What is a Transfer-on-Death Deed in Oklahoma?

A Transfer-on-Death Deed (TODD) allows property owners in Oklahoma to transfer their real estate to beneficiaries upon their death, without the need for probate. This means that the property can pass directly to the designated beneficiaries, simplifying the transfer process and potentially saving time and money.

Who can use a Transfer-on-Death Deed?

Any individual who owns real property in Oklahoma can use a Transfer-on-Death Deed. This includes homeowners, landowners, and anyone with an interest in real estate. However, it’s important to ensure that the deed is executed properly to be valid.

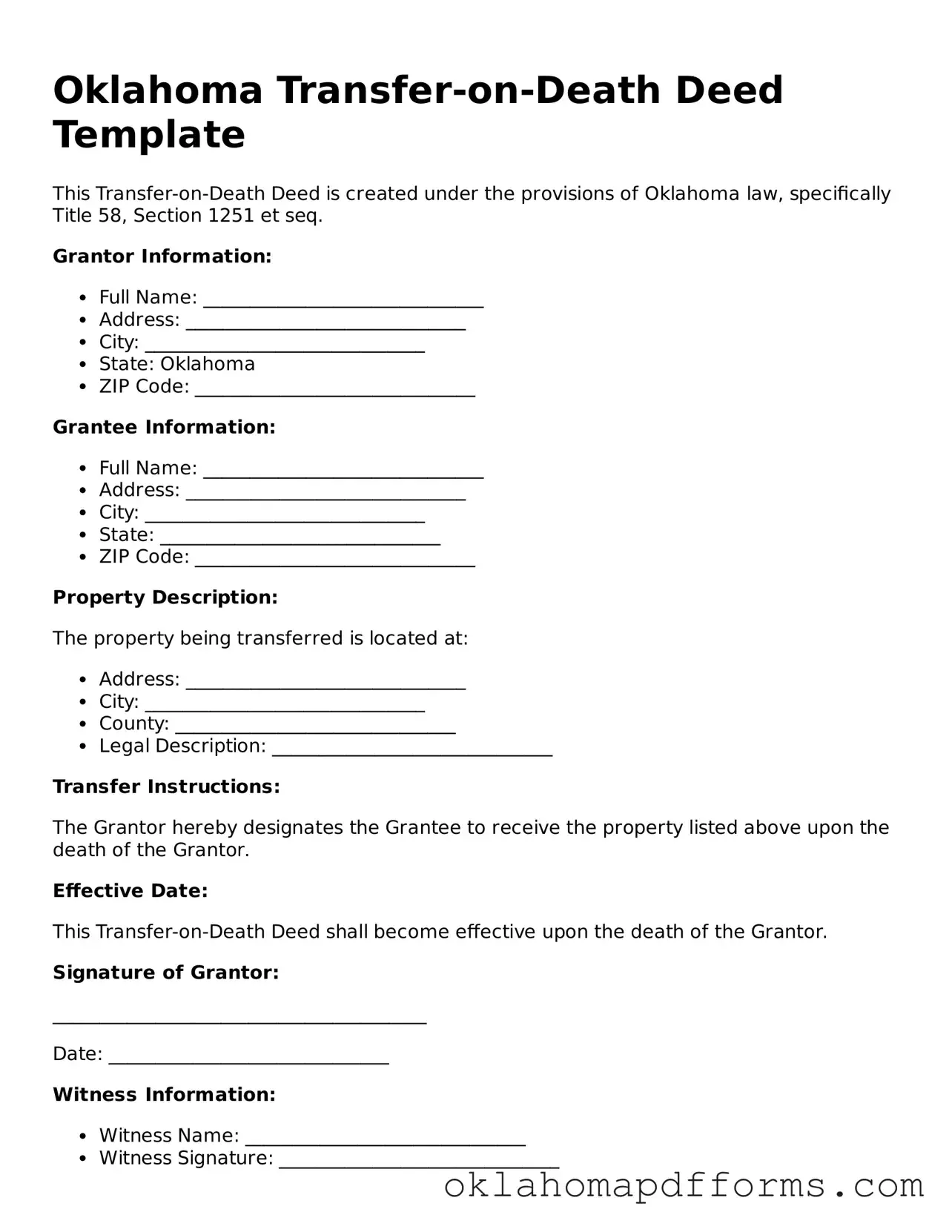

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you must complete the appropriate form, which includes information about the property and the beneficiaries. After filling out the form, you must sign it in front of a notary public. Finally, file the deed with the county clerk’s office where the property is located to ensure it is legally recognized.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are alive. To do this, you must execute a new deed that explicitly revokes the previous one or file a revocation form with the county clerk. It’s advisable to consult with a legal professional to ensure the changes are valid.

What happens if I sell the property after creating a Transfer-on-Death Deed?

If you sell the property after creating a Transfer-on-Death Deed, the deed becomes void. The property will then be transferred to the new owner, and the beneficiaries listed in the original deed will not have any claim to it. Always keep your beneficiaries informed of significant changes to your property ownership.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when creating a Transfer-on-Death Deed. However, the beneficiaries may be subject to property taxes once the property is transferred. Additionally, estate taxes could apply depending on the overall value of the estate. Consulting a tax professional is recommended for personalized advice.

Do I need a lawyer to create a Transfer-on-Death Deed?

While it is not legally required to have a lawyer to create a Transfer-on-Death Deed, seeking legal advice can help ensure that the deed is completed correctly and meets all legal requirements. A lawyer can also provide guidance on how this deed fits into your overall estate planning strategy.

Is a Transfer-on-Death Deed the right choice for my estate planning?

A Transfer-on-Death Deed can be a beneficial tool for many people, but it may not be suitable for everyone. Consider your specific circumstances, including the nature of your assets and your family dynamics. It’s often helpful to discuss your options with an estate planning professional to determine the best approach for your situation.