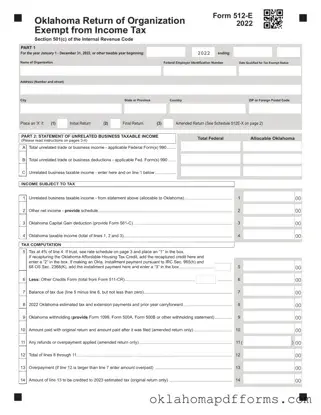

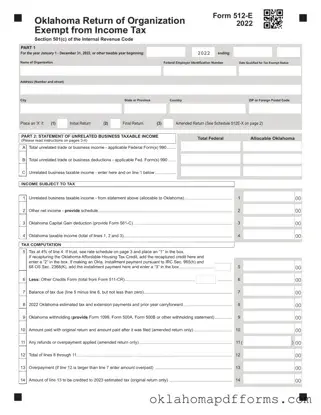

The Oklahoma Return of Organization Exempt from Income Tax Form 512E is a crucial document for organizations seeking tax-exempt status under Section 501(c) of the Internal Revenue Code. This form must be filed annually by organizations with unrelated business income,...

The Oklahoma 538 S form is a document used by residents to claim a credit or refund for sales tax paid during the year. This form is specifically designed for individuals whose household income does not exceed $12,000 and who...

The Oklahoma 561Nr form is used by part-year residents and nonresidents to claim a capital gain deduction on qualifying assets sold during the tax year. This form allows individuals to detail their capital gains and losses from Oklahoma property, ensuring...

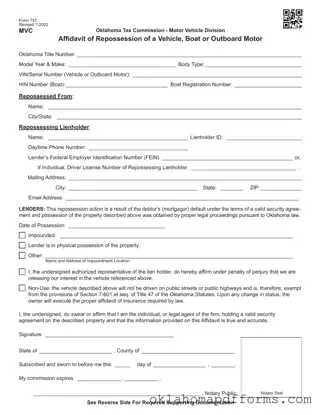

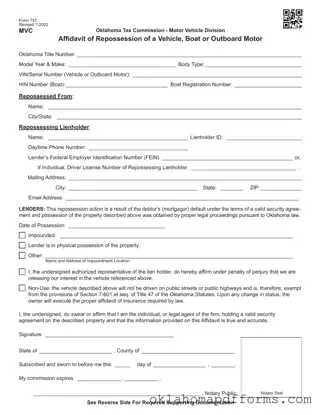

The Oklahoma 737 form serves as an affidavit of repossession for vehicles, boats, or outboard motors in the state of Oklahoma. This form is essential for lenders to document the legal process of reclaiming property due to a debtor's default...

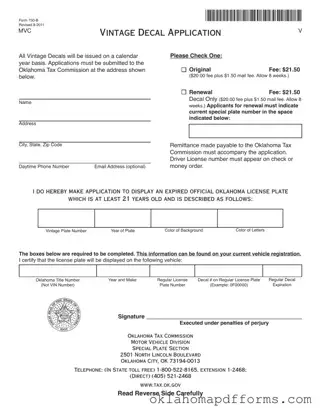

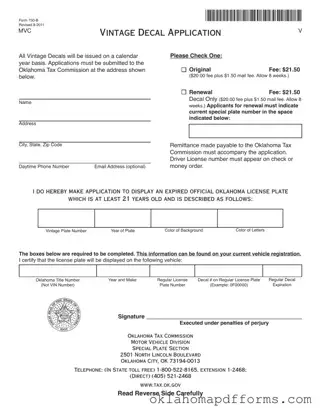

The Oklahoma 750 B form is an application for a vintage decal that allows vehicle owners to display an official Oklahoma license plate that is at least 21 years old. This form must be submitted to the Oklahoma Tax Commission...

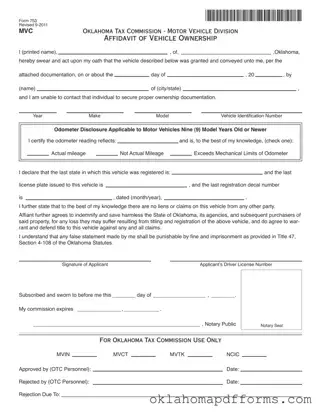

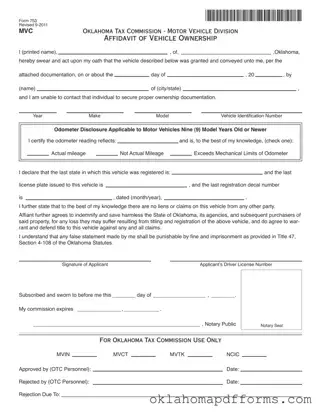

The Oklahoma 753 form is an affidavit of vehicle ownership that individuals in Oklahoma can use when they are unable to obtain proper documentation from a previous owner. This form serves as a legal declaration, allowing the applicant to assert...

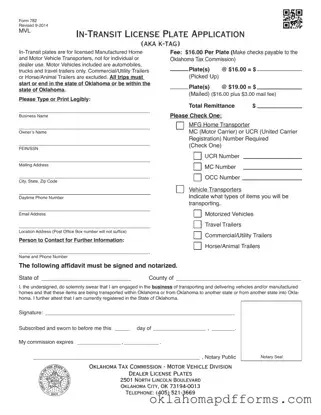

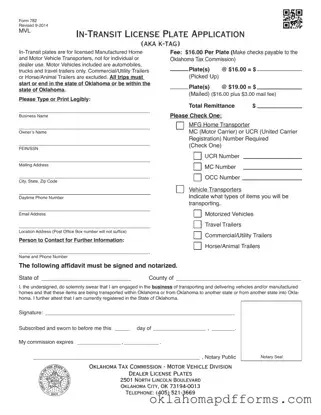

The Oklahoma 782 form is an application for In-Transit license plates, also known as K-Tags. These plates are specifically designed for licensed manufacturers and transporters of motor vehicles and manufactured homes, not for individual or dealer use. It is essential...

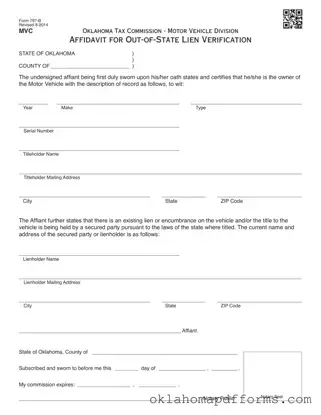

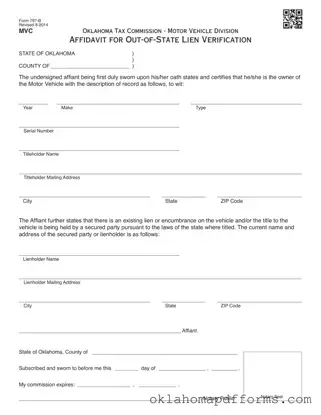

The Oklahoma 797 B form is an affidavit used for verifying out-of-state liens on motor vehicles. This form is essential for individuals who own a vehicle with a lien that is not registered in Oklahoma. It ensures that all necessary...

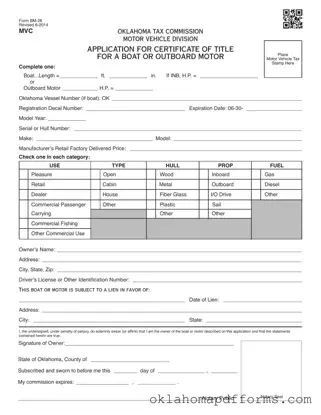

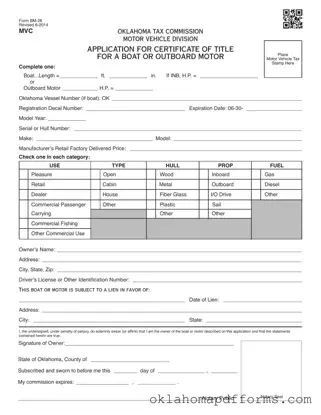

The Oklahoma BM-26 form serves as an essential application for obtaining a certificate of title for a boat or outboard motor in the state of Oklahoma. This form requires detailed information about the vessel, including its specifications, owner details, and...

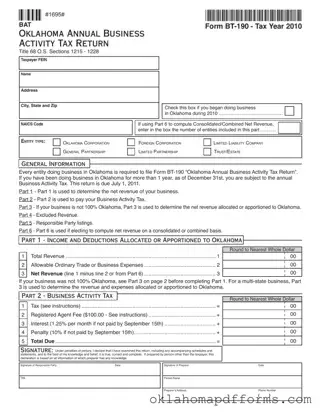

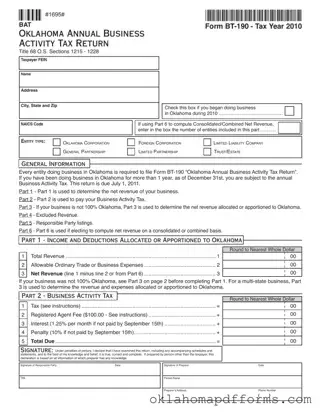

The Oklahoma BT-190 form is the Annual Business Activity Tax Return required for all entities conducting business in Oklahoma. This form helps determine the net revenue of a business and the corresponding tax obligations. Businesses that have been operating in...

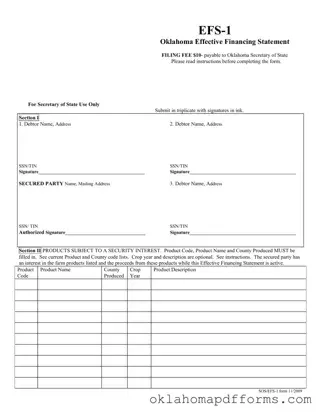

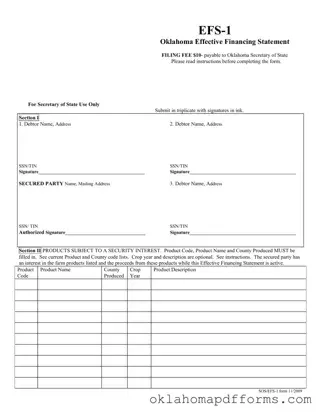

The Oklahoma EFS-1 form is an Effective Financing Statement used to establish a security interest in agricultural products produced in Oklahoma. This form must be filed in triplicate and includes essential information about the debtor and secured party, as well...

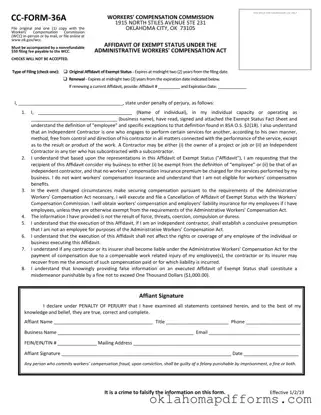

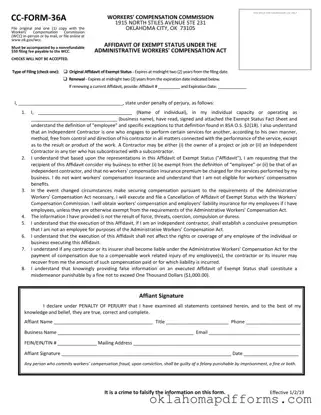

The Oklahoma Exempt Form is a document that allows individuals or businesses to declare their exempt status under the Administrative Workers' Compensation Act. By filing this form, you can request to be recognized as an independent contractor, meaning you won’t...