What is the Oklahoma Small Estate Affidavit?

The Oklahoma Small Estate Affidavit is a legal document that allows individuals to claim the assets of a deceased person without going through the full probate process. This form is typically used when the total value of the deceased's estate is below a certain threshold, making it a simpler and faster option for heirs.

Who can use the Small Estate Affidavit?

Any individual who is an heir or a beneficiary of the deceased person can use the Small Estate Affidavit. This includes spouses, children, siblings, and other relatives. However, the total value of the estate must be within the limits set by Oklahoma law.

What is the value limit for using the Small Estate Affidavit?

As of October 2023, the total value of the estate must not exceed $50,000 for an individual or $200,000 for a married couple. This includes all assets, such as bank accounts, real estate, and personal property. It’s important to assess the value accurately to determine eligibility.

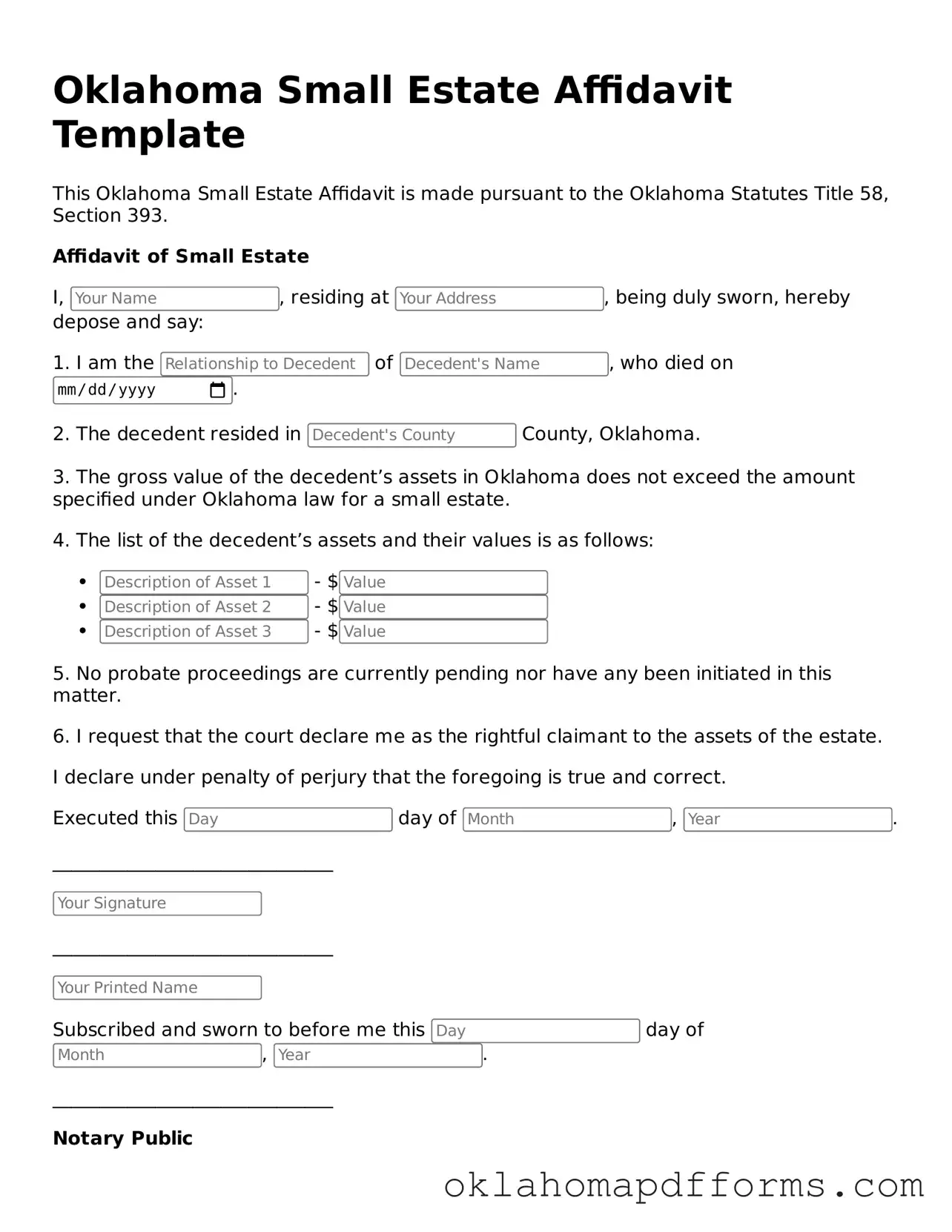

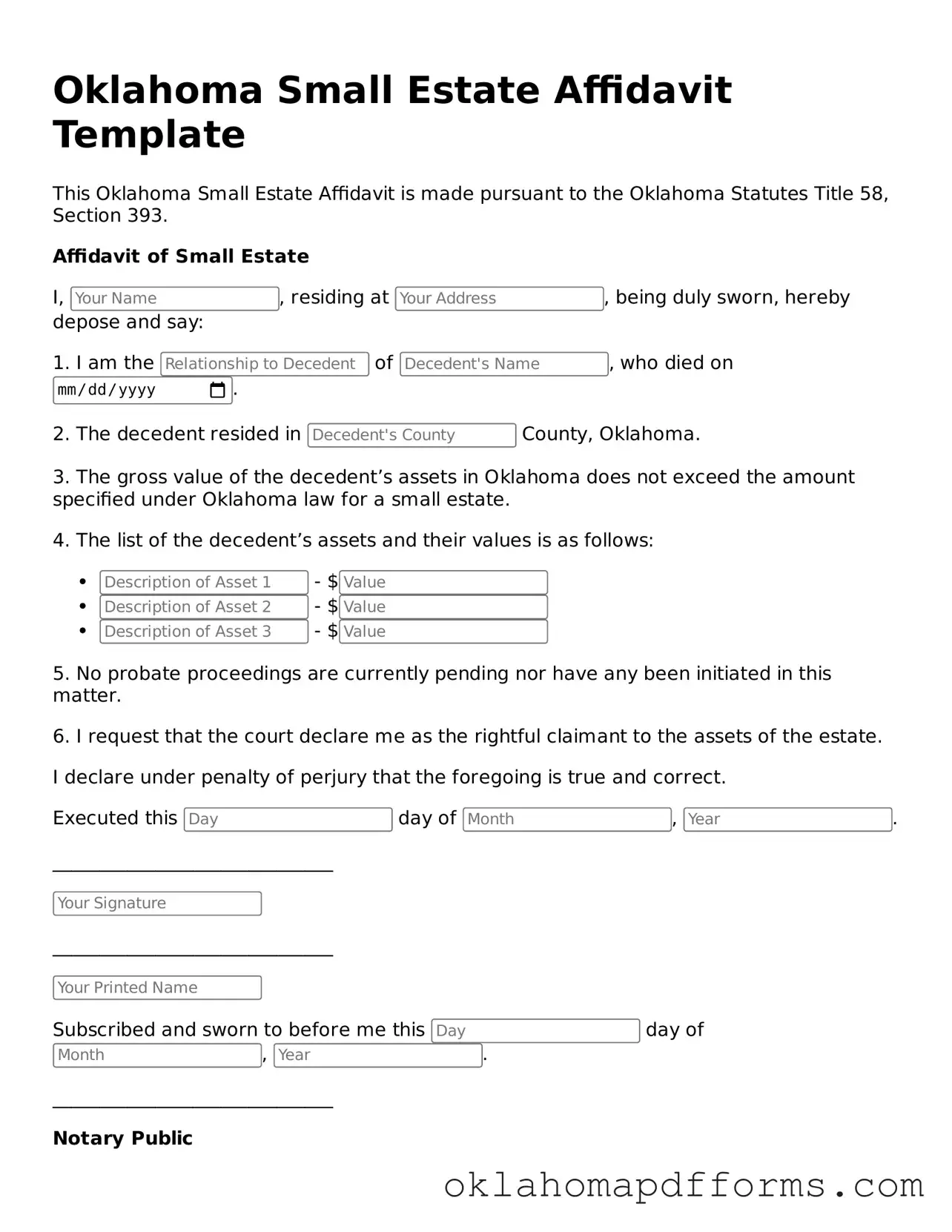

How do I complete the Small Estate Affidavit?

To complete the Small Estate Affidavit, you need to fill out the form with the necessary information about the deceased, the heirs, and the assets involved. Be sure to provide accurate details, including the date of death and the estimated value of the estate. After completing the form, it must be signed in front of a notary public.

Do I need to file the Small Estate Affidavit with the court?

No, you do not need to file the Small Estate Affidavit with the court. Instead, you present the affidavit to financial institutions, title companies, or other entities that hold the deceased's assets. They will use the affidavit to transfer the assets to the rightful heirs.

Is there a waiting period after the death to use the Small Estate Affidavit?

There is no specific waiting period to use the Small Estate Affidavit. However, it is advisable to wait at least 30 days after the death before using the affidavit. This allows time for any potential claims against the estate to be addressed.

What if there are debts owed by the deceased?

If the deceased has debts, those must be settled before distributing the assets. The Small Estate Affidavit does not protect heirs from the deceased's creditors. It’s wise to consult with a legal professional to understand the implications of debts on the estate.

Can the Small Estate Affidavit be revoked?

Yes, the Small Estate Affidavit can be revoked if new information comes to light or if the estate's value exceeds the limit after it has been completed. It is essential to ensure that all information remains accurate and current to avoid complications.

Where can I obtain the Small Estate Affidavit form?

The Small Estate Affidavit form can be obtained from various sources, including online legal resources, local courthouses, and some law offices. Ensure you are using the most current version of the form to comply with Oklahoma laws.